Market Alert: Dragon Capital Group -- September 28, 2010

September 28 2010 - 9:15AM

Marketwired

Stock Market Alerts' performance stock list includes: Dragon

Capital Group Corp. (PINKSHEETS: DRGV), Citigroup, Inc. (NYSE: C),

Bank of America Corp. (NYSE: BAC) and Baidu Inc. (NASDAQ: BIDU).

To receive FREE Mobile Stock Alerts formatted especially for

your cell phone, text the word "press" in the subject line to

68494.

Yesterday after the markets closed, Dragon Capital Group

(PINKSHEETS: DRGV) issued a press release announcing its financial

results for the second quarter and first six months of 2010 ended

June 30, 2010.

According to the release, revenue for the second quarter ended

June 30, 2010 was $15.4 million as compared to $15.0 million

recorded in the second quarter of 2009. Cost of goods sold for the

second quarter of 2010 were $14.7 million compared to $14.1 million

in the second quarter of 2009. Net income for the second quarter of

2010 was $277,800, increasing 123% from the $124,500 recorded in

the second quarter of 2009. The increase in net income was largely

attributable to a decrease in selling expenses as the overall

economic environment improved when compared to the same period in

2009.

Revenue for the first six months of 2010 reached $27.8 million,

a slight increase from the $26.9 million recorded in the first six

months of 2009. For the first six months of 2010, net income

attributable to Dragon Capital Group Corp. was $126,000, a

significant improvement from the net loss of ($554,000) recorded in

the first six months of 2009. The improvement was attributable to a

reduction in selling expenses and a loss recorded in 2009 from the

sale of its Fomde subsidiary.

At June 30, 2010, total assets were $16.3 million with $16.0

million in current assets. This compares to total assets of $15.2

million with $14.9 million in current assets at December 31, 2009.

At June 30, 2010, shareholder equity improved to $7.7 million with

working capital of $8.6 million compared to shareholder equity of

$7.4 million with working capital of approximately $8.2 million at

December 31, 2009.

Mr. Lawrence Wang, CEO of Dragon Capital Group, stated, "We are

extremely pleased with our performance in the first six months of

2010. We have substantially improved our bottom line performance as

we continue to increase our revenue. As the overall economic

environment in China continues to improve for our business, we

believe we can continue to build on these positive trends. We are

committed to achieving continued top line and bottom line growth as

we move into the second half of 2010. We remain focused on

achieving higher operating efficiencies which we believe can extend

our profitability into the coming years as we work diligently to

increase our shareholder value."

The stock closed yesterday at a Penny a share.

Citigroup, Inc. (NYSE: C) down 0.7% on 366.4 million shares

traded. Citi, the leading global financial services company, has

approximately 200 million customer accounts and does business in

more than 140 countries.

Bank of America Corp. (NYSE: BAC) down 2.6% on 123.7 million

shares traded. Bank of America is one of the world's largest

financial institutions, serving individual consumers, small- and

middle-market businesses and large corporations with a full range

of banking, investing, asset management and other financial and

risk management products and services.

Baidu Inc. (NASDAQ: BIDU) up 6.1% on 21 million shares traded.

Baidu, Inc. is the leading Chinese language Internet search

provider.

Stock Market Alerts LLC. (SMA), also doing business as Wall

Street eNews, is an advertising company who disseminates electronic

information to subscribers through its network of affiliated

companies and/or partners. SMA is not a registered broker/dealer

and may not sell, offer to sell or offer to buy any security. SMA

profiles are not a solicitation or recommendation to buy, sell or

hold securities. An offer to buy or sell can be made only with

accompanying disclosure documents from the company offering or

selling securities and only in the states and provinces for which

they are approved. The material in this release is intended to be

strictly informational. The companies that are discussed in this

release may or may not have approved the statements made in this

release and may or may not have approved the timing of this

release. All statements and expressions are the sole opinion of SMA

and are subject to change without notice. Information in this

release is derived from a variety of sources that may or may not

include the referenced company's publicly disseminated information,

information supplied by third parties or SMA's own research. The

accuracy or completeness of the information is not warranted and is

only as reliable as the sources from which it was obtained. While

this information is believed to be reliable, such reliability

cannot be guaranteed. SMA disclaims any and all liability as to the

completeness or accuracy of the information contained and any

omissions of material fact in this release. The release may contain

technical inaccuracies or typographical errors. It is strongly

recommended that any purchase or sale decision be discussed with a

financial adviser, or a broker-dealer, or a member of any financial

regulatory bodies. Investment in the securities of the companies'

