GBPUSD just saw increased volatility at 11:15 GMT as UK PM, Boris Johnson, just announced over Twitter that he had contracted the new Coronavirus. He said he had a cough and a fever, but he also recorded a video, and in it, he was in good spirits.

GBPUSD reacted by declining by 0.79% over 15 minutes as the markets adjusted to the news. PM Johnson is 55 years old, and not in the high-risk categories if we look at age alone. He will receive world-class medical help if he gets more ill. However, it can become a challenge for the UK if Boris Johnson gets sick that he can’t work for weeks. The risk of that happening is the reason why the GBPUSD traded lower.

Looking beyond the near price action, the uptrend in GBPUSD remains intact as the demand for Dollars has declined over the last few days, and as more governments are taking action to stop the Coronavirus spread.

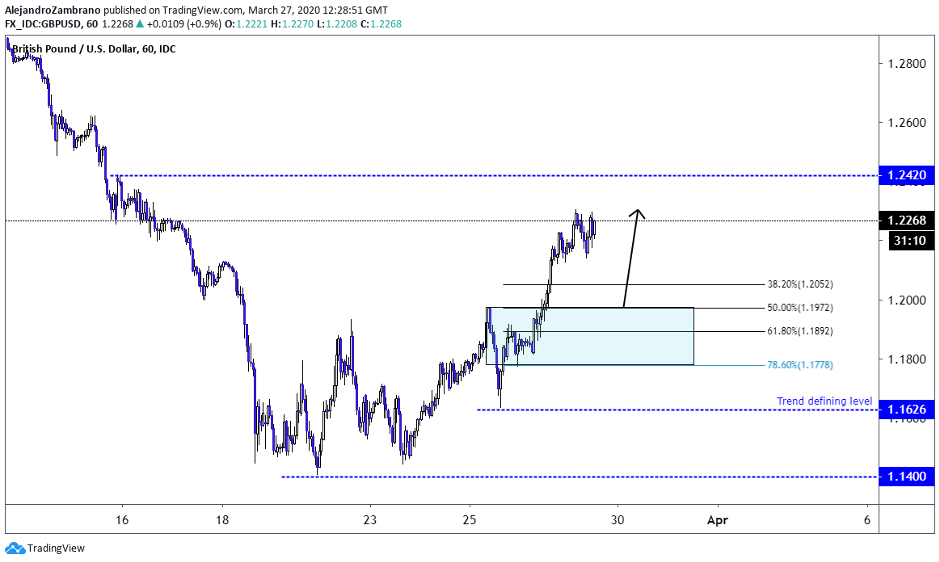

From a technical point of view, the trend will remain upwards above the March 25 low of 1.1626, and if we draw Fibonacci levels from the low, to the current weekly high, we can derive the 50% correction level at 1.1972.

Around the same level, we also find the March 25 high, and it could also act as a support level. The 50% correction level and the prior high, could be the level from where the next bullish left will start, as both levels are important, and as the risk-reward ratio favors long positions between 1.1972 and the March 25 low at 1.1626.

If the price indeed turns higher from the interval mentioned, I suspect the price will revisit the current weekly high at 1.2297, followed by the 1.2420 level. However, on a break to the March 25 low, the price could decline to this year’s low at 1.140.

By Alejandro Zambrano, Chief Market Strategist at ATFX.

Hot Features

Hot Features