Pound Halts Rally As UK Trade Gap Widens

March 13 2012 - 7:00AM

RTTF2

The pound paused its recent rally against other major currencies

in early European trading on Tuesday following a report showed that

the nation's trade gap widened in the month of January.

U.K.'s trade deficit widened to GBP 7.5 billion in January from

GBP 7.2 billion a month ago, the Office for National Statistics

showed today. However, the shortfall was smaller than an expected

GBP 7.9 billion deficit.

Exports of goods climbed by GBP 0.5 billion or 2 percent from

December. Likewise, imports of goods increased by GBP 0.8 billion

or 2.6 percent.

The deficit in trade in goods and services increased to GBP 1.8

billion from GBP 1.2 billion in December. At the same time, the

surplus in trade in services fell to GBP 5.8 billion from GBP 6

billion a month ago.

European stocks advanced as the Eurozone finance ministers gave

their final nod to a second bailout package for Greece after the

country completed a debt swap deal with its private creditors last

week.

"The new Greek program is not only in its starting blocks but

has been politically adopted tonight by the Eurogroup," Luxembourg

Prime Minister Jean-Claude Juncker, who also heads the Eurogroup,

said in Brussels after the meeting on Monday.

Thus far, the U.K. FTSE 100 index advanced 0.60 percent,

France's CAC-40 index climbed to 0.90 percent and Germany's DAX

rose above 0.70 percent.

The pound shed almost 30 pips against the Swiss franc to reach a

low of 1.4364 around 5:45 am ET from an intra-day high of 1.4393.

If the pair extends its decline, it may re-test Asian session's

2-week low of 1.4317.

Swiss producer and import prices declined less than expected by

economists in February, the Federal Statistical Office said today.

Year-on-year, the producer and import price index fell 1.9 percent,

slower than economists' forecast for a 2.4 percent decline.

Compared to the previous month, the index rose 0.8 percent, while

expectations were for a 0.2 percent increase.

The pound that advanced to a 4-day high of 129.69 against the

yen around 5:15 am ET erased some of its gains shortly after the

trade report. The pound-yen pair is presently worth 129.37 with

128.75 seen as the next likely support level and 129.80 seen as the

probable resistance.

Earlier in the morning, the Bank of Japan decided to enhance its

Growth-Supporting Funding Facility to support economic growth and

tackle deflation.

The central bank said that the total amount of loans available

through the fund-provisioning measure will increase by JPY 2

trillion to JPY 5.5 trillion. At the same time, the central bank

kept its monetary policy unchanged.

The pound that reached as high as 1.5673 against the dollar and

0.8383 against the euro around 5:15 am ET moved slightly off

shortly after the report. The pound is presently trading at 1.5660

against the greenback and 0.8394 versus the euro.

Looking ahead, German ZEW economic confidence survey results are

due at 6.00 am ET. Economists forecast economic confidence to rise

to 10 in March from 5.4 in February. The current conditions index

is forecast to improve to 41.5 from 40.3 a month ago.

The U.S. advance retail sales for February and business

inventories data for January are expected in the New York morning

session.

The U.S. Fed will announce its interest rate decision at 2:15 pm

ET. The Fed is expected to maintain its benchmark interest rate at

0.25 percent.

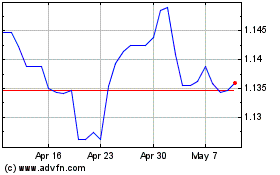

Sterling vs CHF (FX:GBPCHF)

Forex Chart

From Mar 2024 to Apr 2024

Sterling vs CHF (FX:GBPCHF)

Forex Chart

From Apr 2023 to Apr 2024