UPDATE: Reynolds American 1Q Profit Falls 29% On Charges

April 24 2012 - 9:55AM

Dow Jones News

Reynolds American Inc.'s (RAI) first-quarter earnings fell 29%

as the tobacco company booked restructuring-related charges and as

cigarette sales volume dropped more than the broader industry.

Reynolds American and rival tobacco firms face a difficult

operating environment as cigarette volumes have been declining for

years and a weak economy and high unemployment continue to pressure

consumer disposable income.

The major players have responded by enacting price hikes and

cutting costs to help bolster profitability. Reynolds American last

month said it would cut its U.S. work force by about 10% by the end

of 2014, echoing a cost-cutting move by Altria Group Inc. (MO).

Those job cuts were part of a comprehensive review of the company's

business, as Reynolds American sought to get operations in line

with the current business landscape.

Cigarette volume for the nation's second-largest tobacco company

behind Altria, excluding private-label brands, dropped 5.1% in 2011

from the prior year, compared with an overall industry decline of

3.5%. The company has shifted its focus on key brands and has also

diversified into smokeless tobacco and dissolvables in an effort to

seek broader appeal.

In the first quarter, Reynolds American's cigarette volume,

excluding private-label brands, slid 5.6%. That was worse than the

industrywide 4% decline as the company was hurt by high levels of

promotional pricing and lower wholesale inventories.

On a positive note, total volume at American Snuff, the

smokeless tobacco unit that makes Grizzly and Kodiak moist snuff,

was up 7.6% and outpaced the industry's increase of about 5%.

Reynolds American reported a profit of $270 million, or 47 cents

a share, down from $381 million, or 65 cents a share, a year

earlier. Excluding restructuring-related costs and other items,

earnings were down at 63 cents from 64 cents. Revenue decreased

2.9% to $1.93 billion.

Analysts polled by Thomson Reuters most recently projected

earnings of 65 cents on revenue of $1.98 billion.

Gross margin edged up to 48.6% from 48%.

The key Camel and Pall Mall brands posted a relatively steady

quarter. Camel in particular fared well as volume rose 4.4% and

market share inched up 0.1 percentage point. Pall Mall's market

share was flat at 8.5%, though volume dropped 5.2% as the line sees

competition from lower-priced line extensions from Altria's

Marlboro and Lorillard Inc.'s (LO) Newport, as well as standalone

brands like L&M and Maverick.

Citi analyst Vivien Azer called Camel's volume growth "a welcome

surprise," saying she had been concerned that the brand would come

under more pressure from Altria's repackaged products and the

promotion of Marlboro Black.

Total R.J. Reynolds cigarette market share dropped 1.2

percentage points to 26.8%.

Analysts praised two rounds of price increases by the three

largest U.S. tobacco companies last year, as it signaled they

continue to command strong pricing power. The price hikes were

enacted even as state excise taxes have been fairly muted. After

surveying tobacco-industry trade contacts, Wells Fargo recently

said another round of retail price hikes could be coming in May or

June.

Dividend yields and strong cash flows drew investors to tobacco

stocks last year, but shares of the four major publicly traded

companies have been mixed in 2012 as the industry's valuations are

at the upper end of the historical range. Shares of Reynolds

American, which affirmed its full-year earnings guidance, were down

1.7% to $41 in premarket trading.

Results from Altria and Lorillard are due later this week.

-By John Kell, Dow Jones Newswires; 212-416-2480;

john.kell@dowjones.com

--Tess Stynes contributed to this article

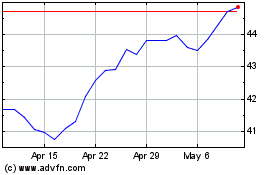

Altria (NYSE:MO)

Historical Stock Chart

From Mar 2024 to Apr 2024

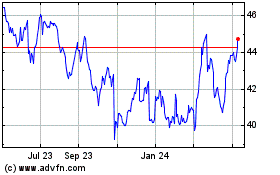

Altria (NYSE:MO)

Historical Stock Chart

From Apr 2023 to Apr 2024