South Korean Won Declines To 5-day Low Against Yen; Recovers Early Losses Against US Dollar

October 14 2009 - 12:50AM

RTTF2

The South Korean won declined to a 5-day low against the

Japanese yen and climbed from a 2-day low against the US dollar

during Wednesday's early trading.

On the equity front, the South Korean stock market is trading

firm on Wednesday with investors picking up stocks cutting across

various sectors on expectations of fairly buoyant quarterly

results.

The benchmark KOSPI index, which opened notably higher at 1,642,

is currently trading at 1,651, up 22.1 points, or 1.36%, over its

previous close.

Wednesday in Asia, the South Korean won dropped against its

Japanese counterpart. The won touched a 5-day low of 13.1040

against the Japanese unit, compared to 13.0730 hit late Tuesday in

New York. On the downside, the next likely target is seen around

the13.19 level.

The Bank of Japan decided to leave the key interest rate

unchanged as expected. The Policy Board of the BoJ unanimously

decided to maintain the uncollateralized overnight call rate at

0.1%. The last change in the rate was a 0.1% cut in interest rates

at the December 2008 meeting.

Earlier a report by the Bank of Japan said that the prices for

domestic corporate goods shed 7.9 percent on year in September,

posting an index score of 103.0. That was exactly in line with

analyst expectations following the 8.5 percent annual decline in

August.

The South Korean won bounced back against the US dollar after

falling to a 2-day low of 1172.60 during Wednesday's early Asian

trading. The won is now trading at 1165.10 against the buck, with

1163.5 seen as the next upside target level. At yesterday's New

York session close, the pair was quoted at 1172.10.

From U.S., advance retail sales is slated to be released at 8:30

am ET. For September, economists estimate a 2.1% decline in the

retail sales, but a 0.2% increase in retail sales excluding

autos.

At the same time, the export & import price indexes for

September, are due out. At 10:00 am ET, the Commerce Department is

scheduled to release its business inventories report for August.

The report is expected to show a 0.9% decline in business

inventories for the month.

The Federal Reserve is scheduled to release the minutes of its

September 22-23 meeting at 2 pm ET.

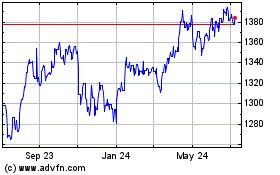

US Dollar vs KRW (FX:USDKRW)

Forex Chart

From Mar 2024 to Apr 2024

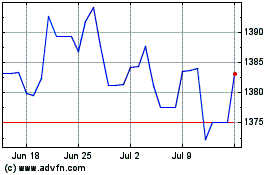

US Dollar vs KRW (FX:USDKRW)

Forex Chart

From Apr 2023 to Apr 2024