Capital Southwest Corporation Announces 3/31/12 Net Asset Value

May 01 2012 - 5:00PM

Capital Southwest Corporation (Nasdaq:CSWC) today reported total

net assets at March 31, 2012 of $628,707,006 equivalent to $167.45

per share. Comparative annual data is summarized below:

| |

March 31, 2012 |

December 31, 2011 |

March 31, 2011 |

| |

|

|

|

| Net assets |

$628,707,006 |

$551,750,266 |

$539,233,139 |

| |

|

|

|

| Shares outstanding |

3,754,538 |

3,754,538 |

3,753,038 |

| |

|

|

|

| Net assets per share |

$167.45 |

$146.95 |

$143.68 |

Assuming reinvestment of all dividends and tax credits on

retained long-term capital gains, the March 31, 2012 net asset

value was 18.1% greater than the March 31, 2011 net asset value of

$143.68 per share and 14.0% above the December 31, 2011 net asset

value of $146.95 per share.

In March 2012, Form S-3 registration statements for Alamo Group,

Inc. (NYSE:ALG), Encore Wire Corporation (Nasdaq:WIRE), and Heelys,

Inc. (Nasdaq:HLYS) were filed with the Securities and Exchange

Commission (SEC). As a result of these registrations becoming

effective with the SEC, restrictions under Rule 144 of the

Securities Act of 1933 were lifted and valuation discounts

previously applied to these holdings were removed. Had the

prior period discounts been applied to ALG, WIRE, and HLYS, the

resulting net asset value would have been $597,793,096, or $159.22

per share. This would have represented increases of 12.3% and

8.3% over the March 31, 2011 and December 31, 2011 net asset

values, respectively.

About Capital Southwest Corporation

Capital Southwest is celebrating over 50 years of helping

companies grow and prosper. Since our founding in 1961, we have

operated as a business development company with a refreshingly

different mindset: we provide capital to exceptional

businesses and have the patience and flexibility to hold

investments indefinitely, enabling companies to achieve their

potential. Visit our website at www.CapitalSouthwest.com to learn

about our investment criteria and how our capital can accelerate

your company's growth.

This press release may contain historical information and

forward-looking statements within the meaning of The Private

Securities Litigation Reform Act of 1995 with respect to the

business, financial condition and results of operations of the

Company. The words "believe," "expect," "intend," "plan," "should"

and similar expressions are intended to identify forward-looking

statements. Such statements reflect the current views, assumptions

and expectations of the Company with respect to future events and

are subject to risks and uncertainties. Many factors could cause

the actual results, performance or achievements of the Company to

be materially different from any future results, performance or

achievements that may be expressed or implied by such

forward-looking statements, including, among others, changes in the

markets in which the Company operates and in general economic and

business conditions, competitive pressures, changes in business

strategy and various other factors, both referenced and not

referenced in this press release. Certain factors that may affect

the Company and its results of operations, are included in the

"Risk Factors" section of the Company's Annual Report on Form 10-K

for the fiscal year ended March 31, 2011 and the Company's

subsequent periodic filings with the Securities and Exchange

Commission. The Company does not assume any obligation to update

these forward-looking statements. This release may also

contain non-GAAP financial measures. These measures are

included to facilitate meaningful comparisons of our results to

those in prior periods and future periods and to allow a better

evaluation of our operating performance, in management's

opinion. Our reference to any non-GAAP measures should not be

considered as a substitute for results that are presented in a

manner consistent with GAAP. These non-GAAP measures are

provided only to enhance investors overall understanding of our

financial performance.

CONTACT: Gary L. Martin or Tracy L. Morris

972-233-8242

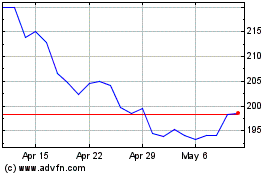

Alamo (NYSE:ALG)

Historical Stock Chart

From Mar 2024 to Apr 2024

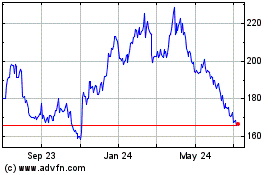

Alamo (NYSE:ALG)

Historical Stock Chart

From Apr 2023 to Apr 2024