US Capital-Equipment Financing Up 9.7% In March - Survey

April 23 2012 - 3:30PM

Dow Jones News

A survey of credit providers showed that loans and leases for

business equipment in the U.S. rose 9.7% in March from a year ago,

capping off a nearly 17% increase in financing activity during the

first quarter.

Respondents to the Equipment Leasing and Finance Association's

monthly survey said they financed $6.8 billion of new equipment

last month, up from $6.2 billion in the year-earlier period.

March's volume was up 36% from February and was the highest since

September 2011. First-quarter volume totaled $16.9 billion,

compared with $14.5 billion a year ago.

March's survey results support a continuation of spending on

capital equipment, as companies replace worn-out or obsolete

equipment after deferring such activity during the U.S. economic

recession in 2008 and the subsequent sluggish recovery. But

year-over-year growth is likely to moderate as the survey faces

tougher year-ago comparison figures and volume eases during the

summer months ahead.

"Increases of the magnitude we have experienced during the past

two to three years in a recovery mode are probably not

sustainable," said William Sutton, president of the

Washington-based trade association. "Nevertheless, a 10% rate of

growth for [March] continues a positive trend by businesses to make

capex investments."

Credit portfolio quality measured by the survey improved from a

year ago and was mostly stable on a month-to-month basis. Loans and

leases past due by more than 30 days fell to 2.8% of survey

respondents' net receivables in March, down from 3.5% a year

earlier and up slightly from 2.5% in March.

Meanwhile, charge-offs amounted to 0.7% of respondents' net

receivables last month, down from 1.3% a year ago and up from 0.5%

in February. The approval rate for loans and leases was 78.4% in

March, up from 75.4% a year ago and down slightly from 78.8% in

February. Survey respondents continued to cite construction and

trucking as the industry sectors within their loan portfolios that

are underperforming.

A monthly confidence index of the U.S. capital-equipment finance

industry rose to 62.7 in April from 61.7 in March.

The 25 respondents to the association's survey included banks

Wells Fargo & Co. (WFC), Bank of America Corp. (BAC) and Fifth

Third Bancorp (FITB), as well as finance units for manufacturers

Caterpillar Inc. (CAT), Deere & Co. (DE), Volvo Group and Dell

Inc. (DELL).

-By Bob Tita, Dow Jones Newswires; 312-750-4129;

robert.tita@dowjones.com

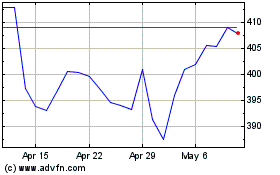

Deere (NYSE:DE)

Historical Stock Chart

From Mar 2024 to Apr 2024

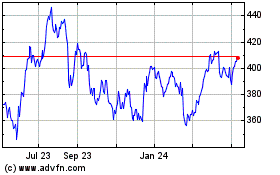

Deere (NYSE:DE)

Historical Stock Chart

From Apr 2023 to Apr 2024