O'Reilly Surpasses, EPS Up 37% - Analyst Blog

April 26 2012 - 11:15AM

Zacks

O’Reilly Automotive Inc. (ORLY) revealed a 25%

increase in profit to $147 million in the first quarter of 2012

from $118 million in the same quarter of 2011. These are equivalent

to earnings per share of $1.14 during the quarter, up 37% from 83

cents in the first quarter of 2011 and the Zacks Consensus Estimate

of $1.04 (all excluding non-recurring items).

Sales during the quarter scaled up 11% to $1.5 billion from $1.4

billion in the same period a year ago. Comparable store sales

(adjusted for the impact of Leap Day in the quarter) increased 6.1%

in the quarter versus 5.7% in the first quarter of 2011.

Gross profit increased 14% to $762 million (49.8% of sales) from

$670 million (48.4%) in the first quarter of 2011. Selling, general

and administrative expenses rose 9% to $514 million (33.6%) from

$473 million (34.2%) a year ago. Operating income grew 26% to $248

million (16.2%) from $196 million (or 14.2%) in the previous year

quarter.

Store Information

During the quarter, O’Reilly opened 73 stores and closed 4

stores, bringing its total store count to 3,809 as of March 31,

2012. Sales per weighted average-store increased to $400 from $381

a year ago.

Share Repurchases

During the quarter, O’Reilly repurchased 1.8 million shares of

its common stock for $154 million, reflecting an average price of

$87.01. Subsequent to the end of the first quarter and through the

date of the earnings release, the company has repurchased an

additional 0.1 million shares for $5.3 million, implying an average

price of $89.96.

Since the inception of the share repurchase program in January

last year, O’Reilly repurchased a total of 17.7 million shares for

$1.14 billion, reflecting an average price of $64.14. As of April

25, 2012, the company had approximately $364 million worth of

shares remaining under its share repurchase program.

Financial Position

O’Reilly had cash and cash equivalents of $575.2 million as of

March 31, 2012, which more than doubled from $230.0 million as of

March 31, 2011. Long-term debt increased to $797.5 million as of

March 31, 2012 from $498.8 million as of March 31, 2011. This

translated into a higher long-term debt-to-capitalization ratio of

22% as of March 31, 2012 compared with 14% as of March 31,

2011.

In the quarter, net cash flow from operations rose 41% to $414.5

million from $294.1 million in the previous year quarter. The

increase in cash flow primarily came on the back of higher profits

and increases in accounts payable and income taxes payable.

Meanwhile, capital expenditures (net) decreased to $75.0 million

from $94.2 million in the same quarter of 2010.

Guidance

O’Reilly has projected comparable store sales gain of 3%–5% for

the second quarter of 2012 and 3%–6% for the full year 2012.

The company expects to generate revenues of $6.15 billion–$6.25

billion for the year. The company has projected gross margin of

49.4%–49.8% and operating margin of 15.4%–15.9% for the year. It

also expects to earn $1.13–$1.17 per share in the second quarter

and $4.47–$4.57 per share in 2012.

The company has also provided capital expenditures forecast of

$315 million to $345 million and free cash flow guidance of $ $700

million to $750 million for the year.

Our Take

O'Reilly Automotive is the third largest specialty retailer of

automotive aftermarket parts, tools, supplies, equipment, and

accessories in the U.S., selling products to both Do-it-Yourself

(DIY) customers and Do-it-for-Me (DIFM) or professional

installers.

The company sells an extensive line of products consisting of

new and remanufactured automotive hard parts (such as mufflers,

brakes, and shock absorbers), maintenance items, accessories, a

complete range of auto body paint and related materials, automotive

tools, and professional service equipment. Its main competitors

include Advance Auto Parts Inc. (AAP),

AutoZone Inc. (AZO) and Pep Boys - Manny,

Moe & Jack (PBY),

Based on its market position as well as improved results and

clear-cut outlook, the company currently retains a Zacks #2 Rank on

its shares, which translates to a short-term rating of “Buy”.

ADVANCE AUTO PT (AAP): Free Stock Analysis Report

AUTOZONE INC (AZO): Free Stock Analysis Report

O REILLY AUTO (ORLY): Free Stock Analysis Report

PEP BOYS M M &J (PBY): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

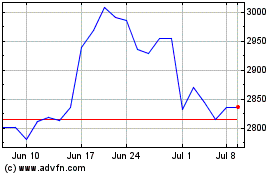

AutoZone (NYSE:AZO)

Historical Stock Chart

From Mar 2024 to Apr 2024

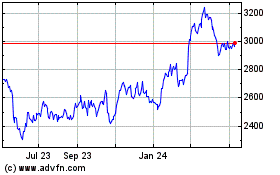

AutoZone (NYSE:AZO)

Historical Stock Chart

From Apr 2023 to Apr 2024