TIDMFPO

RNS Number : 9282S

First Property Group PLC

29 November 2011

Date: 29 November 2011

On behalf First Property Group plc ("First Property",

of: "the Company" or "the Group")

Embargoed: 0700hrs

First Property Group plc

Interim Results for the six months to 30 September 2011

First Property Group plc (AIM: FPO), the commercial property

fund management group, today announces its interim results forthe

six months to 30 September 2011.

Financial Highlights:

Unaudited Unaudited Percentage Audited

Six months Six months change from Year to

to 30 September to 30 September 30 September 31 March

2011 2010 2010 2011

Profit before tax GBP2.54m GBP1.42m +79% GBP2.95m

(continuing operations)

Assets under management GBP374m GBP315m +19% GBP366m

(AUM)

Net assets GBP16.79m GBP15.70m +7% GBP16.57m

Diluted earnings

per share (continuing

operations) 1.61p 0.98p +64% 1.90p

Dividend per share 0.33p 0.32p +3% 1.06p

Profit before tax

by segment:

Profit before tax GBP1.62m GBP1.47m +10% GBP2.74m

from property fund

management ("FPAM")

Profit before tax GBP1.37m GBP0.38m +261% GBP1.24m

from total Group

Properties (including

"FOP"- Fprop Opportunities

plc)

Operational Highlights:

-- The value of assets under management increased by 19% to

GBP374 million (2010: GBP315 million).

-- The UK fund established in February 2010, UK PPP LP, is now

close to being fully invested, having made property purchases of

GBP91.6 million, representing 87% of its GBP106 million of

committed capital. The fund is earning an annualised un-geared rate

of return on equity of 6.4%.

-- Fprop Opportunities plc, the Polish focused fund established

in October 2010, has acquired EUR26.4 million (GBP22.7 million) of

property and earned an annualised rate of return on equity of 13.4%

during the period. Progress is being made in raising new capital

for this fund.

-- Fund raising has begun for a new UK fund, designed to mimic

UK PPP LP and to deliver an un-geared and defensive annual dividend

return of over 6%.

Commenting on the results, Ben Habib, Chief Executive of First

Property, said:

"The steps we took last year in establishing two new funds, one

focused on the UK, the other on Poland, together with restructuring

the cost base of the Blue Tower office block in Warsaw, which we

own directly, have resulted in an excellent first half for the

Group.

"The unfolding sovereign debt crisis in Europe naturally causes

us concern but the Polish economy, where 71% of our assets under

management are located, has continued to perform well, as have our

properties there. Poland remains a bright spot on the European

landscape but we are closely monitoring the crisis in Europe and

any consequences it may have for the Group.

"First Property Group has remained profitable throughout the

credit crunch. This fact and, in particular these excellent interim

results, exemplify the strength of our business model and staff.

Notwithstanding the storms blowing through Europe at the moment I

expect our good performance to continue."

A briefing for analysts will be held at 09:30hrs today at the

offices of First Property Group plc at 35, Old Queen Street, London

SW1H 9JA. A conference call facility will also be available on +44

208 817 9301, a recorded copy of which will subsequently be posted

on the Company website, www.fprop.com.

For further information please contact:

First Property Group plc Tel: 020 7340 0270

Ben Habib (Chief Executive & Chief www.fprop.com

Investment Officer)

George Digby (Group Finance Director)

Jeremy Barkes (Director, Business

Development)

Arden Partners Tel: 020 7614 5917

Chris Hardie (Director, Corporate

Finance )

Redleaf Polhill Tel: 020 7566 6750

Mike Ward / George Parrett firstproperty@redleafpolhill.com

Notes to investors and editors:

-- First Property Group plc is a commercial property fund

manager with operations in the United Kingdom and Central Europe.

The performance of its funds under management ranked No.1 versus

the Investment Property Databank (IPD) Central & Eastern Europe

(CEE) Benchmark over the three, four and five years to 31 December

2008, 2009 and 2010 and also No.1 versus the IPD Polish Benchmark

for the four and five years to 31 December 2009 and 2010.

-- The business model of First Property Group is to:

o Raise third party funds to invest in income producing

commercial property;

o Co-invest in these funds;

o Earn fees for the management of these funds. Fees earned are a

function of the value of assets under management as well as the

performance of the funds;

o Earn a return on its own capital invested in these funds.

-- Further information about the Company can be found at: www.fprop.com.

CHIEF EXECUTIVE'S STATEMENT

Financial Results

I am pleased to report interim results for the six months to 30

September 2011.

Revenue during the period amounted to GBP4,587,000 (2010:

GBP2,960,000), yielding a 79% increase in profit on ordinary

activities before taxation of GBP2,539,000 (2010:

GBP1,419,000).

Diluted earnings per ordinary share increased by 64% to 1.61

pence (2010: 0.98 pence).

The Group ended the period with net assets of GBP16.79 million

(2010: GBP15.70 million) including a cash balance of GBP8.96m

(2010: GBP10.18m).

Dividend

The Board has recommended an increased interim dividend of 0.33

pence per share (2010: 0.32 pence per share) which will be paid on

29 December 2011 to shareholders on the register at 9 December

2011.

