DeVry Inc. (NYSE:DV), a global provider of educational services,

today reported results for its fiscal 2012 third-quarter and

nine-month period ended March 31, 2012.

Significant accomplishments:

- DeVry Brasil acquired Faculdade Boa

Viagem (FBV) to expand its presence in northeastern Brazil

- Becker Professional Education acquired

Falcon Physician Reviews to enter the growing healthcare exam

preparation market

- Chamberlain established campuses in

Atlanta and Indianapolis; sought approvals to open a Tinley Park,

Ill., campus in fiscal 2013

- Becker announced that it prepared all

19 Elijah Watts Sells Winners for the 2010 CPA Exam

Financial Results for the Three Months Ended March 31,

2012:

- Revenues decreased 4 percent to $540.8

million

- Net income declined 28 percent to $67.1

million

- Diluted earnings per share decreased 24

percent to $1.00

Financial Results for the Nine Months Ended March 31,

2012:

- Revenues decreased 3 percent to $1,584

million

- Reported net income declined to $133.5

million from $255.2 million last year, and net income excluding

discrete items was $187.1 million, down 27 percent

- Reported diluted earnings per share

declined to $1.96 from $3.60 per share last year, and earnings per

share excluding discrete items was $2.74 per share, down 24

percent

“While this was a challenging quarter, we continued to execute

on our five-point performance improvement plan, which includes

reducing costs at DeVry University and Carrington Colleges,” said

Daniel Hamburger, DeVry’s president and chief executive officer.

“Our strong financial position enables us to aggressively pursue

our plan without sacrificing quality or foregoing opportunities for

targeted investments. In the quarter, we made promising investments

in high growth areas of our organization, namely the expansion of

Chamberlain into two new markets and the additions of Faculdade Boa

Viagem and Falcon Physician Review to our family of

institutions.”

Business Highlights

Business, Technology, and Management Segment

DeVry University

DeVry University reported new undergraduate student enrollment

of 12,025, a 19.7 percent decline compared with 14,981 last year.

Total student enrollment decreased 15.1 percent to 60,196 students,

compared with 70,863 in spring 2011.

For the January 2012 session, the number of graduate

coursetakers enrolled in master’s degree programs at DeVry

University and its Keller Graduate School of Management was 24,029,

a decrease of 3.0 percent versus January 2011. For the March 2012

session, the number of graduate coursetakers was 23,366, a decline

of 4.3 percent from prior year.

The total number of online undergraduate and graduate

coursetakers in the March 2012 session decreased 13.1 percent to

68,083 versus 78,366 in the same session a year ago.

Enrollment results were impacted by a focus on adjusting to new

regulations and prolonged unemployment, which continued to affect

consumer confidence.

Medical and Healthcare Segment

DeVry Medical International

In the January 2012 term, new students decreased 20.5 percent to

601, compared to a very strong 756 students last year. Total

students increased 1.0 percent to 6,024 compared to 5,965 students

in the same term last year. The decline in new student enrollment

is largely a result of capacity constraints at Ross University

School of Medicine. Ross expects new student enrollment to increase

in the May term reflecting the continued strong demand for medical

education.

Chamberlain College of Nursing

Chamberlain's new student enrollment in spring 2012 increased

2.8 percent to 2,933 students, compared to 2,852 in spring 2011.

Total student enrollment rose 19.9 percent to 11,867 students

compared with 9,897 during the same period last year.

Chamberlain’s newly established Atlanta location has experienced

exceptionally strong interest from applicants for the first classes

at that location.

Carrington Colleges Group

New student enrollment at Carrington decreased 30.9 percent to

2,254 compared with 3,261 in spring 2011. Total enrollment

decreased 28.4 percent to 7,309 students, compared with 10,206 for

the same period last year. Carrington continues to make progress on

its turnaround plan, which includes increasing its student

recruiting effectiveness, aligning its cost structure, and

enhancing academic quality.

Professional Education Segment

Becker Professional Education

In April, Becker announced its acquisition of Falcon Physician

Reviews, a leading provider of comprehensive review programs for

physicians preparing for the United States Medical Licensing

Examination (USMLE) and the Comprehensive Osteopathic Medical

Licensing Examination (COMLEX). The transaction expands Becker’s

exam preparation services into the growing healthcare field.

