Market Waiting to Go Higher - Tactical Trading

November 06 2011 - 7:00PM

Zacks

What is the market telling us after another fun weekend of

Euro-crisis headlines? That it still wants to go higher. I am not

going as far to say that the "path of least resistance" is higher.

It will still be a battle.

But since we finally jumped to confronting the

biggest of sovereign debt worries via Italy, it means something

significant that the market isn't running away scared of systemic

banking contagion.

The Greek drama has really just been the strongest

(weakest?) test case for the Eurozone experiment that the whole

world is forced to watch. Because as I said last week, "if Greece

is the tip, Italy is the iceberg."

I think that "something significant" supporting the

market is that Europe will repair its leaky dams enough not to

hamper the US economy. This is what I predicted in August and

reiterated in September, and I'm sticking by it. And the chart, as

a picture of institutional market psychology, seems to

support this view.

What would surprise most market participants right

now, especially with the VIX slipping down to a nice quiet 31 level

in the past 3 sessions, is a quick trip down to 1,200.

And I think that would be very healthy for this

market too. Flush out the weak hands, so that we can buy with both

of ours.

Sure, a real Euro-scare would take us to 1,160-75.

And that's when you add. Whether you just trade the short term

swings or also invest for the long-term, I don't think we'll get

many more chances to buy the market in the 1,100 handle again.

It's a little debilitating and emotionally

exhausting to feel that our fortunes lie in the hands of so many

policy makers going in so many different directions over there.

We've got enough of our own worries about how politicians will

handle debt and budget battles.

But I'm aligning my mood for now with the picture

above that tells me things will work out.

Kevin Cook is a Senior Stock Strategist with

Zacks.com

Zacks Investment Research

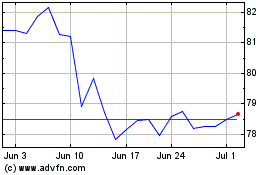

iShares MSCI EAFE (AMEX:EFA)

Historical Stock Chart

From Mar 2024 to Apr 2024

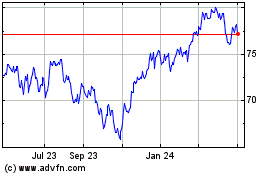

iShares MSCI EAFE (AMEX:EFA)

Historical Stock Chart

From Apr 2023 to Apr 2024