Review of operations

Property fund management (First Property Asset Management

Limited or FPAM)

At 30 September 2011 assets under management stood at GBP374

million (2010: GBP315 million). Of these, 71% were located in

Poland (2010: 77%), 26% were located in the UK (2010: 19%) and 3%

in Romania (2010: 4%). There were five purchases with a total value

of some GBP16.5 million during the period and no property

sales.

Revenue earned by this division amounted to GBP2,112,000 (2010:

GBP1,930,000), generating a profit before tax of GBP1,624,000

(2010: GBP1,474,000) prior to the deduction of unallocated central

overhead costs. This represents 54% (2010: 78%) of the Group's

profit before tax prior to the deduction of unallocated central

overhead costs. Our fund management fee income is currently running

at circa GBP4.35 million per annum on an annualised basis.

The continued growth in assets under management in the UK is

principally attributable to the on-going investment of our most

recent UK fund, UK PPP LP. At 30 September 2011, UK PPP LP had

completed the purchase of GBP91.6 million worth of properties at an

average net initial yield of 7.3% and with a weighted average

unexpired lease term in excess of 12 years. The fund, which is not

geared, is currently making distributions at a rate of some 6.4%

per annum. The fund has a capacity of GBP106 million and we expect

it to be fully invested in the near future.

In anticipation of UK PPP LP becoming fully invested we have

begun to solicit investors for a new UK fund designed to mimic UK

PPP LP in its investment strategy. The new fund will target well

located properties, let at low rents to creditworthy tenants on

long leases. It will target a minimum annualised dividend yield of

6%. We expect interest rates to remain low for some years and we

believe that this relatively high dividend yield should prove to be

attractive to investors, particularly pension funds.

We have not raised any additional third party investments into

Fprop Opportunities plc (FOP) this year. We have had encouraging

discussions with several institutional investors during the period

and are hopeful that these discussions will be positively

concluded. In order to expedite our fund raising efforts we are

also considering issuing an unsecured bond to retail investors.

Such bonds offer a potentially cost effective way to raise funds.

We plan to carry out a feasibility study before launching such a

bond. In the meantime FOP generated an annualised rate of return on

equity during the six month period of 13.4%.

Our other funds under management have all continued to perform

well generating an annualised rate of return on equity in excess of

20% per annum.

Group Properties

Group Properties comprises two properties owned directly by the

Group (both located in Warsaw) and shareholdings in four of the six

funds managed by FPAM.

Revenue from these investments has grown considerably to

GBP2,475,000 (2010: GBP1,002,000), resulting in an increase of

profit before tax of GBP1,371,000 for the period (2010: GBP383,000)

prior to the deduction of unallocated central overhead costs. This

represents 46% (2010: 20%) of Group profit before tax prior to the

deduction of unallocated central overhead costs. The bulk of this

growth in earnings was attributable to our investment in FOP, in

which the Group is, for the time being at least, the majority

shareholder and is thus required to consolidate FOP's results. FOP

earned income of GBP1,306,000 (2010: nil) which generated a profit

before tax of GBP724,000 during the period (2010: nil), of which

GBP609,000 was attributable to the Group.

The two properties owned by the Group continue to trade well.

The Blue Tower office block located in central Warsaw, and the

smaller office block in the Mokotow district of Warsaw, contributed

GBP397,000 (2010: GBP143,000) and GBP132,000 (2010: GBP122,000)

respectively to the Group's profit before tax prior to the

deduction of unallocated central overhead costs. These profits

equate to annualised rates of return on equity of 46.1% and 12.5%

respectively. The latter of the two properties is not geared.

Commercial property markets outlook

Poland

Poland's GDP continues to grow at one of the fastest rates in

Europe, by some 4.3% on an annualised basis in the first six months

of 2011. Looking ahead, its economy is forecast to continue to

grow, but at a slower rate, as the effects of fiscal tightening and

a slowdown in the Global economy begin to bite.

Poland's commercial investment property market had a very good

first nine months of the year with some EUR1.8 billion of property

changing hands. Occupancy levels remain high and indeed rents have

risen in certain areas. We expect the market to slow in the fourth

quarter as the effects of the sovereign debt crisis in Europe

instil a higher degree of caution amongst investors.

Our most immediate concern is a withdrawal of capital from

Poland and a weakening of the PLN. Tenants in our Polish portfolio

of properties typically pay their rents in Euros. A weakening of

the PLN effectively equates to an increase in rents. The PLN is now

some 10% weaker against the Euro (at circa PLN 4.4/ Eur) compared

to the level it was trading at prior to the eruption of troubles in

Europe over the summer (at circa PLN 4.0/ Eur). We do not see the

current exchange rate level as threatening to the properties owned

or managed by the Group in view of the fact that these properties

were not stressed by the weakening of the PLN in 2009, after the

collapse of Lehman Brothers, when the PLN dropped to a low of close

to PLN 5/ Eur.

Our other concern is a weakening of the Euro and a consequent

reduction in the Sterling value of the investments we own and

manage. It seems certain to us that the European Central Bank (ECB)

is going to have to significantly loosen monetary policy. This

would be likely to result in the Euro weakening. However, the UK

itself is vulnerable to the financial consequences of the European

crisis and is involved in its own programme of quantitative easing.

