Indian Rupee Edges Down Against US Dollar

April 12 2012 - 8:11AM

RTTF2

The Indian rupee weakened against the dollar at the end of

Thursday's domestic dealings despite a rally in equities. Stocks

climbed as easing concerns over Europe's debt crisis helped

investors shrug off domestic data showing slower-than-expected

industrial output growth.

Growth in factory output growth, as measured by the Index of

Industrial Production, rose 4.1 percent in February compared to 7.5

percent in the corresponding period last year, the statistics

office said. The January IIP growth has been revised downwards to

1.14 percent from the provisional estimates of 6.8 percent, as high

interest rate regime made borrowings costly and curbed consumer

spending.

Benchmark indexes Sensex and the Nifty maintained their early

gains despite the downward revision in January numbers, as

weaker-than-expected industrial production numbers strengthened the

case for rate cuts from the Reserve Bank of India next week.

The benchmark 30-share Sensex moved in the range of

17,277-17,395 before paring some gains and finishing up 133 points

or 0.77 percent at 17,333, while the broader Nifty index rose by 50

points or 0.96 percent to 5,277.

The rupee moved closer to yesterday's fresh multi-month lows

against the dollar, slipping as low as 51.5955. This was lower than

its Wednesday's closing quote of 51.4550 but the domestic unit

managed to stay away from Wednesday's 3-month low of 51.6450.

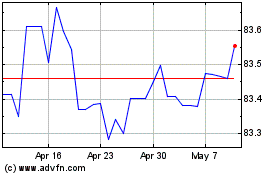

US Dollar vs INR (FX:USDINR)

Forex Chart

From Mar 2024 to Apr 2024

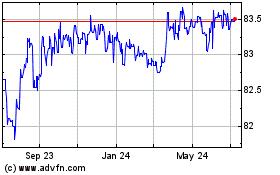

US Dollar vs INR (FX:USDINR)

Forex Chart

From Apr 2023 to Apr 2024