Italy March Fund Inflows EUR1.9 Billion, Reversing Negative Trend

April 26 2012 - 6:47AM

Dow Jones News

Italian asset managers registered a net inflow of EUR1.9 billion

in March, the first month in a year that hasn't recorded a net

outflow, Italian industry association Assogestioni said

Thursday.

Included in this total, open-ended funds, which make up the bulk

of the amount, registered a net inflow of EUR2.4 billion.

Among these funds, those dedicated to equities registered a net

outflow of EUR238 million, while those focused on bonds had an

inflow of EUR3.8 billion.

Italy's Treasury has been issuing bonds with relatively high

yields to lure investors who are concerned about the country's

economic prospects and its enormous debt burden.

Money-market funds had inflows of EUR112 million.

Shares of asset management companies, such as Banca Generali SpA

(BGN.MI), Mediolanum SpA (MED.MI) and Azimut SpA (AZM.MI), as well

as Intesa Sanpaolo SpA (ISP.MI) and UniCredit SpA (UCG.MI), are

sensitive to capital flows data as inflows boost their profits from

fees and commissions.

-By Zofia Bakowska and Gilles Castonguay, Dow Jones Newswires,

+39 02 5821 9905; zofia.bakowska@dowjones.com

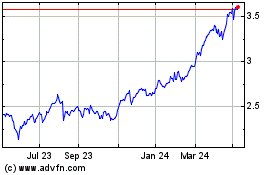

Intesa Sanpaolo (BIT:ISP)

Historical Stock Chart

From Mar 2024 to Apr 2024

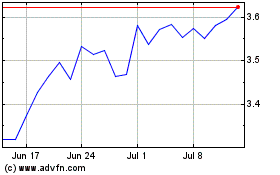

Intesa Sanpaolo (BIT:ISP)

Historical Stock Chart

From Apr 2023 to Apr 2024