So the Euro may not weaken as much as one might otherwise expect.

In addition, if European leaders eventually take decisive action

along with the ejection of some of the weaker members of the

Euro-zone, this may result in the Euro strengthening. Predicting

foreign exchange movements with any degree of certainty is

difficult.

Our investment strategy is income orientated. We expect income

levels in Poland to be sustained and rents to rise over time. The

European situation does not undermine the case for investing in

Poland but we are obviously treading very carefully, as we always

have done.

United Kingdom

The UK economy remains weak and vulnerable. We expect this to

continue for a number of years. In addition, even though the UK is

not a member of the Euro-zone, the financial effects of the

European sovereign debt crisis are being felt in the UK, as would

any fallout from a collapse in the Euro or its restructuring.

The commercial investment property market, as a whole, is

holding broadly steady at the moment. Values of prime properties,

particularly in central London, have recovered sharply since 2009.

It is our view that certain parts of the prime market are now in

bubble territory. On the other hand, secondary properties have not

recovered to the same extent. The gap between the yields available

on prime properties versus those available from secondary

properties is as wide as ever. This creates opportunities for

buyers, such as us, who are prepared to step away from prime

markets.

Banks are now taking more action to force the sale of properties

which are in breach of loan terms, including income producing

properties. It is difficult to assess if the supply of these

properties into the market might suppress values. There is no

evidence of this at this stage, though the tone of the market is

certainly weaker than it was a year ago.

Current trading and prospects

The steps we took last year in establishing and co-investing in

two new funds, together with restructuring the cost base of the

Blue Tower office block in Warsaw which we own directly, have

resulted in an excellent first half for the Group.

The unfolding sovereign debt crisis in Europe naturally causes

us concern but the Polish economy, where 71% of our properties

under management are based, has continued to perform well, as have

our properties there. Poland remains a bright spot on the European

landscape but we are closely monitoring the crisis in Europe and

any consequences it may have for the Group.

First Property Group has remained profitable throughout the

credit crunch. This fact and, in particular, these excellent

interim results, exemplify the strength of our business model and

staff. Notwithstanding the storms blowing through Europe at the

moment, I expect our good performance to continue.

Ben Habib

Chief Executive

29 November 2011

CONDENSED CONSOLIDATED INCOME STATEMENT

for the six months to 30 September 2011

Notes 6 months to 30 Sept 2011 6 months to 30 Sept 2010 Year to 31 March 2011

(unaudited) (unaudited) (audited)

Total results Total results Total results

GBP'000 GBP'000 GBP'000

Continuing operations

-------------------------- ---------- -------------------------- -------------------------- ----------------------

Revenue 2 4,587 2,960 7,110

---------------------------------- -------------------------- -------------------------- ----------------------

Cost of sales (529) (354) (1,050)

Gross profit 4,058 2,606 6,060

Operating expenses (1,271) (1,195) (2,852)

Operating profit 2 2,787 1,411 3,208

Share of results in associates 97 114 221

Dividend income 21 7 14

Interest income 42 50 109

Interest expense (408) (163) (602)

Profit on ordinary activities

before tax 2,539 1,419 2,950

Tax expense 3 (505) (234) (621)

---------------------------------- -------------------------- -------------------------- ----------------------

Profit from continuing operations 2,034 1,185 2,329

---------------------------------- -------------------------- -------------------------- ----------------------

Discontinued operations

Profit/(Loss) for period from

discontinued operations 4 - (69) (82)

Continuing and discontinued

operations

Profit for the period 2,034 1,116 2,247

Attributable to:

Owners of the parent 1,891 1,145 2,178

Non-controlling interest 143 (29) 69

2,034 1,116 2,247

Profit for the period from

continuing operations

attributable to:

Owners of the business 1,891 1,187 2,221

Non-controlling interest 143 (2) 108

---------------------------------- -------------------------- -------------------------- ----------------------

2,034 1,185 2,329

Loss for the period from

discontinued operations

attributable to:

Owners of the business - (41) (43)

Non-controlling interest - (28) (39)

---------------------------------- -------------------------- -------------------------- ----------------------

- (69) (82)

---------------------------------- -------------------------- -------------------------- ----------------------

Earnings per Ordinary 1p share

-basic continuing operations 5 1.70p 1.08p 2.02p

-basic discontinued operations 5 - (0.04)p (0.04)p

---------------------------------- -------------------------- -------------------------- ----------------------

1.70p 1.04p 1.98p

-diluted continuing operations 5 1.61p 1.02p 1.90p

-diluted discontinued operations 5 - (0.04)p (0.04)p

---------------------------------- -------------------------- -------------------------- ----------------------

1.61p 0.98p 1.86p

------------------------------------- -------------------------- -------------------------- ----------------------

CONDENSED CONSOLIDATED STATEMENT OF

COMPREHENSIVE INCOME

for the six months to 30 September 2011

2011 2010 2011

------------------------------- ------- ------------------------- ------------------------- ----------------------

Notes 6 months to 30 Sept 2011 6 months to 30 Sept 2010 Year to 31 March 2011

(unaudited) (unaudited) (audited)

------------------------------- ------- ------------------------- ------------------------- ----------------------

