IAMGOLD Expands Gold Production Pipeline in Canada With Acquisition of Trelawney

April 27 2012 - 6:32AM

Marketwired Canada

All amounts are expressed in Canadian dollars, unless otherwise indicated.

IAMGOLD Corporation (TSX:IMG)(NYSE:IAG) ("IAMGOLD" or "the Company") and

Trelawney Mining and Exploration Inc. (TSX VENTURE:TRR)(FRANKFURT:RTW)

("Trelawney") today announced that they have entered into a definitive agreement

(the "Agreement") whereby IAMGOLD will acquire, through a plan of arrangement,

all of the issued and outstanding common shares of Trelawney. Trelawney is a

Canadian junior mining and exploration company, focused on the development of

the Cote Lake Deposit located adjacent to the Swayze Greenstone Belt in northern

Ontario.

Under the terms of the Agreement, each Trelawney shareholder will receive $3.30

in cash for each Trelawney share held. The transaction price represents a 36.6%

premium based on Trelawney's 20-day volume weighted average price ("VWAP") for

the period ending April 26, 2012.

"The acquisition of Trelawney creates a larger and more geographically balanced

portfolio of long-life gold assets for IAMGOLD. This transaction provides an

accretive return on invested capital as we are effectively redeploying the cash

proceeds from the sale of non-core assets last year into a Canadian gold project

that significantly strengthens our future gold production profile. This is

consistent with our strategy to invest in development projects that we own and

operate so we can derive maximum benefit from leveraging our operational and

development expertise. Trelawney is an excellent strategic fit with our existing

Canadian portfolio and we look forward to advancing this promising property,"

stated Stephen Letwin, President and Chief Executive Officer of IAMGOLD.

Trelawney's President and Chief Executive Officer Greg Gibson said, "Over the

past three years, the Trelawney team has done a tremendous job in advancing the

Cote Lake Project to its current status. I want to take this opportunity to

thank all Trelawney employees for their contributions to the discovery and

advancement of Cote Lake into a world class gold deposit. I am very proud of our

success and the exceptional value that it has created for our shareholders. This

acquisition will reward our shareholders with a significant premium that

reflects this success."

Transaction Highlights

-- Offers Trelawney shareholders an immediate and attractive premium

-- Large NI 43-101 resource open along strike and at depth

-- Indicated resource of 0.93 million ounces of contained gold(1)

-- Inferred resource of 5.94 million ounces of contained gold(1)

-- Increases IAMGOLD's inferred resources by 95% and measured and

indicated resources by 5%

-- Attractive location in northern Ontario's highly prospective gold

producing region

-- Expands geographic footprint in one of the world's friendliest

mining jurisdictions

-- Provides a more geographically balanced portfolio, where Canada will

account for 35% of the resource base compared to 18% pre-

acquisition(2)

-- Significant exploration/expansion potential near current resource

-- Large 516km2 land package

-- Step-out drilling continues to expand mineralization

-- Financial strength

-- IAMGOLD and Trelawney have strong balance sheets with minimal debt

-- Timing of the potential development allows project to be funded from

internal cash flow and available credit facilities

-- Aligned with strategy to continue growing dividend payout

-- All cash transaction provides significant gold resource leverage with no

dilution to IAMGOLD shareholders

Trelawney's main asset is the advanced exploration Cote Lake Project, located in

Ontario, Canada. On February 24, 2012, Trelawney announced an updated mineral

resource estimate for Cote Lake, comprising 35 million tonnes at 0.82 g/t gold

for 0.93 million ounces of indicated resources and 204 million tonnes at 0.91

g/t gold for 5.94 million ounces of inferred resources. Mineralization at Cote

Lake has been intersected over a strike length of 1,200 metres, a horizontal

width of 100 - 300 metres and a depth extent of more than 500 metres(1).

Gordon Stothart, Executive Vice President and Chief Operating Officer of IAMGOLD

stated, "This project has the potential to become a large bulk tonnage

operation, with significant economies of scale at competitive cash costs. I'm

excited to have this asset as part of our portfolio. We believe the project has

the potential and scale to significantly contribute to our future production and

growth profile."

Terms of the Transaction

-- For each common share of Trelawney, IAMGOLD will pay $3.30 in cash.

