Indian Rupee Declines To 10-day Low Against Dollar

April 09 2012 - 1:04AM

RTTF2

In early deals on Monday, the Indian rupee slipped to a 10-day

lowagainst the US dollar as regional equities fell amid weak U.S.

jobs data.

The U.S. Labor Department reported on Friday that non-farm

payroll employment increased by 120,000 jobs in March following an

upwardly revised increase of 240,000 jobs in February. Economists

had expected the addition of about 201,000 jobs.

Despite the weaker than expected job growth, the unemployment

rate unexpectedly edged down to 8.2 percent in March from 8.3

percent in February. With the unexpected drop, the unemployment

rate fell to its lowest level since coming in at 7.8 percent in

January of 2009.

India's benchmark 30-share Sensex is currently trading near the

day's low at 17,264, down 222 points or 1.27 percent from its

previous close, while the broader Nifty index is down 73 points or

1.36 percent at 5,250.

The rupee is now trading at a 10-day low of 51.4150 per dollar

and if the rupee falls further, it may likely target the 52 level.

The dollar-rupee pair ended last Wednesday's trading at 51.1150.

Indian markets were closed on Thursday and Friday for religious

holidays.

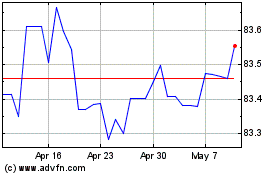

US Dollar vs INR (FX:USDINR)

Forex Chart

From Mar 2024 to Apr 2024

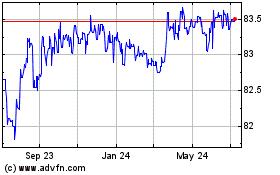

US Dollar vs INR (FX:USDINR)

Forex Chart

From Apr 2023 to Apr 2024