GBP'000 GBP'000 GBP'000

------------------------------- ------- ------------------------- ------------------------- ----------------------

Profit for the period 2,034 1,116 2,247

---------------------------------------- ------------------------- ------------------------- ----------------------

Other comprehensive income

Exchange differences on retranslation

of foreign subsidiaries (1,015) (273) (171)

Taxation - - -

Total comprehensive income for the year 1,019 843 2,076

---------------------------------------- ------------------------- ------------------------- ----------------------

Total comprehensive income for

the year:

Owners of the parent 887 872 2,012

Non-controlling interest 132 (29) 64

1,019 843 2,076

--------------------------------------- ------------------------- ------------------------- ----------------------

CONDENSED CONSOLIDATED BALANCE SHEET

as at 30 September 2011

Notes As at 30 Sept 2011 As at 30 Sept 2010 As at 31 March 2011

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

-------------------------- ------ -------------------------- -------------------------- --------------------------

Non-current assets

Goodwill 114 138 114

Investment properties 21,428 - 22,061

Property, plant and

equipment 73 94 79

Interest in associates 6a 413 363 377

Other receivables 7 420 - 473

Other financial assets 6b 874 423 711

Deferred tax assets 622 237 199

-------------------------- ------ -------------------------- -------------------------- --------------------------

Total non-current Assets 23,944 1,255 24,014

Current assets

Inventories - land and

buildings 10,687 10,848 10,896

Current tax assets - - 95

Trade and other

receivables 7 1,122 2,107 1,660

Cash and cash equivalents 8,966 10,180 5,441

-------------------------- ------ -------------------------- -------------------------- --------------------------

Total current assets 20,775 23,135 18,092

Current liabilities:

Trade and other payables 8 (1,219) (1,809) (1,859)

Financial liabilities 9a (561) (19) (500)

Current tax liabilities (126) (25) (39)

-------------------------- ------ -------------------------- -------------------------- --------------------------

Total current liabilities (1,906) (1,853) (2,398)

-------------------------- ------ -------------------------- -------------------------- --------------------------

Net current assets 18,869 21,282 15,694

Total assets less current

liabilities 42,813 22,537 39,708

-------------------------- ------ -------------------------- -------------------------- --------------------------

Non-current liabilities:

Financial liabilities 9b (25,385) (6,760) (22,946)

Deferred tax liabilities (635) (72) (191)

-------------------------- ------ -------------------------- -------------------------- --------------------------

Net assets 16,793 15,705 16,571

-------------------------- ------ -------------------------- -------------------------- --------------------------

Equity

Called up share capital 1,149 1,136 1,146

Share premium 5,490 5,423 5,463

Foreign Exchange

Translation Reserve (326) 577 678

Share-based payment

reserve 155 120 140

Retained earnings 10,023 8,264 8,950

-------------------------- ------ -------------------------- -------------------------- --------------------------

Issued capital and

reserves attributable to

the owners of the parent 16,491 15,520 16,377

Non-controlling interest 302 185 194

-------------------------- ------ -------------------------- -------------------------- --------------------------

Total equity 16,793 15,705 16,571

-------------------------- ------ -------------------------- -------------------------- --------------------------

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

for the six months to 30 September 2011

Share Share Share Foreign Purchase/Sale Retained Non-controlling TOTAL

capital premium Based Exchange of own Shares Earnings Interest

Payment Translation

Reserve Reserve GBP'000

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

GBP'000

At 1 April 2010 1,136 5,423 105 844 (625) 8,520 251 15,654

Total

comprehensive

income for the

period - - - (267) - 1,145 (35) 843

Share based

payments - - 15 - - - - 15

Dividends Paid - - - - - (776) (31) (807)

At 30 Sept 2010 1,136 5,423 120 577 (625) 8,889 185 15,705

Issue of new

shares 10 39 - - - - - 49

Sale of

discontinued

business - - - - - - (103) (103)

Total

comprehensive

income for the

period - - - 101 - 1,102 30 1,233

Non-controlling

interest in FOP

share capital - - - - - - 13 13

Treasury Shares - 1 - - 4 - - 5

Non-controlling

interest on

acquisition - - - - - (69) 69 -

Share based

payments - - 20 - - - - 20

Dividends Paid - - - - - (351) - (351)

At 1 April 2011 1,146 5,463 140 678 (621) 9,571 194 16,571

Issue of new

shares 3 27 - - - - - 30

Total

comprehensive

income for the

period - - - (1,004) - 1,891 132 1,019

Share based

payments - - 15 - - - - 15

Sale/purchase of

treasury shares - - - - 4 - - 4

Dividends paid - - - - - (822) (24) (846)

At 30 Sept 2011 1,149 5,490 155 (326) (617) 10,640 302 16,793

CONDENSED CONSOLIDATED CASH FLOW STATEMENT

for the six months to 30 September 2011

6 months to 30 Sept 2011 (unaudited) 6 months to 30 Sept 2010 (unaudited) 12 months to 31 March 2011

(audited)

GBP'000 GBP'000 GBP'000

----------------------- ------------------------------------- ------------------------------------- ---------------------------

Cash flows from

operating activities

Operating profit 2,787 1,411 3,208

Adjustments for:

