Pound Recovers Against Most Majors; U.K. Trade Data Eyed

March 13 2012 - 6:18AM

RTTF2

In early European deals on Tuesday, the British pound recovered

its previous session's losses against the currencies of Japan,

Europe and Switzerland. But the pound showed choppy trading versus

the dollar.

Investors now focus on the U.K. trade data for January, which is

due at 5:30 am ET. The visible trade deficit is seen widening to

GBP 7.9 billion from GBP 7.11 billion in December.

The pound is now worth 0.8394 against the euro, compared to near

a 2-week low of 0.8426 hit in early Asian deals. The near term

resistance level for the pound is seen at 0.835.

The pound that fell to near a 2-week low of 1.4317 against the

franc at 3:20 am ET rebounded thereafter. At present, the

pound-franc pair is worth 1.4375 with 1.445 seen as the next upside

target level.

Swiss producer and import prices declined less than expected by

economists in February, the Federal Statistical Office said.

Year-on-year, the producer and import price index fell 1.9 percent,

slower than economists' forecast for a 2.4 percent decline.

Compared to the previous month, the index rose 0.8 percent, while

expectations were for a 0.2 percent increase.

After hitting a low of 128.30 against the yen at 1:35 am ET, the

pound gained. The pound-yen pair is currently trading at a 4-day

high of 129.50. The next upside target level for the pound is seen

at 129.8.

The Bank of Japan today decided to expand its loan scheme aimed

at supporting economic growth by JPY 2 trillion following the

conclusion of its March monetary policy meeting. At the same time,

the central bank kept its monetary policy unchanged.

The measure was largely aimed at tackling deflation and

establishing a new basis for economic growth, the central bank

said.

But the pound showed choppy trading against the dollar today,

moving between 1.564 and 1.566.

Looking ahead, German ZEW economic sentiment index for March is

expected at 6 am ET.

The U.S. advance retail sales for February and business

inventories for January are expected in the New York morning

session.

The Federal Open Market Committee is scheduled to begin a 1-day

meeting to discuss the near term direction of monetary policy. The

monetary policy-setting arm of the Federal Reserve is set to

release a post-meeting policy statement at 2:15 pm ET.

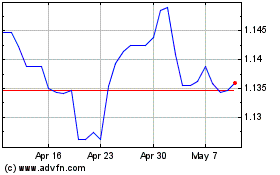

Sterling vs CHF (FX:GBPCHF)

Forex Chart

From Mar 2024 to Apr 2024

Sterling vs CHF (FX:GBPCHF)

Forex Chart

From Apr 2023 to Apr 2024