Becker announced recently that 100 percent of the 2010 Elijah

Watt Sells Award winners prepared for the exam with Becker’s CPA

Exam Review. Since the American Institute of Certified Public

Accountants (AICPA) began recognizing the Elijah Watt Sells Award

recipients nationally in 2005, 66 of the 74 winners have prepared

with Becker’s CPA Exam Review.

The Elijah Watt Sells Award is presented to the 10 CPA

candidates, who, on their first attempt, achieve the highest

cumulative scores for all four sections of the Uniform CPA

Examination within a calendar year. In 2010 several candidates

received identical cumulative scores, resulting in a tie and

increasing the number of award recipients to 19.

Other Educational Services Segment

DeVry Brasil

In February, DeVry Brasil announced it had acquired Faculdade

Boa Viagem, adding another quality institution to its growing

family of schools in northeastern Brazil.

For the spring 2012 term, new students increased 46.1 percent to

5,599, compared to 3,833 students for prior year term. Total

students increased 55.6 percent to 21,297 compared to 13,688

students in the same term last year, driven by strong demand and

the acquisition of FBV.

Balance Sheet/Cash Flow

For the first nine months of fiscal 2012, DeVry generated $355.1

million of operating cash flow. As of March 31, 2012, cash,

marketable securities and investment balances totaled $332.1

million and there were no outstanding borrowings.

Share Repurchase Plan

During the quarter, a total of 863,369 shares were repurchased

under the organization’s seventh repurchase program for

approximately $32.1 million, at an average cost of $37.21 per

share.

Conference Call and Webcast Information

DeVry will host a conference call on April 24, 2012, at 3:30

p.m. Central Daylight Time (4:30 p.m. Eastern Daylight Time) to

discuss its fiscal 2012 third-quarter results. The conference call

will be led by Daniel Hamburger, president and chief executive

officer, Tim Wiggins, chief financial officer, and Pat Unzicker,

vice president of finance.

For those wishing to participate by telephone, dial (866)

314-4483 (domestic) or (617) 213-8049 (international). Use passcode

53841990 or say “DeVry Call.” DeVry will also broadcast the

conference call live via the Internet. Interested parties may

access the webcast through the Investor Relations section of the

organization's website at http://www.media-server.com/m/p/7r9x3m5e.

Please access the website at least 15 minutes prior to the start of

the call to register, download and install any necessary audio

software.

DeVry will archive a telephone replay of the call until May 1,

2012. To access the replay, dial (888) 286-8010 (domestic) or (617)

801-6888 (international), passcode: 95020056. To access the webcast

replay, please visit DeVry’s website at www.devryinc.com.

About DeVry Inc.

DeVry's purpose is to empower its students to achieve their

educational and career goals. DeVry (NYSE: DV, member S&P 500

Index) is a global provider of educational services and the parent

organization of Advanced Academics, American University of the

Caribbean School of Medicine, Becker Professional Education,

Carrington College, Carrington College California, Chamberlain

College of Nursing, DeVry Brasil, DeVry University, and Ross

University Schools of Medicine and Veterinary Medicine. These

institutions offer a wide array of programs in business, healthcare

and technology. DeVry’s institutions serve students in secondary

through postsecondary education and professionals in accounting and

finance. For more information, please call 630.353.3800 or visit

http://www.devryinc.com.

Certain statements contained in this release concerning DeVry's

future performance, including those statements concerning DeVry's

expectations or plans, may constitute forward-looking statements

subject to the Safe Harbor Provision of the Private Securities

Litigation Reform Act of 1995. These forward-looking statements

generally can be identified by phrases such as DeVry Inc. or its

management "believes," "expects," "anticipates," "foresees,"

"forecasts," "estimates" or other words or phrases of similar

import. Actual results may differ materially from those projected

or implied by these forward-looking statements. Potential risks,

uncertainties and other factors that could cause results to differ

are described more fully in Item 1A, "Risk Factors," in DeVry's

most recent Annual Report on Form 10-K for the year ending June 30,

2011 and filed with the Securities and Exchange Commission on

August 26, 2011.