-- The fully diluted in the money value of the transaction is approximately

$608 million with an enterprise value of $505 million net of cash.

-- Represents a 36.6% premium based on Trelawney's 20-day VWAP for the

period ending April 26, 2012.

-- Completion of the transaction is subject to customary conditions,

including court approvals, a favourable vote of at least 66 2/3% of the

holders of Trelawney common shares voted at a special meeting of

shareholders, and the receipt of all necessary regulatory approvals.

-- The definitive agreement includes a non-solicitation clause, right to

match covenants and provides for the payment of a $21 million break fee

to IAMGOLD under certain circumstances.

-- The transaction will be carried out via a plan of arrangement. Assuming

Trelawney shareholders approve the transaction at the special meeting

and final court approvals are obtained, the transaction is expected to

close by the end of June.

-- Shares held by IAMGOLD and shareholders who have agreed to voting

arrangements, including management and the Board of Directors, represent

approximately 13.3% of the current shares outstanding.

Board Recommendations

The transaction has been approved by the Board of Directors of IAMGOLD and the

Board of Directors of Trelawney following the unanimous recommendation of a

special committee comprising independent Trelawney directors. The Board of

Directors of Trelawney recommends that holders of Trelawney shares vote in

favour of the transaction. RBC Capital Markets has provided an opinion to the

Trelawney Board of Directors that the consideration to be received by Trelawney

shareholders under the transaction is fair, from a financial point of view, to

the Trelawney shareholders.

Advisors

IAMGOLD's financial advisor is GMP Securities L.P. and its legal advisor is

Fasken Martineau DuMoulin LLP.

Trelawney's financial advisor is RBC Capital Markets and its legal advisor is

Stikeman Elliott LLP.

Conference Call and Webcast

IAMGOLD will hold a conference call and webcast to discuss the proposed

acquisition on Friday, April 27, 2012 at 8:30 a.m. (Eastern Daylight Time). A

webcast of the conference call will be available through the Company's website -

www.iamgold.com.

Conference Call Information: North America Toll-Free: 1-866-206-0240 or

International number: 1-646-216-7111, passcode: 34099898#.

A live and archived webcast will be available at IAMGOLD's website at

www.iamgold.com or Trelawney's website at www.trelawneymining.com.

IAMGOLD and Trelawney shareholders and other interested parties are advised to

read the materials relating to the proposed transaction that will be filed with

securities regulatory authorities in Canada when they become available. Anyone

may obtain copies of these documents when available free of charge at the

Canadian Securities Administrators' website at www.sedar.com.

A replay of this conference call will be available from April 27 to May 27 2012.

Access this replay by dialing: North America toll-free: 1-866-206-0173 or

International number: 1-646-216-7204, passcode: 272107#.

Footnotes

(1) Trelawney mineral resource on a 100% basis, based on current mineral

resource estimate. Refer below for complete reference to the Technical Report.

(2) Measured and indicated resources and inferred resources for IAMGOLD are

based on IAMGOLD's attributable share. Attributable mineral resources for

Trelawney are included at 92.5%. See footnote 1 above for the mineral resource

technical report reference.

Qualified Persons

Geoffrey Chinn P.Geo., Manager Resource Geology of IAMGOLD and David Beilhartz

P.Geo, Vice-President Exploration of Trelawney, both Qualified Persons as

defined under National Instrument 43-101, have reviewed and approved this

disclosure having current knowledge of the project.

Scientific and Technical Disclosure

For complete disclosure of the Trelawney mineral resource estimate refer to the

Technical Report on the Cote Lake Resource Update, Chester Property, Ontario,

Canada reported in accordance with National Instrument 43-101 requirements,

signed by W. Roscoe and B. Cook, Roscoe Postle Associates Inc., effective

February 24, 2012.

Resource and reserve estimates in accordance with the CIM definitions.

Investors are cautioned that mineral resources are not mineral reserves and do

not have demonstrated economic viability.