Depreciation of

property, plant &

equipment 21 12 28

(Profit)/loss on sale

of property, plant &

equipment (3) - (27)

(Profit)/loss on sale - (9) -

of investments

Share based payments 15 15 35

Released (profit) from

sale of associate - - (26)

(Increase)/decrease in

inventories (20) (46) (171)

(Increase)/decrease in

trade and other

receivables 346 607 483

Increase/(decrease) in

trade and other

payables (493) (255) 671

Other non cash - (23) -

adjustments

----------------------- ------------------------------------- ------------------------------------- ---------------------------

Cash generated from

operations 2,653 1,712 4,201

Income taxes paid (464) (174) (582)

----------------------- ------------------------------------- ------------------------------------- ---------------------------

Net cash flow

from/(used in)

operating activities

of continuing

operations 2,189 1,538 3,619

Net cash flow

from/(used in)

operating activities

by discontinued

activities - (282) (465)

----------------------- ------------------------------------- ------------------------------------- ---------------------------

Net cash flow from

operating activities 2,189 1,256 3,154

----------------------- ------------------------------------- ------------------------------------- ---------------------------

Cash flow from

investing activities

Proceeds from disposal

of discontinued

activity - - 20

Cash and cash

equivalents disposed

on sale of

discontinued activity - - (110)

Purchase of

investments (163) (324) (612)

Proceeds on sale of

associates and

investments - 87 131

Purchase of investment

properties - - (21,955)

Proceeds from sale of 4 - -

property, plant &

equipment

Purchase of property,

plant and equipment (19) (8) (75)

Dividends received 82 46 117

Interest received 42 50 109

----------------------- ------------------------------------- ------------------------------------- ---------------------------

Net cash flow from

investing activities

from continuing

operations (54) (149) (22,375)

Net cash flow from - (8) -

investing activities

from discontinued

operations

----------------------- ------------------------------------- ------------------------------------- ---------------------------

Net cash flow

from/(used in)

investing activities (54) (157) (22,375)

----------------------- ------------------------------------- ------------------------------------- ---------------------------

Cash flow from

financing activities

Proceeds from issue of

shares 30 - 49

(Repayments)/Proceeds

from shareholder

loans in subsidiaries (33) - 1,267

Interest paid (408) (163) (602)

Proceeds from finance

lease/bank loans 3,194 - 15,394

Repayment of finance

lease/bank loans (259) - (187)

Sale of shares held in

Treasury 4 - 4

Dividends paid (822) (776) (1,127)

Dividends paid to

minority interest (24) (31) (31)

----------------------- ------------------------------------- ------------------------------------- ---------------------------

Net cash flow from

financing activities

of continuing

operations 1,682 (970) 14,767

Net cash flow from

financing activities

of discontinued

activities - (19) (33)

----------------------- ------------------------------------- ------------------------------------- ---------------------------

Net cash flow

from/used in

financing activities 1,682 (989) 14,734

----------------------- ------------------------------------- ------------------------------------- ---------------------------

Net

increase/(decrease)

in cash and cash

equivalents 3,817 110 (4,487)

----------------------- ------------------------------------- ------------------------------------- ---------------------------

Cash and cash

equivalents at the

beginning of period 5,441 10,126 10,126

----------------------- ------------------------------------- ------------------------------------- ---------------------------

Currency translation

gains/(losses) on

cash and cash

equivalents (292) (56) (198)

----------------------- ------------------------------------- ------------------------------------- ---------------------------

Cash and cash

equivalents at the

end of the period 8,966 10,180 5,441

----------------------- ------------------------------------- ------------------------------------- ---------------------------

NOTES TO THE CONDENSED CONSOLIDATED RESULTS

for the six months ended 30 September 2011

1. Basis of preparation

-- These interim condensed consolidated financial statements for

the six months ended 30 September 2011 have not been audited or

reviewed and do not constitute statutory accounts within the

meaning of section 435 of the Companies Act 2006. They have been

prepared in accordance with the Group's accounting policies as set

out in the Group's latest annual financial statements for the year

ended 31 March 2011 and are in compliance with IAS 34 "Interim

Financial Reporting". These accounting policies are drawn up in

accordance with International Accounting Standards (IAS) and

International Financial Reporting Standards (IFRS) as issued by the

International Accounting Standards Board and as adopted by the

European Union (EU).

-- The following IFRS's which are effective for the first time

have been applied in these financial statements. Where adoption is

material their effect is detailed below:

IFRIC 19: Extinguishing financial liabilities with equity

instruments, had no effect on these financial statements,

Improvements to IFRS 2010: Amendments were made to IFRS 1, 3 and

7; IAS 1,27 and 34, and IFRIC 13 none of which had any effect on

these financial statements,

IAS 24 (Revised) Related party disclosures had no effect on

these financial statements,

And Amendment to IFRIC 14: prepayments of a minimum funding

requirement, had no effect on these financial statements.

-- The comparative figures for the financial year ended 31 March

2011 are not the statutory accounts for the financial year but are

abridged from those accounts prepared under IFRS which have been

reported on by the Group's auditors and delivered to the Registrar

of Companies. The report of the auditors was unqualified, did not

include references to any matter to which the auditors drew

attention by way of emphasis without qualifying their report and

did not contain a statement under section 498 (2) or (3) of the

Companies Act 2006.