Selected Operating Data (in thousands, except per share

data)

Third Quarter FY 2012

FY 2011 Change Revenues $540,807

$562,730 (3.9%) Net Income $67,131 $92,900

(27.7%) Earnings per Share (diluted) $1.00 $1.32 (24.2%) Number of

common shares (diluted) 67,225 70,272 (4.3%)

Nine

Months FY 2012 FY 2011

Change Revenues $1,583,894 $1,635,621 (3.2%)

Net Income $133,480 $255,207 (47.7%) Earnings per Share (diluted)

$1.96 $3.60 (45.6%) Number of common shares (diluted) 68,235 70,886

(3.7%)

Use of Non-GAAP Financial Information and Supplemental

Reconciliation Schedule

During the second quarter of fiscal year 2012, DeVry recorded

impairment charges related to its Carrington Colleges reporting

unit. Also, DeVry recorded a gain from the sale of Becker’s Stalla

CFA review operations. The following table illustrates the effects

of the impairment charges and gain on sale of assets on DeVry’s

results. Management believes that the disclosure of non-GAAP net

income and earnings per share provides investors with useful

supplemental information regarding the underlying business trends

and performance of DeVry’s ongoing operations and is useful for

period-over period comparisons of such operations given the

discrete nature of the impairment charges and gain on the sale of

assets. DeVry uses these supplemental financial measures internally

in its management and budgeting processes. However, the non-GAAP

financial measures should be viewed in addition to, and not as a

substitute for, DeVry’s reported results prepared in accordance

with GAAP. The following table reconciles these items to the

relevant GAAP information (in thousands, except per share

data):

For The Nine Months Ended March 31:

2012 2011 Net Income $133,480 $255,207

Earnings per Share (diluted) $1.96 $3.60 Impairment

Charges (net of tax) $55,751 -- Effect on Earnings per Share

(diluted) $0.82 -- Gain on Sale of Assets (net of tax)

$(2,174 ) -- Effect on Earnings per Share (diluted) $(0.03 )

-- Net Income Excluding the Impairment Charges and Gain on

Sale of Assets $187,057 $255,207 Earnings per Share

Excluding the Impairment Charges and Gain on Sale of Assets

(diluted) $2.74 $3.60

Spring 2012 Enrollment

Results

2012 2011

Change Total DeVry Inc. Postsecondary

Enrollments(1) 126,165 130,957 (3.7)%

DeVry

University Undergraduate(2) New students 12,025 14,981 (19.7%)

Total students 60,196 70,863 (15.1%) Graduate

coursetakers(2)(3) January 24,029 24,784 (3.0%) March 23,366 24,406

(4.3%)

Online coursetakers(3) – March

68,083 78,366 (13.1%)

Chamberlain College of Nursing –

Spring(2

) New students 2,933 2,852 +2.8% Total

students 11,867 9,897 +19.9%

DeVry Medical

International(4) New students 601 756 (20.5%) Total students

6,024 5,965 +1.0%

Carrington Colleges – Spring

New students 2,254 3,261 (30.9%) Total students 7,309 10,206

(28.4%)

DeVry Brasil – Spring(5) New students 5,599

3,833 +46.1% Total students 21,297 13,688 +55.6%

DeVry Brasil – Spring (excluding

FBV)

New students 4,336 3,833 +13.1% Total students 15,876 13,688 +16.0%

1. Excludes Becker and Advanced Academics. 2.

Includes both onsite and online students 3. The term “coursetaker”

refers to the number of courses taken by a student. Thus one

student taking two courses equals two coursetakers 4. DeVry Medical

International includes Ross University Schools of Medicine and

Veterinary Medicine and the American University of the Caribbean

School of Medicine (AUC). AUC’s new student enrollment for the

January 2012 and 2011 terms were 87 students and 114 students,

respectively. AUC’s total student enrollment for the January 2012

and 2011 terms were 1,184 students and 1,155 students,

respectively. 5. DeVry acquired FBV in northeastern Brazil in

January. For the Spring 2012 term, FBV’s new student enrollment was

1,263 students and total student enrollment was 5,421 students.