discussed in this release is highly speculative and carries a high

degree of risk. SMA is not liable for any investment decisions by

its readers or subscribers. Investors are cautioned that they may

lose all or a portion of their investment if they make a purchase

in SMA profiled stocks.

This profile is not without bias, and is a paid promotional

release. To comply with Section 17(b) of the Securities Act of

1933, SMA is disclosing that the company has been compensated for

dissemination of this information on behalf of one or more of the

companies mentioned in this release. For current services performed

for Dragon Capital Group Corp. (OTC: DRGV), China Direct

Industries, Inc., China America Holdings, Sunwin International

Neutraceuticals, Inc., China Armco Metals, Inc. and China Logistics

Group, Inc., SMA has been compensated a total of Three Hundred and

Seventy Thousand Dollars (Seventy Thousand dollars for current

services and Three Hundred Thousand dollars for previous services)

by China Direct Investments Inc., a Florida corporation, and a

wholly owned subsidiary of China Direct. In addition, SMA has also

been compensated One Million restricted shares of China Logistics

Group, Inc. and Two Million restricted shares of China America

Holdings. SMA may receive compensation for future services. Any

additional compensation will be disclosed at such time that SMA is

aware of a client's desire to extend the original services. SMA may

have received shares of a company profiled in this release prior to

the dissemination of the information in this release. In the event

of any receipt of such shares, full disclosure would be shown

above. SMA may immediately sell some or any shares in a profiled

company held by SMA and may have previously sold shares in a

profiled company held by SMA. SMA's services for a company may

cause the company's stock price to increase, in which event SMA

would make a profit when it sells its stock in a company. In

addition, SMA's selling of a company's stock may have a negative

effect on the market price of the stock.

This release contains "forward-looking statements" within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E the Securities Exchange Act of 1934, as amended and

such forward-looking statements are made pursuant to the safe

harbor provisions of the Private Securities Litigation Reform Act

of 1995. "Forward-looking statements" describe future expectations,

plans, results, or strategies and are generally preceded by words

such as "may", "future", "plan" or "planned", "will" or "should",

"expected," "anticipates", "draft", "eventually" or "projected".

You are cautioned that such statements are subject to a multitude

of risks and uncertainties that could cause future circumstances,

events, or results to differ materially from those projected in the

forward-looking statements, including the risks that actual results

may differ materially from those projected in the forward-looking

statements as a result of various factors, and other risks

identified in a companies' annual report on Form 10-K or 10-KSB and

other filings made by such company with the Securities and Exchange

Commission. You should consider these factors in evaluating the

forward-looking statements included herein, and not place undue

reliance on such statements. The forward-looking statements in this

release are made as of the date hereof and SMA undertakes no

obligation to update such statements.

PINKSHEETS:DRGV NYSE:C NYSE:BAC NASDAQ:BIDU

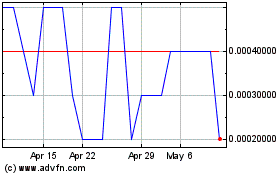

Dragon Capital (PK) (USOTC:DRGV)

Historical Stock Chart

From Mar 2024 to Apr 2024

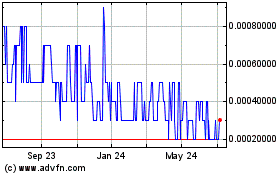

Dragon Capital (PK) (USOTC:DRGV)

Historical Stock Chart

From Apr 2023 to Apr 2024