With Lumber in Short Supply, Record Wood Costs Are Set to Juice Home Prices

March 01 2018 - 10:29AM

Dow Jones News

By Benjamin Parkin

A lumber shortage has pushed prices to record highs as builders

stock up for what is expected to be one of the busiest construction

seasons in years.

Builders say the higher lumber costs are making homes more

expensive. Lumber prices started rising last year after fires

destroyed prime forests and a trade dispute between the U.S. and

Canada restricted supplies. Now a shortage of railcars and trucks

is forcing builders to pay even more.

"We are in a lumber supply crisis," said Stinson Dean, a broker

in Kansas City, Mo., who ships wood from sawmills to lumber yards,

in a note to clients. "None of us have experienced a market like

this."

Marc Towne of Classic Homes, which builds midrange to high-end

houses in Colorado Springs, Colo., said he is spending $8,500 more

on lumber for a typical home than a year ago, an increase of almost

40%. The company's passing on about half the cost to buyers for now

while it waits to see if lumber prices fall.

"We hate to give large increases all at once because it can

freeze your market," Mr. Towne said. High lumber costs added about

$3,000 to the price of a home he purchased himself in Castle Rock,

Colo., late last year.

Prices are rising as lumber yards try to stock up ahead of what

looks likely to be a busy building season this spring. A strong

economy and tight supply of houses are heating up the home-building

market. The number of new units under construction in the U.S. rose

almost 10% in January, the Commerce Department said, as strong

demand kept builders working through the winter. Permits for new

homes, a sign of anticipated construction, also rose.

Material prices now rival labor shortages as builders' main

concerns, a National Association of Home Builders survey showed in

January. Prices for common building varieties like spruce and

southern pine are at or near records, according to price-tracking

publication Random Lengths. March-dated lumber futures at the

Chicago Mercantile Exchange hit a record of $532.60 per 1,000 board

feet last week after climbing more than 50% in 14 months.

That run-up began with a trade dispute between the U.S. and

Canada, which provides about a third of U.S. timber, leaving many

dealers hesitant to restock at elevated prices. The Trump

administration eventually instituted tariffs of 20% or more on

Canadian sawmills.

Problems mounted. The worst wildfires on record hit Canada's

Pacific coast. Hurricane Irma temporarily closed mills in the

forests of Florida and Georgia. And then came a shortage of

railcars and trucks to transport timber from forests in places like

the Pacific Northwest. Rates for flatbed trucks rose 24% in January

from a year earlier, according to DAT Solutions LLC.

Forestry company Canfor Corp. said lumber shipments fell almost

10% in the final quarter of 2017, partly due to bad weather in

western Canada. The transportation bottlenecks have caused weeks of

delays, frustrating customers already paying record prices.

"People are screaming for their wood," said Russell Taylor,

managing director for Canada at analysis firm Forest Economic

Advisors LLC.

Franklin Building Supply in Boise, Idaho, ran out of a type of

lumber used in walls, flooring and roofs one day in February for

the first time in years. Rick Lierz, who runs the supplier, said

one shipment of wood he was waiting for was stuck on a railcar just

20 miles away.

His employees drove to local Home Depot Inc. stores to buy the

lumber needed to fill orders to local builders due that day. Home

Depot recently told investors that rising lumber sales and prices

contributed to higher earnings in the fourth quarter of 2017.

"The cardinal rule when you're a supplier is you don't run out

of what you need to supply," Mr. Lierz said. "It's like an ice

cream shop running out of chocolate."

--Bob Tita contributed to this article.

Write to Benjamin Parkin at Benjamin.Parkin@wsj.com

(END) Dow Jones Newswires

March 01, 2018 10:14 ET (15:14 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

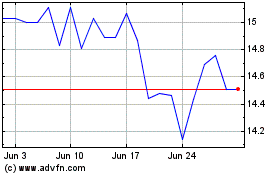

Canfor (TSX:CFP)

Historical Stock Chart

From Mar 2024 to Apr 2024

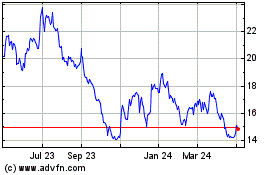

Canfor (TSX:CFP)

Historical Stock Chart

From Apr 2023 to Apr 2024