Chart 1: Remaining DeVry Inc. Calendar 2012 Announcements

& Events

Aug. 9, 2012 Fiscal 2012 Year-End Results and Enrollment

DeVry University Chamberlain College of Nursing Carrington

Colleges Group DeVry Medical International Oct. 25, 2012

Fiscal 2013 First Quarter Results and Enrollment DeVry

University Chamberlain College of Nursing Carrington Colleges Group

DeVry Medical International DeVry Brasil November 7, 2012

Annual Shareholder’s Meeting

Chart 2: Calendar 2013 Announcements & Events

January 24, 2013 Fiscal 2013 Second Quarter and Enrollment

DeVry University Chamberlain College of Nursing Carrington

Colleges Group DeVry Medical International April 23, 2013

Fiscal 2013 Third Quarter Results and Enrollment DeVry

University Chamberlain College of Nursing Carrington Colleges Group

DeVry Medical International DeVry Brasil August 15, 2013

Fiscal 2013 Second Quarter and Enrollment DeVry University

Chamberlain College of Nursing Carrington Colleges Group DeVry

Medical International

October 24, 2013

Fiscal 2013 Third Quarter Results and

Enrollment

DeVry University

Chamberlain College of Nursing

Carrington Colleges Group

DeVry Medical International

DeVry Brasil

November 6, 2013

Annual Shareholder’s Meeting

Chart 3: Link to DeVry University USOC Campaign

http://www.youtube.com/user/TheDevryUniversity?ob=0&feature=results_main

DEVRY INC.

CONSOLIDATED

BALANCE SHEETS

(Dollars in Thousands) (Unaudited) PRELIMINARY

March 31, June 30,

March 31, 2012 2011 2011

ASSETS

Current

Assets

Cash and Cash Equivalents $ 329,440 $ 447,145 $ 596,515

Marketable Securities and Investments 2,665 2,575 2,556 Restricted

Cash 13,194 2,308 7,378 Accounts Receivable, Net 254,661 114,689

223,953 Deferred Income Taxes, Net 23,019 24,457 26,290 Prepaid

Expenses and Other 42,389 33,476

31,030 Total Current Assets 665,368

624,650 887,722

Land, Buildings

and Equipment

Land 66,019 54,404 54,274 Buildings 382,972 314,274 302,843

Equipment 422,271 402,179 361,837 Construction In Progress

50,192 63,310 73,713

921,454 834,167 792,667 Accumulated Depreciation and

Amortization (374,904 ) (365,923 ) (354,711 )

Land, Buildings and Equipment, Net 546,550

468,244 437,956

Other

Assets

Intangible Assets, Net 292,887 195,462 191,870 Goodwill

566,547 523,620 517,822 Perkins Program Fund, Net 13,450 13,450

13,450 Other Assets 27,400 25,077

21,607 Total Other Assets 900,284

757,609 744,749

TOTAL

ASSETS $ 2,112,202 $ 1,850,503 $ 2,070,427

DEVRY INC.

CONSOLIDATED

BALANCE SHEETS

(Dollars in Thousands) (Unaudited) PRELIMINARY

March 31, June 30,

March 31, 2012 2011 2011

LIABILITIES

Current

Liabilities

Accounts Payable $ 53,208 $ 63,611 $ 63,741 Accrued

Salaries, Wages and Benefits 72,443 107,829 69,410 Accrued Expenses

56,328 47,097 45,338 Advance Tuition Payments 23,257 22,362 22,435

Deferred Tuition Revenue 349,200 75,532

398,452 Total Current Liabilities

554,436 316,431 599,376

Non-Current

Liabilities

Deferred Income Taxes, Net 63,693 69,029 63,874 Deferred

Rent and Other 91,415 68,772

62,130 Total Non-current Liabilities 155,108

137,801 126,004

TOTAL

LIABILITIES 709,544 454,232

725,380

NON-CONTROLLING INTEREST 8,168 6,755

6,466

SHAREHOLDERS'

EQUITY

Common Stock, $0.01 par value, 200,000,000 Shares

Authorized; 65,831,000, 68,635,000 and 68,966,000 Shares issued and

outstanding at March 31, 2012, June 30, 2011 and March 31, 2011,

respectively. 741 738 736 Additional Paid-in Capital 267,285

248,418 238,813 Retained Earnings 1,490,371 1,367,972 1,300,862

Accumulated Other Comprehensive Income 3,163 15,729 13,662 Treasury

Stock, at Cost (8,266,000, 5,148,000 and 4,638,000 Shares,

Respectively) (367,070 ) (243,341 ) (215,492 )

TOTAL SHAREHOLDERS' EQUITY 1,394,490

1,389,516 1,338,581

TOTAL

LIABILITIES AND SHAREHOLDERS' EQUITY $ 2,112,202 $

1,850,503 $ 2,070,427

DEVRY INC.