-- These interim financial statements were approved by the Board

of Directors on 28 November 2011.

2. Segmental Analysis

Segment Reporting six months to 30 September 2011

Property Group Group fund Property Other fees & Unallocated

fund properties properties facilities income central TOTAL

management ("FOP") management overheads

("FPS")

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

External

revenue

-existing

operations 2,112 1,169 1,306 - - - 4,587

-business - - - - - - -

acquisitions

2,112 1,169 1,306 - - - 4,587

Depreciation

and

amortisation (12) (9) - - - - (21)

Operating

profit

-existing

operations 1,624 620 1,029 - - (486) 2,787

-interest

payable - (91) (317) - - - (408)

- interest

receivable

and dividend

income - 21 12 - - 30 63

-share of

results in

associates - 97 - - - - 97

Profit before

tax 1,624 647 724 - - (456) 2,539

Analysed as:

Before

performance

fees and

related

items: 1,624 647 511 - - (456) 2,326

Performance - - - - - - -

fees

Staff bonus - - - - - - -

Realised

foreign

currency

gain - - 213 - - - 213

Profit before

tax 1,624 647 724 - - (456) 2,539

Segment Reporting six months to 30 September 2010

Property fund Group Group fund Property Other fees & Unallocated

management properties properties facilities income central TOTAL

("FOP") management overheads

("FPS")

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

External

revenue

-existing

operations 1,930 1,002 - 1,136 28 - 4,096

-less

discontinued

operations - - - (1,136) - - (1,136)

1,930 1,002 - - 28 - 2,960

Depreciation

and

amortisation (10) (1) - (19) - - (30)

Operating

profit

-existing

operations 1,474 424 - - 27 (514) 1,411

-discontinued

operations - - - (93) - - (93)

-interest

payable - (163) - (3) - - (166)

-interest

receivable

and dividend

income - 8 - - - 49 57

-share of

results in

associates - 114 - - - - 114

-less

discontinued

operations - - - 96 - - 96

Profit before

tax 1,474 383 - - 27 (465) 1,419

Analysed as:

Before

performance

fees and

related

items: 1,474 383 - - 27 (465) 1,419

Performance - - - - - - -

fees

Staff bonus - - - - - - -

Profit before

tax 1,474 383 - - 27 (465) 1,419

Reconciliation of segmental profit before tax as previously

reported for 2010:

Operating profit as previously reported 1,474 538 - (93) 27 (514) 1,432

-interest payable - (163) - (3) - - (166)

-interest receivable - 8 - - - 49 57

Less: discontinued operations - - - 96 - - 96

Profit before tax 1,474 383 - - 27 (465) 1,419

----------------------------------------- ------ ------ --- ----- --- ------ ------

Segment Reporting 12 months to 31 March 2011

Property Group Group fund Property Other fees Unallocated

fund properties properties facilities & income central TOTAL

management ("FOP") management overheads

("FPS")

------------------- ------------ ------------ ----------- ----------------- ------------ ------------ ---------

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------- ------------ ------------ ----------- ----------------- ------------ ------------ ---------

External revenue

-existing

operations 3,970 2,233 907 2,305 - - 9,415

-less discontinued

operations - - - (2,305) - - (2,305)

------------------- ------------ ------------ ----------- ----------------- ------------ ------------ ---------

3,970 2,233 907 - - - 7,110

Depreciation and

amortisation (18) (10) - (32) - - (60)

Operating profit

-existing

operations 2,735 1,022 581 - - (1,130) 3,208

-discontinued

operations (114) (114)

-Interest payable - (277) (325) (7) - - (609)

-Interest

receivable and

dividend income - 14 - 1 - 109 124

-share of results

in associates - 221 - - - - 221

Less: discontinued

operations - - - 120 - - 120

------------------- ------------ ------------ ----------- ----------------- ------------ ------------ ---------

Profit before tax 2,735 980 256 - - (1,021) 2,950

------------------- ------------ ------------ ----------- ----------------- ------------ ------------ ---------

Analysed as:

Before performance

fees and related

items: 2,826 995 268 - - (653) 3,436

Performance fees - - - - - - -

Staff bonus (91) (15) (12) - - (368) (486)

------------------- ------------ ------------ ----------- ----------------- ------------ ------------ ---------

Profit before tax 2,735 980 256 - - (1,021) 2,950

------------------- ------------ ------------ ----------- ----------------- ------------ ------------ ---------

Assets-group 1,151 12,159 22,824 - - 5,595 41,729

Assets-associates - 685 - - - (308) 377

Liabilities (563) (7,538) (17,167) - - (267) (25,535)

------------------- ------------ ------------ ----------- ----------------- ------------ ------------ ---------

Net assets 588 5,306 5,657 - - 5,020 16,571

------------------- ------------ ------------ ----------- ----------------- ------------ ------------ ---------

Revenue for the six months to 30 September 2011 from continuing

operations consists of revenue arising in the United Kingdom 9%

(2010: 6%) and Central and Eastern Europe 91% (2010: 94%) and all

relates solely to the Group's principal activities.

