TIDMASHM

RNS Number : 0490P

Ashmore Group PLC

27 September 2011

Ashmore Group PLC

27 September 2011

Notice of Annual General Meeting and Annual Report for the year

ended 30 June 2011

Ashmore Group plc issued its Notice of Annual General Meeting ("

the Notice") today, 27 September 2011. The Circular containing the

Notice contains a summary of the business of the resolutions to be

proposed at the meeting which is available on the Company's

website.

The Company's Annual General Meeting will be held at 12 noon on

Thursday 27 October 2011 at Kingsway Hall Hotel, 66 Great Queen

Street, London WC2B 5BX.

Copies of the Company's Notice of Annual General Meeting,

together with the Annual Report for the year ended 30 June 2011,

have been uploaded to the UK Financial Services Authority National

Storage Mechanism and will shortly be available for inspection at

www.Hemscott.com/nsm.do

The above documents can also be downloaded from the Company's

website at :-

http://www.ashmoregroup.com

Additional Information :

Included in this announcement is additional information, for the

purposes of compliance with the Disclosure and Transparency Rules,

which includes the Directors responsibility statement and Risk

Statement, all as extracted from the 2011 Annual Report and

Accounts dated 12 September 2011.

Statement of Directors' Responsibilities

The Directors are responsible for preparing the Annual Report

and the Group and parent company financial statements in accordance

with applicable law and regulations.

Company law requires the Directors to prepare Group and parent

company financial statements for each financial year. Under that

law they are required to prepare the Group financial statements in

accordance with IFRSs as adopted by the EU and applicable law and

have elected to prepare the parent company financial statements on

the same basis.

Under company law the Directors must not approve the financial

statements unless they are satisfied that they give a true and fair

view of the state of affairs of the Group and parent company and of

their profit and loss for that period. In preparing each of the

Group and parent company financial statements, the Directors are

required to:

-- select suitable accounting policies and then apply them

consistently;

-- make judgements and estimates that are reasonable and

prudent;

-- state whether they have been prepared in accordance with

IFRSs as adopted by the EU; and

-- prepare the financial statements on the going concern basis

unless it is inappropriate to presume that the Group and the parent

company will continue in business.

The Directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the parent

company's transactions and disclose with reasonable accuracy at any

time the financial position of the parent company and enable them

to ensure that its financial statements comply with the Companies

Act 2006. They have general responsibility for taking such steps as

are reasonably open to them to safeguard the assets of the Group

and to prevent and detect fraud and other irregularities.

Under applicable law and regulations, the Directors are also

responsible for preparing a Directors' report, Directors'

remuneration report and corporate governance statement that comply

with that law and those regulations.

The Directors are responsible for the maintenance and integrity

of the corporate and financial information included on the

Company's website. Legislation in the UK governing the preparation

and dissemination of financial statements may differ from

legislation in other jurisdictions.

Responsibility statement of the Directors in respect of the

annual financial report

We confirm that to the best of our knowledge:

-- the financial statements, prepared in accordance with the

applicable set of accounting standards, give a true and fair

view

-- of the assets, liabilities, financial position and profit or

loss of the Company and the undertakings included in the

consolidation taken as a whole; and

-- the Directors' report includes a fair review of the

development and performance of the business and the position of the

issuer and the undertakings included in the consolidation taken as

a whole, together with a description of the principal risks and

uncertainties that they face.

Risk

Risk is inherent in all businesses and is therefore present

within the Group's activities. The Group seeks to effectively

identify, monitor and manage each of its risks and actively

promotes a risk awareness culture throughout the organisation. The

ultimate responsibility for risk management rests with the Board.

However, from a practical perspective some of this activity is

delegated.

The key risks, their mitigants, and their delegated owners are

set out on the page below for each of the four risk categories that

Ashmore considers most important: strategic and business,

investment, operational, and treasury - with reputational risk

being a common characteristic across all four categories.

During the year the Group's risk control framework has been

enhanced to take account of changing business and market

conditions. This included reviews conducted by the Group's Internal

Audit function. There has also been specific focus on the further

refinement of the Group Risk Matrix, which seeks to identify the

key risks to the Group, as well as current mitigants and

forward-looking action plans.

Risk management and control

Risk management and control is one element of the Group's

overall system of internal controls within its corporate governance

framework - incorporating risk, compliance and internal audit.

Further details of the Group's internal control environment are

described in the corporate governance report on pages 37 to 41 of

the Ashmore 2011 Annual Report .