Forward Looking Statement

This news release contains forward-looking statements. All statements, other

than of historical fact, that address activities, events or developments that

the Company or Trelawney believes, expects or anticipates will or may occur in

the future (including, without limitation, statements regarding the expected

benefits of acquiring Trelawney, expected, estimated or planned gold and niobium

production, cash costs, margin expansion, capital expenditures and exploration

expenditures and statements regarding the estimation of mineral resources,

exploration results, potential mineralization, potential mineral resources and

mineral reserves) are forward-looking statements. Forward-looking statements are

generally identifiable by use of the words "may", "will", "should", "continue",

"expect", "anticipate", "estimate", "believe", "intend", "plan" or "project" or

the negative of these words or other variations on these words or comparable

terminology. Forward-looking statements are subject to a number of risks and

uncertainties, many of which are beyond the Company's and Trelawney's ability to

control or predict, that may cause the actual results of the Company or

Trelawney to differ materially from those discussed in the forward-looking

statements. In respect of the Company, factors that could cause actual results

or events to differ materially from current expectations include, among other

things, without limitation, failure to complete the acquisition of Trelawney or

the failure to realize the benefits of such acquisition, to meet expected,

estimated or planned gold and niobium production, cash costs, margin expansion,

capital expenditures and exploration expenditures and failure to establish

estimated mineral resources, the possibility that future exploration results

will not be consistent with the Company's expectations, changes in world gold

markets and other risks disclosed in IAMGOLD's most recent Form 40-F/Annual

Information Form on file with the United States Securities and Exchange

Commission and Canadian provincial securities regulatory authorities. In respect

of Trelawney, factors that could cause actual results or events to differ

materially from current expectations include, among other things, the timing and

content of upcoming work programs, geological interpretations, receipt of

property titles, potential mineral recovery processes and other risks disclosed

in Trelawney's filings with Canadian provincial regulatory authorities. Any

forward-looking statement speaks only as of the date on which it is made and,

except as may be required by applicable securities laws, the Company and

Trelawney disclaims any intent or obligation to update any forward-looking

statement.

Cautionary Note to U.S. Investors

The United States Securities and Exchange Commission limits disclosure for U.S.

reporting purposes to mineral deposits that a company can economically and

legally extract or produce. IAMGOLD uses certain terms in this presentation,

such as "measured," "indicated," or "inferred," which may not be consistent with

the reserve definitions established by the SEC. U.S. investors are urged to

consider closely the disclosure in the IAMGOLD Annual Reports on Forms 40-F. You

can review and obtain copies of these filings from the SEC's website at

http://www.sec.gov/edgar.shtml or by contacting the Investor Relations

department.

About IAMGOLD

IAMGOLD (www.iamgold.com) is a leading mid-tier gold mining company producing

approximately one million ounces annually from five gold mines (including

current joint ventures) on three continents. In the Canadian province of Quebec,

the Company also operates Niobec Inc., which produces more than 4.5 million

kilograms of niobium annually, and owns a rare earth element resource close to

its niobium mine. IAMGOLD is uniquely positioned with a strong financial

position and extensive management and operational expertise. To grow from this

strong base, IAMGOLD has a pipeline of development and exploration projects and

continues to assess accretive acquisition opportunities. IAMGOLD's growth plans

are strategically focused in certain regions in Canada, select countries in

South America and Africa.

About Trelawney

Trelawney is a Canadian junior mining and exploration company with a

growth-oriented strategy focused on expanding its gold resources and developing

its Canadian mineral properties. The company's current focus is directed towards

the development and continued exploration of its Cote Lake Project, located in

Northern Ontario.

Please note:

This entire news release may be accessed via fax, e-mail, IAMGOLD's website at

www.iamgold.com and through CNW Group's website at www.newswire.ca. All material

information on IAMGOLD can be found at www.sedar.com or at www.sec.gov.

Si vous desirez obtenir la version francaise de ce communique, veuillez

consulter le http://www.iamgold.com/French/Home/default.aspx.

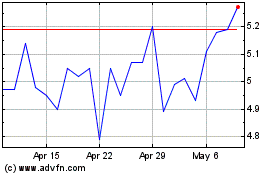

IAMGOLD (TSX:IMG)

Historical Stock Chart

From Mar 2024 to Apr 2024

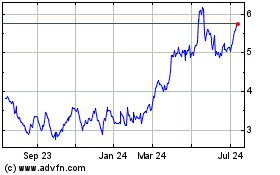

IAMGOLD (TSX:IMG)

Historical Stock Chart

From Apr 2023 to Apr 2024