Head office costs and overheads that are common to all segments

are shown separately under unallocated central costs. Assets,

liabilities and costs that relate to Group central activities

(including all cash) have not been allocated to business

segments.

3. Discontinued operations

The Group sold its 60% interest in First Property Services Ltd

("FPS"), for GBP170,000 on 17 March 2011 resulting in a profit on

sale of GBP16,000. The carried value of the Group's shareholding in

FPS at the date of the sale was GBP154,000 (March 2010:

GBP213,000). The consideration of GBP170,000 was partly settled by

a cash payment of GBP20,000 on the date of sale, with the remaining

GBP150,000 payable in cash within twenty four months.

Year ended 31 March 2011

The pre-tax loss during the year up to the date of the disposal

in March 2011 of discontinued operations amounted to GBP136,000 and

for the first six months to 30 September 2010 the pre-tax loss was

GBP96,000.

Financial performance of 2011 2010 2011

discontinued operations

Six months to 30 September Six months to 30 September Twelve months to 31 March

GBP'000 GBP'000 GBP'000

Trading performance of

discontinued operations

External revenue - 1,136 2,305

Operating costs - (1,229) (2,435)

Operating profit - (93) (130)

Interest income - - 1

Interest expense - (3) (7)

(Loss)/profit before tax - (96) (136)

Tax (expense)/credit - 27 38

(Loss)/profit after tax - (69) (98)

Non-controlling interest - 28 39

(Loss)/profit attributable to

owners of the parent - (41) (59)

Profit/(loss) for the year

from discontinued operations

Profit/(loss) after tax - (69) (98)

Profit on disposal of

discontinued operations - - 16

Tax on profit on disposal of - - -

discontinued operations

- (69) (82)

Net assets disposed and disposal proceeds of discontinued operations 2011 2010 2011

GBP'000 GBP'000 GBP'000

---------------------------------------------------------------------- ---------- ---------- ---------

Increase/(decrease) in retained liabilities - - -

---------------------------------------------------------------------- ---------- ---------- ---------

Cash and cash equivalents disposed on sale of subsidiary - - (110)

---------------------------------------------------------------------- ---------- ---------- ---------

Profit/(loss) on disposal before tax - - 16

---------------------------------------------------------------------- ---------- ---------- ---------

Cash consideration received, net of costs - - 20

---------------------------------------------------------------------- ---------- ---------- ---------

Consideration deferred to future periods - - 150

---------------------------------------------------------------------- ---------- ---------- ---------

Total consideration - - 170

---------------------------------------------------------------------- ---------- ---------- ---------

Net assets of discontinued operations disposed of - - (154)

---------------------------------------------------------------------- ---------- ---------- ---------

Profit/(loss) on disposal before tax - - 16

---------------------------------------------------------------------- ---------- ---------- ---------

Net cash inflow/(outflow) from disposals - - (90)

---------------------------------------------------------------------- ---------- ---------- ---------

Summary of net assets disposed of

2011 2010 2011

GBP'000 GBP'000 GBP'000

Non-current assets - - 63

Debtors - - 955

Cash - - 110

Current liabilities - - (854)

Non-current liabilities - - (17)

Non-controlling interest - - (103)

--------- --------- --------

- - 154

--------- --------------------------------------------- --------

4. Tax expense

The tax charge is based on a combination of actual current tax

charged and an effective rate that is expected to apply to the

profits for the full year.

5. Earnings per ordinary 1p share

The basic earnings per ordinary share is calculated on the

profit on ordinary activities after taxation and after

non-controlling interests on the weighted average number of

ordinary shares in issue, during the period.

Figures in the table below have been used in the

calculations.

Six months ended Six months 12 months ended

30 Sept 2011 ended 30 Sept 31 March 2011

2010

--------------------- ----------------- --------------- ----------------

Basic 1.70p 1.04p 1.98p

Diluted 1.61p 0.98p 1.86p

--------------------- ----------------- --------------- ----------------

Number Number Number

--------------------- ----------------- --------------- ----------------

Weighted average

number of ordinary

shares in issue 111,032,835 109,770,727 109,890,897

Share options 7,540,000 7,650,000 7,790,000

--------------------- ----------------- --------------- ----------------

Total 118,572,835 117,420,727 117,680,897

--------------------- ----------------- --------------- ----------------

GBP'000 GBP'000 GBP'000

--------------------- ----------------- --------------- ----------------

Basic earnings 1,891 1,145 2,178

Diluted earnings

assuming full

dilution at

closing share

price 1,908 1,153 2,195

--------------------- ----------------- --------------- ----------------

6. Interest in associates and other financial assets

Six months Six months 12 months

ended 30 ended 30 ended 31

Sept 2011 Sept 2010 March 2011

--------------------------------- ----------- ----------- ------------

a) Associated undertakings GBP'000 GBP'000 GBP'000

Cost of investment at beginning

of period 377 337 337

Share of accumulated post

tax profit 97 114 221

Dividends received (61) (39) (103)

Disposals - (72) (104)

