E.ON Says Has Agreed To Adjust Terms Of Gas Purchase Deals With Statoil

March 14 2012 - 4:20AM

Dow Jones News

E.ON AG (EOAN.XE) said Wednesday it has reached an agreement

with Norwegian natural gas producer Statoil ASA (STO) to readjust

the commercial terms of long-term, oil-indexed gas contracts that

account for around 25% of the German utility's gas portfolio.

The purchase prices of the gas it acquires from Statoil have

been brought down to market level, said E.ON without further

elaborating on the expected impact of that agreement on its

earnings in 2012.

The company earlier Wednesday said it posted its first ever net

loss in 2011 due partially to its loss-making wholesale gas

business, where procurement prices that are linked to the price of

oil far exceed selling prices in an oversupplied European

market.

The disconnect between high procurement prices and low selling

prices has been putting the company's wholesale gas business under

enormous pressure and its gas supply and sales business recorded a

loss of around EUR700 million, E.ON said.

The agreement with Statoil marks a major step forward for E.ON,

which now has renegotiated some 65% of its gas procurement

contracts with producers.

However, talks with Russia's Gazprom OAO (GAZP.RS)--which

supplies around 35% of E.ON's gas portfolio--are ongoing, E.ON

said.

Chief Executive Johannes Teyssen said that E.ON still expects to

bring all of its long-term gas supply contracts to a "competitive

level" by 2013.

-By Jan Hromadko, Dow Jones Newswires; +49 69 29 725 503;

jan.hromadko@dowjones.com

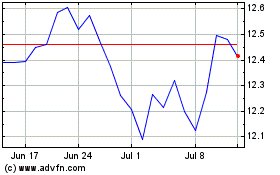

E. On (TG:EOAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

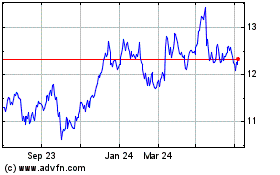

E. On (TG:EOAN)

Historical Stock Chart

From Apr 2023 to Apr 2024