Key risks and mitigants

Risk type/owner Description of risk Mitigation

------------------------- ------------------------ -------------------------

Strategic and These include: -- A These include: -- The

business risk long-term downturn in Board's long investment

The risk that the fundamental and management experience;

the medium and technical dynamics of -- A clearly defined

long-term profitability emerging markets; -- Group strategy,

of the Group Reputational damage to understood throughout

could be adversely Ashmore impacting the organisation and

impacted by the marketing and actively monitored; --

failure to identify distribution The diversification of

and implement capabilities; -- investment capabilities

the correct strategy, Potential market to reduce single

and to react capacity issues and event/product exposure;

appropriately increased -- A committee based

to changes in competition. top down investment

the business methodology to create a

environment. scalable business

Delegated to: model; -- Experienced,

Ashmore Group centrally managed and

plc Board globally located

distribution team.

------------------------- ------------------------ -------------------------

Investment risk The risk These include: -- That These include: --

of non-performance or the investment manager Experienced Investment

manager neglect, does not adhere to Committees meet weekly

including the risk that policies; -- A ensuring consistent

long-term investment downturn in investment core investment

outperformance is not performance; -- processes are applied;

delivered thereby Expansion into -- Dedicated emerging

damaging prospects for unsuccessful themes; markets research and

winning and retaining -- Insufficient investment focus, with

clients, and putting counterparties. frequent country

average management fee visits; -- Strong

margins under pressure. Compliance and Risk

Delegated to: Ashmore Management oversight of

Group Investment policies, restrictions,

Committees limits and other

related controls; --

Formal counterparty

reviews held at least

quarterly.

------------------------- ------------------------ -------------------------

Operational risk Risks These include: -- The These include: -- The

in this category are inability to fairly valuations of the most

broad in nature and price assets; -- material assets are

inherent in most Oversight of overseas outsourced to

businesses and subsidiaries including independent third

processes. They include the recent acquisition parties with the

the risk that of AshmoreEMM; -- Pricing Methodology

operational flaws result Compliance with Committee (PMC)

from a lack of resources regulatory providing additional

or planning, error or requirements as well oversight of valuations

fraud, the inability to as with respect to the used for hard-to-price

capitalise on market monitoring of assets; -- An

opportunities, or investment breaches; integrated control and

weaknesses in systems -- Controls around management framework is

and controls. Delegated special purpose in place to ensure

to: Ashmore Group Risk vehicles; -- Execution day-to-day global

and Compliance and process operations are managed

Committee management; -- effectively; -- A Risk

Business and systems and Compliance

disruption; -- The Committee meets on a

risk associated with monthly basis to

the integration of consider the Group's

AshmoreEMM Key Risk Indicators

particularly migrating ("KRIs"); -- A disaster

the entity onto the recovery procedure

Group's core systems; exists and is tested

-- Fraud by an regularly; --

employee or third Engagement letters or

party service service level

provider. agreements are in place

with all significant

service providers; --

The development of a

structured AshmoreEMM

integration plan with

dedicated resources

applied to its

execution; -- A New

Product Committee

approves new product

launches.

------------------------- ------------------------ -------------------------

Treasury risk These include: -- These include: --

These are the Group revenues are Monthly reporting of

risks that management primarily US all balance sheet

does not appropriately dollar-based, whereas exposures to the

mitigate balance results are Executive; -- A

sheet risks or denominated in proportion of Group

exposures which Sterling; -- The Group currency exposures are

could ultimately invests in its own hedged as a matter of

impact the financial funds from time to policy; -- Significant

performance or time, exposing it to corporate investments

position of the price risk, credit are approved by the

Group. risk and foreign Board, and all others

Delegated to: exchange risk; -- by the CEO; -- Cash

Chief Executive Liquidity management; flows are forecast and

Officer and Group -- The Group is monitored on a regular

Finance Director exposed to credit risk basis and managed in

and interest rate risk line with approved

in respect of its cash policy; -- The

balances. availability of GBP and

USD S&P AAA rated

liquidity funds managed

by experienced cash

managers.

------------------------- ------------------------ -------------------------

Enquiries:

Michael Perman

Company Secretary

Tel : +44 (0) 203 077 6000

27 September 2011

END

This information is provided by RNS

The company news service from the London Stock Exchange

END

STRBLGDCIDDBGBR

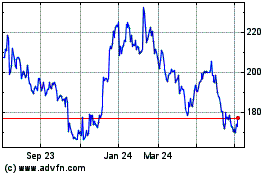

Ashmore (LSE:ASHM)

Historical Stock Chart

From Mar 2024 to Apr 2024

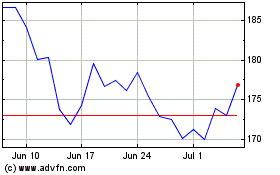

Ashmore (LSE:ASHM)

Historical Stock Chart

From Apr 2023 to Apr 2024