CORRECT: =3rd UPDATE: Reckitt Benckiser In GBP2.54 Billion SSL Deal

July 21 2010 - 6:35AM

Dow Jones News

Reckitt Benckiser Group PLC (RB.LN) Wednesday added condoms and

insoles to its stable of products, as it continued to reposition

itself as a personal care company with the GBP2.54 billion

acquisition of SSL International PLC (SSL.LN).

Reckitt said it would pay 1163 pence in cash per SSL share as

well as a dividend of 8 pence, valuing the company at GBP2.54

billion. It will also assume SSL's GBP41.1 million debt.

The acquisition adds Durex condoms and Scholl footcare products

to its stable of "powerbrands" and will immediately boost

earnings.

The market welcomed the deal and by 0837 GMT Reckitt's shares

were up 75 pence, or 2.4%, at 3,265 pence, while SSL's were up 33%

at 1,174 pence.

The deal's key benefit is to accelerate Reckitt's shift to the

faster-growing and higher-margin health and personal care sector,

and away from the more sluggish household products categories, said

Evolution analyst Chas Manso.

The deal also materially enhances Reckitt's business in China

and Japan.

Health and Personal Care brands such as Nurofen, Strepsils and

Veet have been the key drivers of Reckitt's growth in recent years

as household goods such as Airwick, Cillit Bang and Harpic posted

more subdued growth through the recession.

Reckitt has expanded its health and personal care business

rapidly, buying Adams Respiratory Therapeutics for GBP1.1 billion

in 2007 and Boots Healthcare International for GBP1.93 billion in

2006.

Wednesday's acquisition will increase the unit's sales by 36% to

GBP2.8 billion, or one third of the group's total.

Durex and Scholl grew at 4.8% and 5.7%, respectively, last year

and Becht said Reckitt could accelerate this through investment and

Reckitt's greater distribution.

Shore Capital's Darren Shirley said that while the price looked

"chunky," the targeted cost savings make the price more

compelling.

The company is targeting GBP100 million of cost savings by the

end of 2012 from closing administration functions and improving

procurement.

Shirley said Reckitt's good track record of integration meant

the targets can be achieved, and may be exceeded.

The GBP100 million in cost savings is almost as high as SSL's

entire operating profit in the year to March of GBP126 million.

Reckitt's profit in 2009 was GBP1.89 billion.

Reckitt can certainly afford the deal. Its strong cash flow

means it quickly pays down debt and had net cash of GBP663 million

at the end of the first quarter.

Reckitt is funding the offer with a GBP1.25 billion loan

facility arranged by HSBC Bank, together with working capital and

existing facilities.

Deutsche Bank was financial adviser to Reckitt, while SSL was

advised by J.P. Morgan Cazenove and Lazard.

The deal has been rumored since 2003, when SSL received an

approach--reportedly from Reckitt--but talks eventually came to

nothing.

While the deal was welcomed by the market, one analyst

questioned why Reckitt waited so long, given its long-held

interest.

SSL's shares have grown almost 60% in the last year and have

increased fourfold since 2003.

The offer represents a premium of 32.8% to SSL's closing price

Tuesday and is four times SSL's price five years ago.

SSL has operations in over 30 countries across Europe, Asia

Pacific and the Americas and sells into over 100 countries.

It was formed through the mergers of Seton Healthcare and Scholl

in 1998 and the combination with London International Group in

1999. Scholl had been in existence since 1904, while London

International had been importing condoms since 1915.

Under Chief Executive Garry Watts, SSL made a push into emerging

markets, buying condom brands in Ukraine, Russia and Poland, and

adding sex toys and lubricants to the Durex brand.

Its pipeline includes an erection-enhancing condom developed in

partnership with the U.K.'s Futura Medical PLC (FUM.LN) and one

being developed with Australia's Starpharma Holdings Ltd. (SPL.AU),

which contains a gel that kills bugs that cause sexually

transmitted diseases, including HIV.

SSL's 10,000 staff will now join Reckitt's 25,000-strong

workforce, though the integration will lead to the removal of some

commercial and administrative overlaps, said Reckitt.

-By Jason Douglas and Michael Carolan, Dow Jones Newswires;

44-20-7842-9272; jason.douglas@dowjones.com

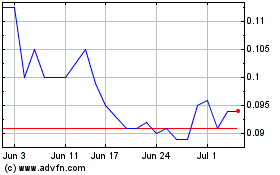

Starpharma (ASX:SPL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Starpharma (ASX:SPL)

Historical Stock Chart

From Apr 2023 to Apr 2024