CONSOLIDATED

STATEMENTS OF INCOME

(Dollars in Thousands Except for Per Share Amounts)

(Unaudited) PRELIMINARY

For The Quarter For The Nine

Months Ended March 31, Ended March 31,

2012 2011 2012 2011

REVENUES: Tuition $ 505,651 $ 521,484 $ 1,488,432 $

1,528,003 Other Educational 35,156 41,246

95,462 107,618 Total

Revenues 540,807 562,730

1,583,894 1,635,621

OPERATING COSTS

AND EXPENSES: Cost of Educational Services 244,195 232,914

723,655 690,912 Student Services and Administrative Expense 201,158

192,589 596,125 560,114 Asset Impairment Charge -

- 75,039 - Total

Operating Costs and Expenses 445,353 425,503

1,394,819 1,251,026

Operating Income 95,454 137,227 189,075 384,595

INTEREST AND OTHER INCOME (EXPENSE): Interest Income 110 435

520 1,239 Interest Expense (650 ) (348 ) (1,653 ) (841 ) Net Gain

on Sale of Assets - - 3,695

- Net Interest and Other Income

(Expense) (540 ) 87 2,562

398

Income Before Income Taxes 94,914 137,314

191,637 384,993

Income Tax Provision 27,610

44,405 57,741 129,851

NET INCOME 67,304 92,909 133,896 255,142

Net (Income) Loss Attributable to Noncontrolling Interest

(173 ) (9 ) (416 ) 65

NET INCOME ATTRIBUTABLE TO DEVRY INC. $ 67,131 $

92,900 $ 133,480 $ 255,207

EARNINGS

PER COMMON SHARE ATTRIBUTABLE TO DEVRY INC. SHAREHOLDERS

Basic $ 1.01 $ 1.34 $ 1.97 $ 3.64

Diluted $ 1.00 $ 1.32 $ 1.96 $

3.60

Cash Dividend Declared per Common Share $

- $ - $ 0.15 $ 0.12

DEVRY INC.

CONSOLIDATED

STATEMENTS OF CASH FLOWS

(Dollars in Thousands) (Unaudited) PRELIMINARY

For The Nine Months Ended March 31, 2012

2011 CASH FLOWS FROM OPERATING ACTIVITIES: Net

Income $133,896 $255,142 Adjustments to Reconcile Net Income to Net

Cash Provided by Operating Activities: Stock-Based

Compensation Expense 12,891 11,192 Depreciation 56,512 43,289

Amortization 8,336 4,589 Impairment of Goodwill and Intangible

Assets 75,039 - Provision for Refunds and Uncollectible Accounts

73,058 73,534 Deferred Income Taxes (5,157 ) 16,220 Loss on

Disposals of Land, Buildings and Equipment 805 262 Realized Gain on

Sale of Assets (3,695 ) - Changes in Assets and Liabilities, Net of

Effects from Acquisitions and Divestitures of Businesses:

Restricted Cash (10,886 ) (5,276 ) Accounts Receivable (212,973 )

(177,807 ) Prepaid Expenses And Other (5,392 ) (6,225 ) Accounts

Payable (11,327 ) (26,631 ) Accrued Salaries, Wages, Expenses and

Benefits (26,149 ) (16,267 ) Advance Tuition Payments 877 1,384

Deferred Tuition Revenue 269,294 311,825

NET CASH PROVIDED BY OPERATING ACTIVITIES 355,129

485,231

CASH FLOWS FROM INVESTING ACTIVITIES:

Capital Expenditures (92,167 ) (91,299 ) Marketable Securities

Purchased (66 ) (91 ) Marketable Securities Sales - 13,495 Payment

for Purchase of Businesses, Net of Cash Acquired (250,150 ) - Cash

Received from Sale of Assets 4,475 - Other - (627 )

NET CASH USED IN INVESTING ACTIVITIES (337,908 ) (78,522 )

