The Zacks Analyst Blog Highlights: McGraw-Hill, Nokia, Apple, Google and Microsoft - Press Releases

May 02 2012 - 4:30AM

Zacks

For Immediate Release

Chicago, IL – May 2, 2012 – Zacks.com announces the list of

stocks featured in the Analyst Blog. Every day the Zacks Equity

Research analysts discuss the latest news and events impacting

stocks and the financial markets. Stocks recently featured in the

blog include McGraw-Hill (MHP), Nokia

Corp. (NOK), Apple Inc. ( AAPL),

Google Inc. ( GOOG) and Microsoft

Corp. ( MSFT).

Get the most recent insight from Zacks Equity Research with the

free Profit from the Pros newsletter:

http://at.zacks.com/?id=5513

Here are highlights from Tuesday’s Analyst

Blog:

S&P Downgrades Nokia to Junk

McGraw-Hill (MHP)-owned rating agency Standard

and Poor's (S&P) recently downgraded the credit rating of

Nokia Corp. (NOK) to BB+ from BBB-. The rating

agency has also downgraded the company’s short-term credit rating

to B from A-3. With this downgrade, Nokia’s debt now falls under

the junk category, which is a notch lower than its previous

investment grade rating of BBB-.

The company’s poor first quarter results coupled with the news

that Samsung Electronics has surpassed Nokia as world’s largest

mobile phone maker was mainly responsible for the rating

downgrades.

Recently, Nokia announced disappointing financial results for

first quarter 2012 based on increased competition from

Apple Inc.’s ( AAPL) iPhone and a gamut of

smartphones that runs on Google Inc.’s ( GOOG)

Android operating system. Nokia also faces stiff competition in the

low-end segment from Chinese manufacturer ZTE.

S&P also held Nokia’s disappointing outlook for the second

quarter of fiscal 2012 responsible for the downgrade. Recently,

Fitch also downgraded Nokia’s credit rating to junk category while

Moody’s slashed it to near junk status. S&P has warned that it

could further slash the telecom giant’s ratings if it fails to

improve its financial performance.

Currently, Nokia is in a transition phase, shifting from its own

Symbian-based feature phone to Microsoft Corp. (

MSFT) developed windows-based smartphones. Sales has been slowing

and as per data published by research firm Strategy Analytics,

Nokia has been overtaken by Samsung as the world’s largest mobile

phone manufacturer, with 44.5 million smartphones sold in the first

quarter compared to Nokia’s 12 million.

Moreover, Nokia’s latest LTE-based Lumia 900 smartphone is

facing some data connection problems, which could hamper Lumia’s

success. To reduce its loss, the company plans to trim down its

costs, improve its cash flow and introduce innovative new

products.

Based on these measures, we believe Nokia plans to turn around

its fortunes and avoid any further downgrades. However, we remain

very much skeptical regarding the company’s turnaround any time

soon.

We, therefore, retain our long-term Underperform recommendation

on Nokia. Currently, Nokia has a Zacks #5 Rank, implying a

short-term Strong Sell rating.

Want more from Zacks Equity Research? Subscribe to the free

Profit from the Pros newsletter: http://at.zacks.com/?id=5515.

About Zacks Equity Research

Zacks Equity Research provides the best of quantitative and

qualitative analysis to help investors know what stocks to buy and

which to sell for the long-term.

Continuous coverage is provided for a universe of 1,150 publicly

traded stocks. Our analysts are organized by industry which gives

them keen insights to developments that affect company profits and

stock performance. Recommendations and target prices are six-month

time horizons.

Zacks "Profit from the Pros" e-mail newsletter provides

highlights of the latest analysis from Zacks Equity Research.

Subscribe to this free newsletter today:

http://at.zacks.com/?id=5517

About Zacks

Zacks.com is a property of Zacks Investment Research, Inc.,

which was formed in 1978 by Leon Zacks. As a PhD from MIT Len knew

he could find patterns in stock market data that would lead to

superior investment results. Amongst his many accomplishments was

the formation of his proprietary stock picking system; the Zacks

Rank, which continues to outperform the market by nearly a 3 to 1

margin. The best way to unlock the profitable stock recommendations

and market insights of Zacks Investment Research is through our

free daily email newsletter; Profit from the Pros. In short, it's

your steady flow of Profitable ideas GUARANTEED to be worth your

time! Register for your free subscription to Profit from the Pros

at http://at.zacks.com/?id=5518.

Visit http://www.zacks.com/performance for information about the

performance numbers displayed in this press release.

Follow us on Twitter: http://twitter.com/zacksresearch

Join us on Facebook:

http://www.facebook.com/home.php#/pages/Zacks-Investment-Research/57553657748?ref=ts

Disclaimer: Past performance does not guarantee future results.

Investors should always research companies and securities before

making any investments. Nothing herein should be construed as an

offer or solicitation to buy or sell any security.

Media Contact

Zacks Investment Research

800-767-3771 ext. 9339

support@zacks.com

http://www.zacks.com

APPLE INC (AAPL): Free Stock Analysis Report

GOOGLE INC-CL A (GOOG): Free Stock Analysis Report

MCGRAW-HILL COS (MHP): Free Stock Analysis Report

MICROSOFT CORP (MSFT): Free Stock Analysis Report

NOKIA CP-ADR A (NOK): Free Stock Analysis Report

To read this article on Zacks.com click here.

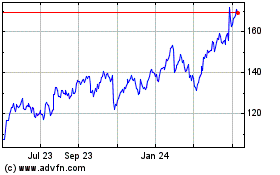

Alphabet (NASDAQ:GOOGL)

Historical Stock Chart

From Mar 2024 to Apr 2024

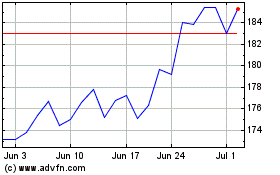

Alphabet (NASDAQ:GOOGL)

Historical Stock Chart

From Apr 2023 to Apr 2024