Most Southeast Asian Currencies Plunge Against Dollar

October 09 2009 - 12:36AM

RTTF2

Friday in Asia, most Southeast Asian currencies plummeted

against the U.S. dollar despite a gain in most Asian stocks.

The Hong Kong and the Taiwan dollars slipped to 3-day low

against the US currency. Meanwhile, the currencies of India,

Philippine and South Korea fell from 1-year highs against the

dollar.

On the other hand, the Chinese yuan surged up to a 4-month high

against the dollar as the former was supported by China's Shangai

composite index, which jumped more than 3.5% today.

Federal Reserve Chairman Ben Bernanke reiterated Thursday that

low interest rates will likely remain in effect for the foreseeable

future.

"My colleagues at the Federal Reserve and I believe that

accommodative policies will likely be warranted for an extended

period," Bernanke said in remarks prepared for delivery to the

Federal Reserve Board Conference on Key Developments in Monetary

Policy in Washington, DC.

Bernanke said the Fed will begin tightening monetary policy

"when the economic outlook improves sufficiently." He added that

the timing and pace of any future tightening or use of other tools

will be done "to best foster our dual objectives of maximum

employment and price stability."

The Singapore dollar that closed yesterday's trading at 1.3891

against the U.S. currency fell to 1.3935 in early Asian deals on

Friday. The near term support for the Singapore currency is seen

around the 1.403 level.

During early Asian trading on Friday, the Hong Kong dollar

weakened to a 3-day low of 7.7510 against the U.S. currency. This

may be compared to Thursday's closing value of 7.7502. On the

downside, 7.7516 is seen as the next target level for the Hong Kong

dollar.

The Thai baht declined to 33.42 against the US dollar during

early Asian deals on Friday. The next downside target level for the

Thailand currency is seen at 33.48. At yesterday's close, the

dollar-baht pair was quoted at 33.33.

In early Asian deals on Friday, the Malaysian ringgit slipped to

3.4025 against the dollar. If the Malaysian currency weakens

further, it may likely target the 3.420 level. The dollar-ringgit

pair closed yesterday's North American session at 3.3775.

The Philippine peso that jumped to a 1-year high of 46.28

against the dollar at 6:45 pm ET Thursday weakened thereafter. The

peso thus dropped to 46.6950 per dollar by about 10:05 pm ET. The

next downside target level for the Philippine currency is seen at

46.735. The dollar-peso pair was worth 46.35 at yesterday's

close.

The Taiwan dollar, which closed yesterday's trading at 32.1650

against the U.S. currency slumped to a 3-day low of 32.3390 during

early Asian deals on Friday. On the downside, 32.295 is seen as the

next support level for the Taiwan dollar.

During early Asian deals on Friday, the Chinese yuan gained

against the dollar and reached a 4-month high of 6.8250 at 9:40 pm

ET. Although the yuan slipped thereafter, it rebounded shortly and

the pair is currently worth 6.8257. If the Chinese currency

advances further, it may target the 6.822 level.

The People's Bank of China has set today's central parity rate

for the dollar-yuan pair at 6.8270.

The South Korean won declined against the dollar after hitting a

new 1-year high of 1164.10 at 8:05 pm ET Thursday. The won dipped

to 1168.95 per dollar by about 8:15 pm ET and this may be compared

to yesterday's close of 1164.60. On the downside, 1169.5 is seen as

the next target level for the Korean currency.

The Indian rupee that soared to a new 1-year high of 46.07

against the US dollar at 8:25 pm ET Thursday edged down thereafter.

The rupee slipped to 46.45 per dollar by about 11:35 pm ET. If the

Indian currency drops further, it may target the 46.68 level. The

dollar-rupee pair closed yesterday's New York session at

46.3550.

Today, Thailand will release foreign reserves data for the week

ending October 2. Forecasts call for an increase of 132.8 percent

on year after the 132.3 percent annual jump in the previous

week.

Also, Philippines will provide August numbers for exports, with

analysts expecting a decline of 20 percent on year following the

25.4 percent annual contraction in July.

From the U.S., the trade balance report for August has been

slated for release in the North American session.

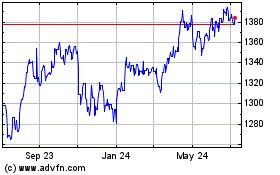

US Dollar vs KRW (FX:USDKRW)

Forex Chart

From Mar 2024 to Apr 2024

US Dollar vs KRW (FX:USDKRW)

Forex Chart

From Apr 2023 to Apr 2024