Yum Brands Buys 3% Stake in Food-Delivery Service GrubHub

February 08 2018 - 10:53AM

Dow Jones News

By Cara Lombardo and Julie Jargon

Yum Brands Inc. is buying a 3% stake in food-delivery service

GrubHub Inc. for $200 million, making it one of the first fast-food

companies to directly invest in a food-delivery service as it

maneuvers the world of online food sales.

Yum Finance Chief David Gibbs told investors Thursday that the

relationship with GrubHub is designed to increase customers' access

to its KFC, Taco Bell and Pizza Hut brands. Food makers are

increasingly trying to capture sales from consumers who are finding

it easier -- and often, cheaper -- to dine at home or in their

office.

Yum will partner with GrubHub to add online ordering for pickup

and delivery to its restaurants. The company has been testing

GrubHub with KFC and said it expects GrubHub to cover about 80% of

the KFC restaurants that could provide delivery by the end of the

year. Nearly 1,500 Taco Bell restaurants already deliver food, but

the partnership with GrubHub will expand the number of Taco Bells

that can deliver.

Mizuho analyst Jeremy Scott said the deal is "a major win for

GrubHub" as it is likely to include a joint marketing campaign

during the rollout phase. Pizza Hut President Artie Starrs will

also join GrubHub's board of directors as part of the deal.

GrubHub shares rose 22% in early trading Thursday. Yum shares

were down 2%.

Other fast-food chains have teamed up with delivery services but

have stopped short of making investments. Wendy's Co. partners with

DoorDash Inc. and McDonald's Corp. has a partnership with Uber

Eats, enabling delivery of its burgers and fries to customers in 13

countries. Dairy Queen's new Chief Executive Troy Bader has said

innovative mobile-app ordering and delivery services is one of his

priorities.

Panera Bread Co., which has one of the highest rates of online

sales in the industry, has its own online platform, Panera 2.0,

which in its last quarter as a public company accounted for more

than a quarter of the company's sales. Panera employs more than

10,000 of its own delivery drivers.

Other food retailers have made investments in or entered into

partnerships with delivery or meal-kit subscription services as a

way to get their food to consumers who have an increasing number of

options from which to purchase food. Target Corp. in December

agreed to buy grocery-delivery company Shipt Inc. National

supermarket chain Albertson's Cos. last year bought Plated, a

meal-kit delivery service. Packaged-food companies also have been

investing in meal-kit companies. Campbell Soup Co. last year

announced it would invest in Chef'd to help the soup maker grow its

e-commerce business.

GrubHub makes local deliveries of food from about 80,000

restaurants in more than 1,600 U.S. cities. But it faces

competition from Amazon.com Inc., which is partnering with

restaurant-technology provider Olo to expand its restaurant

delivery selection.

Write to Cara Lombardo at cara.lombardo@wsj.com and Julie Jargon

at julie.jargon@wsj.com

(END) Dow Jones Newswires

February 08, 2018 10:38 ET (15:38 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

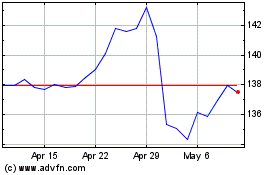

Yum Brands (NYSE:YUM)

Historical Stock Chart

From Mar 2024 to Apr 2024

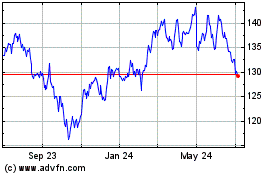

Yum Brands (NYSE:YUM)

Historical Stock Chart

From Apr 2023 to Apr 2024