PAA Unitholders to Further Benefit - Analyst Blog

April 11 2012 - 12:56PM

Zacks

Plains All American Pipeline LP (PAA) once more

increased the cash distribution rate extending its practice of

sharing more benefits with its unitholders. The partnership

announced a new quarterly cash distribution rate of $1.045 per unit

on all of its outstanding limited partner units.

The partnership has a long history of increasing distributions

to unitholders. With this distribution, Plains has hiked the

quarterly distribution to limited partners in 30 out of the past 32

quarters.

The new distribution reflects 2.0% growth over the quarterly

distribution of $1.025 per unit paid in February 2012 and 7.7%

growth from the quarterly distribution of 97 cents per unit paid in

May 2011. This distribution will be paid on May 15, 2012, to unit

holders of record as of May 4, 2012.

Plains’ cash distributions depend primarily on cash flow that

includes cash flow from financial reserves and working capital

borrowings. The cash distribution does not solely depend on

profitability, which can be affected by non-cash items. Hence, the

partnership can sustain cash distribution even when it is incurring

losses.

Plains reported strong fourth quarter results, which surpassed

the year-ago performance as well as our expectation. The

partnership is optimistic about maintaining its growth momentum for

the remainder of the year and expects to share more with

unitholders by increasing the distribution rate by 8% to 9% in

2012. We believe the partnership is presently on track to meet its

expected distribution growth.

We believe the steady and incremental cash distribution makes it

easier for the partnership to raise funds from the market by way of

issuing common units. Recently, the partnership issued 5.75 million

common units at an average price of $80.03 per unit and utilized

the net proceeds of $445 million to fund an acquisition partly.

Enterprise Products Partners

LP (EPD), a Plains All American peer, also increased its

quarterly cash distribution rate in January 2012. The increased

quarterly distribution of 62 cents per unit, paid in February 2012,

represented growth of 5.1% over the quarterly distribution of 59

per unit paid in February 2011 and an increase of 1.2% from the

quarterly distribution of 61.25 cents per unit paid in November

2011.

Plains All American Pipeline currently retains a Zacks #1 Rank,

which translates into a short-term Strong Buy rating. The

partnership competes with Enterprise Products Partners LP and

Sunoco Logistics Partners L.P. (SXL) among

others.

Houston, Texas-based Plains All American is engaged in the

transportation, storage, terminalling and marketing of crude oil,

refined products and liquefied petroleum gas and other natural gas

related petroleum products. The partnership is also involved in the

development and operation of natural gas storage facilities.

ENTERPRISE PROD (EPD): Free Stock Analysis Report

PLAINS ALL AMER (PAA): Free Stock Analysis Report

SUNOCO LOGISTIC (SXL): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

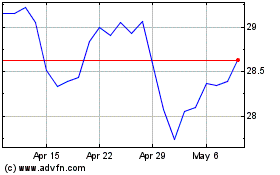

Enterprise Products Part... (NYSE:EPD)

Historical Stock Chart

From Mar 2024 to Apr 2024

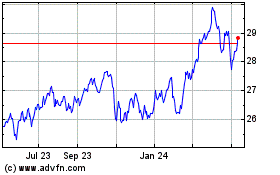

Enterprise Products Part... (NYSE:EPD)

Historical Stock Chart

From Apr 2023 to Apr 2024