CASH FLOWS FROM FINANCING ACTIVITIES: Proceeds from

Exercise of Stock Options 6,041 3,081 Proceeds from Stock issued

Under Employee Stock Purchase Plan 1,298 1,033 Repurchase of Common

Stock for Treasury (124,160 ) (104,746 ) Cash Dividends Paid

(18,430 ) (15,529 ) Excess Tax Benefit from Stock-Based Payments

727 561 Payment of Debt Financing Fees (70 ) -

NET

CASH USED IN FINANCING ACTIVITIES (134,594 ) (115,600 )

Effects of Exchange Rate Differences (332 ) (2,296 )

NET

(DECREASE) INCREASE IN CASH AND CASH EQUIVALENTS (117,705 )

288,813

Cash and Cash Equivalents at Beginning of

Period 447,145 307,702

Cash and Cash

Equivalents at End of Period $329,440 $596,515

DEVRY INC.

SEGMENT

INFORMATION

(Dollars in Thousands) (Unaudited) PRELIMINARY

For The Quarter

For The Nine Months Ended March 31, Ended March

31, Increase Increase 2012 2011

(Decrease) 2012 2011 (Decrease)

REVENUES: Business, Technology and Management $ 338,790 $

378,698 -10.5 % $ 1,001,959 $ 1,102,359 -9.1 % Medical and

Healthcare 160,483 142,544 12.6 % 461,456 421,347 9.5 %

International, K-12 and Professional Education 41,534

41,488 0.1 % 120,479 111,915

7.7 % Total Consolidated Revenues 540,807

562,730 -3.9 % 1,583,894

1,635,621 -3.2 %

OPERATING INCOME: Business,

Technology and Management 64,667 99,351 -34.9 % 183,850 283,342

-35.1 % Medical and Healthcare 25,963 29,289 -11.4 % (2,681 )

88,415 -103.0 % International, K-12 and Professional Education

7,214 10,263 -29.7 % 14,378 15,858 -9.3 % Reconciling Items:

Amortization Expense (2,800 ) (1,497 ) 87.0 % (7,844 ) (4,449 )

76.3 % Depreciation and Other 410 (179 ) NM

1,372 1,429 -4.0 % Total

Consolidated Operating Income 95,454 137,227 -30.4 % 189,075

384,595 -50.8 %

INTEREST AND OTHER INCOME (EXPENSE):

Interest Income 110 435 -74.7 % 520 1,239 -58.0 % Interest Expense

(650 ) (348 ) 86.8 % (1,653 ) (841 ) 96.6 % Net Gain on Sale of

Assets - - NM 3,695

- NM Net Interest and Other Income (Expense)

(540 ) 87 -720.7 % 2,562

398 543.7 % Total Consolidated Income before Income

Taxes $ 94,914 $ 137,314 -30.9 % $ 191,637 $

384,993 -50.2 %

Intangible asset and goodwill impairment charges were recorded

for the nine month period ended March 31, 2012. These charges are

related to DeVry's Carrington Colleges Group, Inc. which is part of

the Medical and Healthcare segment. The following table illustrates

the effects of these impairment charges on the operating income of

the Medical and Healthcare segment. Management believes that the

non-GAAP disclosure of operating earnings provides investors with

useful supplemental information regarding the underlying business

trends and performance of DeVry’s ongoing operations and are useful

for period-over-period comparisons of such operations given the

discrete nature of these impairment transactions. DeVry uses these

supplemental financial measures internally in its budgeting

process. However, the non-GAAP financial measures should be viewed

in addition to, and not as a substitute for, DeVry’s reported

results prepared in accordance with GAAP. The following table

reconciles these items to the relevant GAAP information:

For The Quarter For The Nine

Months Ended March 31, Ended March 31,

Increase Increase 2012

2011 (Decrease) 2012 2011

(Decrease) Medical and Healthcare Operating Income $

25,963 $ 29,289 -11.4 % $ (2,681 ) $ 88,415 -103.0 % Asset

Impairment Charge - - NM 75,039

0 NM Medical and Healthcare Operating Income Excluding Charge for

Asset Impairments $ 25,963 $ 29,289 -11.4 % $ 72,358 $

88,415 -18.2 %

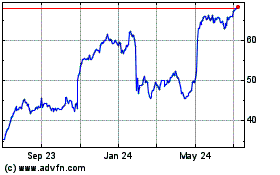

Adtalem Global Education (NYSE:ATGE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Adtalem Global Education (NYSE:ATGE)

Historical Stock Chart

From Apr 2023 to Apr 2024