SNB Continues To Enforce Minimum Exchange Rate Of EUR/CHF - Jordon

April 11 2012 - 2:07AM

RTTF2

Swiss National Bank interim President Thomas Jordan said in a

press briefing on Tuesday that the central bank will continue to

enforce the minimum exchange rate at CHF 1.20 per euro, without any

restrictions.

Jordon's comments came in response to the franc's rise to 1.20

per euro euro last Thursday.

"The fact that a few individual transactions at less than CHF

1.20 per euro were observed last Thursday has led to some isolated

doubts being raised about the SNB's resolve to enforce its minimum

exchange rate," Jordon said.

"The Swiss National Bank is enforcing the minimum exchange rate

with all the means at its disposal and we are prepared to buy

foreign currency in unlimited quantities for this purpose. In this

respect, our policies are totally unchanged," he added.

"Within a few seconds the euro/franc fell from 1.2020 to 1.2000,

and despite SNB offers placed in the trading systems, a few

isolated transactions occurred below CHF1.20 per euro," Jordan

said.

However "at no time did the best available euro exchange rate in

the market fall below CHF1.20," he said.

Jordan also reiterated that the franc is still overvalued and

poses a substantial risk to the Swiss economy, though he expects it

to weaken further. "Should the economic outlook and the risk of

deflation so require, the SNB stands ready to take further measures

at any time," he added.

The SNB introduced its limit on September 6 to fight deflation

threats and help Swiss exporters. Since then, the central bank's

governing board members have repeatedly stressed their resolve to

defend the ceiling, saying that the franc is overvalued.

The euro-franc pair that slipped to a 7-month low of 1.2002 last

Thursday has been trading around 1.202 level this week.

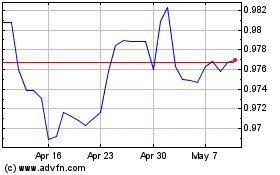

Euro vs CHF (FX:EURCHF)

Forex Chart

From Mar 2024 to Apr 2024

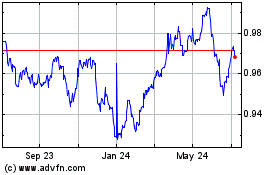

Euro vs CHF (FX:EURCHF)

Forex Chart

From Apr 2023 to Apr 2024