Pound Spikes Up Against Majors

April 12 2012 - 5:30AM

RTTF2

In early European deals on Thursday, the pound advanced against

other major currencies despite a report showed that the U.K. trade

deficit widened in February.

The UK's visible trade gap increased in February and exceeded

economists' expectations, data from the Office for National

Statistics showed.

The deficit on seasonally adjusted trade in goods was GBP 8.8

billion in February, compared with a revised GBP 7.9 billion

deficit in January. Economists expected a deficit of GBP 7.65

billion, higher than January's previously estimated shortfall of

GBP 7.53 billion.

The deficit on trade in goods and services was GBP 3.4 billion

in February, higher than GBP 2.5 billion in January. Expectations

were for a shortfall of GBP 2 billion.

Investors now await Italian bond auction results for signs of

stability in the euro zone.

The pound that closed yesterday's deals at 128.65 against the

yen and 1.5909 against the greenback reached a 2-day high of 129.38

and a 9-day high of 1.5958, respectively. The next upside target

level for the pound is seen at 130.00 against the yen and 1.60

against the greenback.

Bank of Japan Governor Masaaki Shirakawa today said that the

central bank will continue powerful monetary easing and warned that

uncertainty over global economy still remained high.

In a speech at a quarterly meeting of the central bank's

regional branch managers, Shirakawa said the BoJ will pursue

powerful easing to help the economy overcome deflation and return

to a sustainable growth path.

Against the euro and the franc, the pound approached a new

3-month high of 0.8229 and a fresh 4-week high of 1.4618 from

yesterday's close of 0.8243 and 1.4597, respectively. If the pound

gains further, it may target 0.815 against the euro and 1.47

against the franc.

Eurozone inflation is expected to stay above 2 percent in 2012,

with upside risks prevailing, the editorial to the European Central

Bank's monthly bulletin showed.

Over the policy-relevant horizon, the ECB forecasts price

developments to remain in line with price stability.

The U.S. PPI for March, trade data for February, weekly jobless

claims for the week ended April 7, Canada trade data and new

housing price index for February are expected in the New York

morning session.

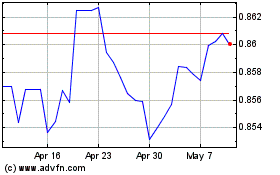

Euro vs Sterling (FX:EURGBP)

Forex Chart

From Mar 2024 to Apr 2024

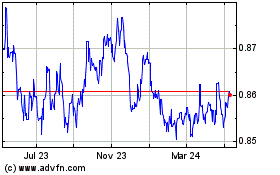

Euro vs Sterling (FX:EURGBP)

Forex Chart

From Apr 2023 to Apr 2024