Most South East Asian Currencies Plunge Against US Dollar

September 23 2009 - 7:23PM

RTTF2

During Thursday's Asian trading, most Southeast Asian currencies

plunged against the U.S. dollar as a slump in most Asian stocks

decreased demand for emerging market assets. The currencies of

South Korea, Philippine, Thailand, Malaysia, China, Taiwan and

Singapore dropped against the greenback.

On the other hand, the Indian rupee and the Pakistan rupee

showed strength against the dollar.

Most of the Stock markets across the Asia Pacific are trading

lower today with the overnight weak close on Wall Street pushing

participants on to a defensive mood. Markets in Hong Kong, South

Korea, Shanghai, Singapore, New Zealand and Taiwan are trading

notably lower. The Japanese and Indonesian stock markets, which had

an extended weekend, are trading in positive territory with notable

gains. Stock markets across the region had turned in another mixed

performance on Wednesday.

Thursday morning in Asia, the Malaysian currency showed weakness

against its US counterpart. The ringgit reached a low of 3.481

against the dollar by 8:50 pm ET, down 0.6 percent from yesterday's

fresh 2009 high of 3.4615. The dollar-ringgit pair, which closed

Wednesday's deals at 3.4675, is currently worth 3.4774 with 3.49

seen as the next target level.

The Philippine peso plunged to 47.59 against the US dollar on

Thursday morning in Asia, compared to yesterday's close of 47.27.

On the downside, the peso is likely to test support around the

47.68 level.

The Taiwan dollar lost ground against the US dollar during early

Asian trading on Thursday. The domestic currency dropped to a 2-day

low of 32.4095 against the greenback by 9:10 pm ET, compared to

Wednesday's New York session closing value of 32.357. On the

downside, 32.47 is seen as the next target level for the Taiwan

dollar.

Taiwan's central bank will announce its decision on interest

rates today, with analysts are expecting the bank to keep rates on

hold at the current 1.25 percent.

The Singapore dollar dropped to a 2-day low of 1.4175 against

the US dollar in early Asian trading on Thursday, down 0.8 percent

from yesterday's 1-year high of 1.4076. If the domestic unit

declines further, support is seen around the 1.42 level. The pair

closed yesterday's deals at 1.4135.

During Thursday's early Asian deals, the South Korean won

declined to 1198.10 against the dollar. The next downside target

level for the Korean currency is seen at 1210.10. The dollar-won

pair was worth 1192.60 at Wednesday's close.

Extending its 2-day winning streak, the Indian rupee advanced to

47.83 against the US dollar on Thursday morning in Asia. This set

the highest level for the rupee since August 14. On the upside,

resistance is likely to be seen around the 47.78 level for the

domestic currency.

The Chinese yuan traded lower against its US counterpart during

Thursday's early Asian trading. The yuan is now trading at 6.8310

versus the buck, and if it declines further 6.833 is seen as the

next target level. At yesterday's New York session close, the pair

was quoted at 6.8271.

The People's Bank of China has set today's central parity rate

for the dollar-yuan pair at 6.8280. The pair is allowed to move 5%

above or below the target rate.

Thursday in Asia the Pakistan rupee staged a sharp rise against

its US counterpart. The Pakistan currency reached a high of 82.45

against the US currency by 11:50 pm ET, with 82.15 seen as the next

upside target level. The pair closed Wednesday's deals at

82.71.

The Thai baht that closed yesterday's trading at 33.55 against

the U.S. dollar weakened to 33.66 during early Asian deals on

Thursday. The near term support for the Thailand currency is seen

around the 33.78 level.

Across the Atlantic, the U.S. Labor Department is due to release

its customary weekly jobless claims report for the week ended

September 19th at 8:30 am ET. Economists expect a small increase in

claims to 550,000. At 10:00 ma ET, the National Association of

Realtors is scheduled to release its report on existing home sales

for August. Economists estimate existing home sales of 5.35 million

for the month.

The Chair of the White House Council of Economic Advisers

Christina Romer is scheduled to deliver the keynote address to the

Chicago Federal Reserve Bank's International Banking Conference in

Chicago at 1 pm ET.

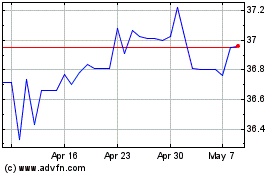

US Dollar vs THB (FX:USDTHB)

Forex Chart

From Mar 2024 to Apr 2024

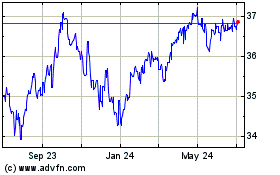

US Dollar vs THB (FX:USDTHB)

Forex Chart

From Apr 2023 to Apr 2024