ETF Trading Report: Financial, Silver Miner ETF Are Big Movers - ETF News And Commentary

April 12 2012 - 12:41PM

Zacks

Thanks to lower bond yields in Europe and speculation over a

strong China GDP report, investors scooped up stocks yet again in

Thursday trading. All of the major indexes finished up at least

1.3% on the session, led by strength in the industrial, tech, and

banking sectors.

The U.S. dollar wasn’t quite as lucky as stocks, as the

benchmark U.S. dollar index slid by $0.42 to the $79.32 mark in

today’s session. The greenback was mixed against the euro and the

pound, lost against the yen, but gained nearly a penny against the

Aussie dollar.

Commodity markets were broadly positive-- despite the flat

dollar-- as pretty much every natural resource gained on the day.

Crude oil added about 1.2% while soft products also gained nearly

2% across the board. Industrial metals were also strong, as copper

added about seven cents a pound on hopes from China.

ETF Trading was mixed from a volume perspective, as many of the

most popular products saw average days. Additionally, many popular

commodity and style box ETFs also saw below average trading,

despite the gains in the market (read Oil Bull Is No Place For MLP

ETF Investors).

With that being said, there were certainly some exceptions,

namely in the case of the Market Vectors Bank and Brokerage

ETF (RKH). This fund saw volume of nearly 165,000 shares,

well above the 45,000 average that the popular ETF usually

sports.

This surge in volume was likely due to strong performances from

many of the top holdings in the product. Big banks saw gains across

the board while Citi and Bank of America both added more than 3% on

the day, ahead of tomorrow’s key earnings report from bellwether JP

Morgan. In total, the financial ETF gained more than 1.9% on

the session, easily outpacing the broad market for the day.

Another fund which saw outsized trading volumes in Thursday

trading was the Global X Silver Miners ETF (SIL).

This popular ETF—which has nearly $300 million in AUM—saw volume

exceed 725,000 shares, well above the 214,500 average that the

product usually sees (see Silver ETFs Outshine Gold).

This huge bump in interest was probably due to the solid

performance in silver during Thursday trading. The while metal

added about 2.7% today on optimism in the U.S. as well as

speculation over more demand in China.

Thanks to this, investors sought to gain a ‘leveraged’ way to

play the precious metal in equity form. Since SIL often trades at a

multiple to the underlying silver, it ended up being a strong

performer on the day, adding close to 4.6% for the session and

spurring increased interest from a variety of mining ETF

investors.

See more on ETFs at the Zacks ETF Center.

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

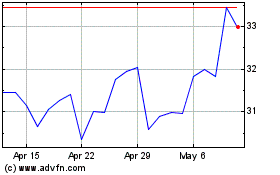

Global X Silver Miners (AMEX:SIL)

Historical Stock Chart

From Mar 2024 to Apr 2024

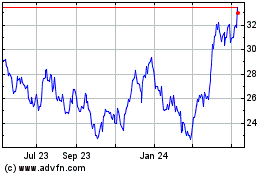

Global X Silver Miners (AMEX:SIL)

Historical Stock Chart

From Apr 2023 to Apr 2024