Release of share of profit

in associate withheld - 23 26

--------------------------------- ----------- ----------- ------------

Cost of investment at end

of period 413 363 377

--------------------------------- ----------- ----------- ------------

Investments in Associated

undertakings

5(th) Property Trading Ltd 528 459 495

Regional Property Trading

Ltd 193 215 190

--------------------------------- ----------- ----------- ------------

721 674 685

Less: share of profit withheld

after tax on sale of property

to associate in 2007 (308) (311) (308)

--------------------------------- ----------- ----------- ------------

Cost of investment at end

of period 413 363 377

--------------------------------- ----------- ----------- ------------

b) Other financial assets

and investments

--------------------------------- ----------- ----------- ------------

Cost of investment at beginning

of period 711 99 99

Additions 163 324 612

Impairment charge - - -

--------------------------------- ----------- ----------- ------------

Cost of investment at end

of period 874 423 711

--------------------------------- ----------- ----------- ------------

7. Trade and other receivables

Six months Six months 12 months

ended 30 ended 30 ended 31

Sept 2011 Sept 2010 March 2011

------------------------------- ----------- ----------- ------------

GBP'000 GBP'000 GBP'000

Current assets

Trade receivables 772 1,068 1,059

Amounts due from undertakings - - -

in which the company has

a participation interest

Other receivables 123 228 312

Prepayments and accrued

income 227 811 289

1,122 2,107 1,660

------------------------------- ----------- ----------- ------------

Non-current assets 420 - 473

------------------------------- ----------- ----------- ------------

8. Trade and other payables

Six months Six months 12 months

ended 30 ended 30 ended 31

Sept 2011 Sept 2010 March 2011

----------------------------- ----------- ----------- ------------

GBP'000 GBP'000 GBP'000

Trade payables 228 622 831

Other taxation and social

security 287 262 313

Other payables and accruals 687 875 698

Deferred income 17 50 17

1,219 1,809 1,859

----------------------------- ----------- ----------- ------------

9. Financial liabilities

Six months Six months 12 months

ended 30 ended 30 ended 31

Sept 2011 Sept 2010 March 2011

------------------------------------ ----------- ----------- ------------

a) Current liabilities GBP'000 GBP'000 GBP'000

Finance lease 458 19 499

Foreign bank loans 103 - 1

561 19 500

------------------------------------ ----------- ----------- ------------

b) Non-current liabilities

------------------------------------ ----------- ----------- ------------

Loans repayable by subsidiary

(FOP) to third party shareholders 1,234 - 1,267

Finance lease 14,422 26 15,063

Foreign bank loans 9,729 6,734 6,616

25,385 6,760 22,946

------------------------------------ ----------- ----------- ------------

Loans repayable by FOP to third party shareholders are repayable

in August 2020.

Bank loans and finance leases totalling GBP24,712,000

(2010:GBP6,779,000) included within financial liabilities are

secured against investment properties owned by Fprop Opportunities

plc ("FOP") and properties owned by the Group shown under

inventories.

There are two foreign bank loans. The first of these two, for a

sum of GBP6,809,000 (2010: GBP6,734,000), is included under

non-current financial liabilities and is secured against the Blue

Tower office block owned by the Group. It is non-recourse and is

denominated in U.S. Dollars. Capital repayments commence in

November 2013 at a rate of US$17,675 per month until its maturity

in November 2015. Interest payments are charged at an annualised

rate of one month US Dollar Libor plus a margin of 2.15%.

The second bank loan, for a sum of GBP3,023,000, is partly

included under current liabilities and partly under non-current

liabilities and is secured against the Krasnystaw shopping centre

owned by FOP. It is non-recourse and is denominated in Euros. The

loan was drawn down by FOP in June 2011. Capital repayments are

made on a quarterly basis at a rate of approximately Eur 30,000 per

quarter until its maturity in 2014. Interest payments are fixed for

30% of the loan at an annualised rate of 2.4% plus a margin of 2.8%

and for the remaining 70%, charged at an annualised rate of three

month Euribor plus a margin of 2.8%.

The finance lease outstanding, for GBP14,880,000 (2010: GBPnil),

is included partly under current liabilities and partly under

non-current liabilities and is secured against the Lodz hypermarket

owned by FOP. It is non-recourse and is denominated in Euros.

Capital repayments are made on a monthly basis at a rate of

approximately Eur 45,000 per month until its maturity in 2017. The

monthly interest rate payable is fixed at an annualised rate of

3.58% until October 2013 when it reverts to a floating rate based

on an annualised rate of three month Euribor plus an all in margin

of 2.68%. Interest rate caps are in place with effect from October

2013 until maturity.

The interim results are being circulated to all shareholders and

can be downloaded from the Company's web site (www.fprop.com).

Further copies can be obtained from the registered office at 35 Old

Queen Street, London SW1H, 9JA.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR KVLFLFFFZFBZ

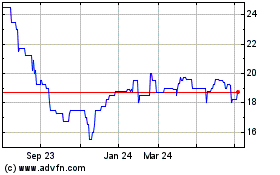

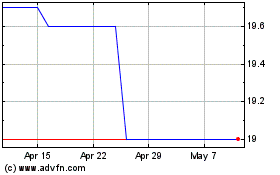

First Property (LSE:FPO)

Historical Stock Chart

From Mar 2024 to Apr 2024

First Property (LSE:FPO)

Historical Stock Chart

From Apr 2023 to Apr 2024