INTERVIEW: Bechtel Expects To Mitigate LNG Project Cost Pressures

December 08 2011 - 12:40AM

Dow Jones News

Bechtel Group is confident the three gas-export projects worth

over US$50 billion that it's building for international oil

companies in Australia's Queensland state can be delivered on time

and budget, a senior executive said Thursday.

Richard McIlhattan, Bechtel's general manager for the global LNG

business, said cost and time schedules remained in place despite a

tighteing of Australia's labor market driven by the huge scale of

investments in energy and mining projects.

The three Queensland projects intend to ship liquefied natural

gas to Asian customers by 2014 and 2015. Bechtel has also been

contracted by Chevron Corp. (CVX) to build the US$29 billion

Wheatstone LNG project in Western Australia state.

Many analysts warn that Australia's booming mining sector will

crimp the supply of labor and push up costs, potentially throwing

the developments off course. Woodside Petroleum Ltd. (WPL.AU) this

year announced a third cost blowout and delay to its A$14.9 million

Pluto LNG project in Western Australia, partly blaming a shortage

of welders, pipe fitters and other tradespeople.

"Bechtel only takes on work that it believes it can complete on

time, within budget, to quality, and safely," McIlhattan told Dow

Jones Newswires. "Customers come to us for certainty of outcome.

All of our previous LNG projects have been delivered on time and on

budget, this includes our last project here in Australia: the

Darwin LNG plant for ConocoPhillips (COP)."

McIlhattan said cost pressures are being mitigated by

experienced project management teams and that extensive planning

has been conducted through the early engineering and design

processes.

"This enables us to ensure the projects will be successfully

executed," he said.

A labor shortage means that more delays and cost blowouts at

Australian projects are clearly possible, Noel Tomnay, the head of

global gas at UK-based energy consultancy Wood Mackenzie said

Wednesday. "But we also recognize that there's an opportunity

because everyone's so aware of the risk now," Tomnay said.

Bechtel recently announced a new program in Australia to train

400 adult-aged apprentices to work on various gas projects. Two

universities in Queensland this week established study centers for

unconventional gas production, assisted partly by funding from the

state government.

Energy companies often include buffers in their schedule and

cost estimates to absorb unexpected delays. Santos Ltd. (STO.AU)

Chief Executive David Knox says the $16 billion estimate for its

LNG joint venture in Queensland is "conservative" and includes

contingencies.

Managers of all three projects--being built by Santos and

partners including Total SA (TOT); ConocoPhillips (COP), Origin

Energy Ltd. (ORG.AU) and China Petrochemical Corp.; and Royal Dutch

Shell PLC (RDSB) and PetroChina Co. (PTR)--this week said their

developments remain on track. But the developments are yet to hit

peak construction.

-By Ross Kelly, Dow Jones Newswires; +61-2-82724692;

ross.kelly@dowjones.com

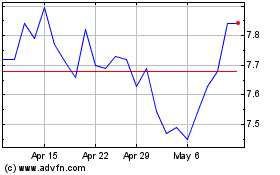

Santos (ASX:STO)

Historical Stock Chart

From Mar 2024 to Apr 2024

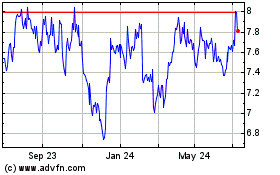

Santos (ASX:STO)

Historical Stock Chart

From Apr 2023 to Apr 2024