Euro Slips On Weak Equities

April 13 2012 - 6:06AM

RTTF2

The euro weakened against other major counterparts in the

European session on Friday as market sentiment dampened following a

slower than expected GDP growth in China.

Thus far, Germany's DAX lost 1.11 percent, France's CAC 40 index

edged down 1.18 percent and U.K.'s FTSE 100 index fell 0.57

percent.

The Chinese economy slowed more than expected in the first

quarter, data from the National Bureau of Statistics showed.

The gross domestic product expanded 8.1 percent year-on-year in

the first three months of 2012, slower than the fourth quarter's

8.9 percent increase. Economists were looking for a growth slowdown

to 8.4 percent.

In economic news, Germany's EU harmonized inflation slowed in

March as initially estimated, final data from the Federal

Statistical Office showed today.

The harmonized index of consumer prices for Germany, which is

calculated for European purposes, rose 2.3 percent annually, which

was slightly slower than the 2.5 percent growth seen in

February.

The European single currency slipped to 0.8257 against the pound

and 1.3144 against the greenback with 0.82 and 1.31 seen as the

next downside target levels, respectively. At Thursday's close, the

euro was worth 0.8265 against the pound and 1.3189 against the

greenback.

U.K. output price inflation slowed to 3.6 percent annually in

March from 4.1 percent in February, the Office for National

Statistics showed today. But it stayed slightly above the 3.5

percent consensus forecast.

Input price inflation also eased in March, to 5.8 percent from

7.8 percent in the prior month.

After touching a 3-day high of 107.12 against the yen in early

Asian deals, the euro fell shortly thereafter. The euro is now

trading at 106.49 against the yen and the next downside target

level for the euro is seen at 106.00.

Against the franc, the euro edged down to 1.2015 with 1.20 seen

as the next downside target level. The euro-franc pair ended

Thursday's deals at 1.2019.

The euro slipped to a 3-day low of 1.3096 against the Canadian

dollar, compared to 1.3117 hit late New York Thursday. If the euro

slides further, it may target 1.305 level.

The U.S. inflation report for March and the University of

Michigan's consumer confidence survey results for April are slated

for release in the New York session.

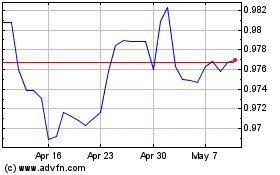

Euro vs CHF (FX:EURCHF)

Forex Chart

From Mar 2024 to Apr 2024

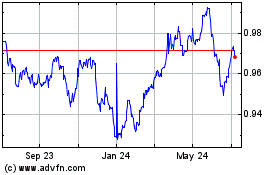

Euro vs CHF (FX:EURCHF)

Forex Chart

From Apr 2023 to Apr 2024