Trading Statement (9824V)

January 23 2012 - 2:01AM

UK Regulatory

TIDMUKC

RNS Number : 9824V

UK Coal PLC

23 January 2012

23 January 2012

UK COAL PLC

("UK Coal" or the "Group")

Trading Update

Trading update for the year ended 31 December 2011, in advance

of the publication of its preliminary results in April.

Strategic Recovery Plan

In 2011, UK Coal was restored to profitability and the Board now

anticipates operating profit for the full year to be in line with

expectations, with full year tonnage of 7.5m tonnes.

We have continued to make progress on the Group's three year

Strategic Recovery Plan, which was launched in May 2011. We

realised GBP65m of property net receipts in the year and this,

together with operating cash-flow, reduced our total net debt to

GBP139m and net bank debt to GBP55m, excluding restricted cash.

Looking forward, delivery of the recovery plan at Daw Mill remains

the highest priority.

Production

Total production in the fourth quarter was 1.6m tonnes (Q4 2010:

2.3m tonnes), bringing full year production to 7.5m tonnes (2010:

7.2m tonnes), in line with expectations.

Deep mine production was 1.2m tonnes for the quarter (Q4 2010:

1.8m tonnes). Kellingley mined above expectations and Thoresby

mined in line with expectations. These, however, were offset by

lower production at Daw Mill where the programme to mitigate a face

gap fell short of the mine's commitment, resulting in negligible

production from Daw Mill through December. A new face is ramping up

during January.

Surface mine production was 0.4m tonnes in the final quarter (Q4

2010: 0.5m tonnes), leaving output for the full year at 1.8m

tonnes, ahead of expectations.

Working Practices and cost of employment

Our Strategic Recovery Plan highlighted that the restraint of

labour costs and changes to working practices and pension

arrangements were critical to the recovery of UK Coal.

In December, we concluded negotiations and reached an agreement

on pay and working practices with our workforce and their unions.

When combined with the pension changes previously announced, this

agreement is expected to hold per capita employment costs at 2010

levels through to the end of 2013.

Daw Mill

A key priority for 2012 is to safely recover production levels

and significantly improve development at Daw Mill. The Board

recently reviewed options for the future of Daw Mill. As a result,

in January, a more intensive intervention in the day to day

management of the mine has been introduced to bring pace to the

programme of improvement.

Property (Harworth Estates)

Property disposals have generated around GBP6m of net receipts

in the fourth quarter, bringing total net receipts in the year to

GBP65m. We recorded a profit on property disposals of GBP3m for the

full year. We have exchanged conditional contracts on further sales

with a value of GBP18m, meaning net property sales of around

GBP106m have been exchanged under our new approach since Q4,

2010.

Harworth Power

As part of our asset realisation programme to reduce borrowings,

the Group is in the early stages of investigating the possible sale

of Harworth Power, a business which generates electricity from mine

methane.

Debt

Net bank debt reduced to GBP55m by the year end (December 2010:

GBP141m), excluding restricted cash. Generator loans/prepayments

were GBP84m (December 2010 GBP101m).

- END -

Enquiries:

Analysts and investors

Jonson Cox Chairman Tel: 01302 755 002

David Brocksom Group Finance Director Tel: 01302 755 002

Media

Rob Ballantyne Cardew Group Tel: 020 7930 0777

Emma Crawshaw Cardew Group Tel: 020 7930 0777

Andrew Mackintosh Director of Communications Tel: 01302 755 218

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTPGUCPGUPPUQW

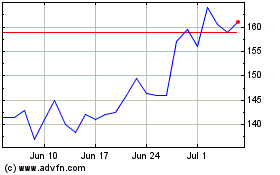

Harworth (LSE:HWG)

Historical Stock Chart

From Mar 2024 to Apr 2024

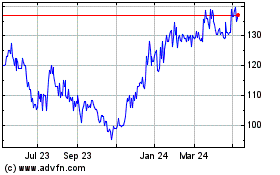

Harworth (LSE:HWG)

Historical Stock Chart

From Apr 2023 to Apr 2024