With 33% CAGR annual value creation since its IPO 20 years ago (over 296 times appreciation*) a study finds that Eurofins ran...

October 24 2017 - 1:30AM

Business Wire

Regulatory News:

Eurofins (Paris:ERF):

Eurofins Scientific (EUFI.PA), the world leader in bioanalytical

testing, celebrates 20 years since the Group’s Initial Public

Offering (IPO) on the 24th of October, 1997. Coinciding with

the anniversary, the UK-based Marten & Co. independent research

firm has published a detailed report examining Eurofins’ value

creation performance over the past 20 years.

Data from Marten & Co.’s research show that in the 20 years

since its IPO, Eurofins ranks highest in terms of its total

returns to shareholders (a TSR of 33.3% compounded annual

growth rate or “CAGR”) among all companies that were listed in

Europe for the whole period, as well as compared to its

publicly-listed peers in both the Testing, Inspection and

Certification and the Healthcare sectors. Investors who have

supported the Group have outperformed key benchmark indices (CAC

40, SBF 120 and S&P 500) by over 29% CAGR on average from

October 1997 to October 2017*.

An investor having invested the equivalent of EUR 3,500 at

Eurofins’ IPO would have over EUR 1 million today including

dividends received.

Eurofins’ value creation track record over the last 20 years

(based on CAGR of total shareholder return) is therefore comparable

to stock market behemoths (Apple 32.5% and Amazon 29.8%). More

importantly, Eurofins’ internal stakeholders have also benefitted

from its success, with over 100 of the Group’s leaders having

accumulated in excess of EUR 1 million capital gains*** from the

Company’s Long Term Incentive (LTI) Stock Program in the

last 20 years and over 200 more than EUR 500,000.

The management of Eurofins believes that beyond the robust

structural drivers supporting its businesses, the Group’s singular

focus on innovation and achieving market leadership in the few

laboratory activities that have a direct positive impact on health

rather than being very diversified has been one of its key success

factors. This strategy has been reflected in significant long-term

investments to ensure that Eurofins has the best laboratory network

with the most state-of-the-art infrastructure and the most

comprehensive analytical service portfolio to serve the food,

environment and pharmaceutical sectors, as well as clinicians and

healthcare providers. It is this relentless commitment to be the

best and most innovative laboratory partner for our clients that

has enabled Eurofins to grow by over 36% per year on average from

EUR 6.6m of revenues in 1997 to EUR 2.5bn in 2016, creating a

cumulative total shareholder return of 29,582% between 24 October

1997 and 10 October 2017.

Comment from Dr. Gilles Martin, Eurofins CEO: “The

inherent value of our activities, both in terms of their positive

impact on health, safety and the environment, and as reflected in

the value we generate for our clients, our employees and all our

stakeholders, drives our passion to continue to build a unique

laboratory infrastructure and deliver the most innovative and best

quality testing service to all our clients. It reinforces our

commitment to remain true to our vision of becoming the world

leader in testing for life, and our mission of contributing

to a safer and healthier world by providing our customers with

innovative and high quality laboratory and advisory services whilst

creating opportunities for our employees and generating

sustainable shareholder value.”

*Based on closing share price of 10th October 2017 – EUR

543.00

**Source: Marten and Co.’s value creation study, 24th October

2017

***Being the sum of pre-tax capital gains realized and potential

gains on outstanding LTI Stock Program at reference share price as

of 10th October 2017.

Notes for the editor:

Eurofins – a global leader in bio-analysis

Eurofins Scientific through its subsidiaries (hereinafter

sometimes “Eurofins” or “the Group”) believes it is the world

leader in food, environment and pharmaceutical products testing and

that it is also one of the global independent market leaders in

certain testing and laboratory services for agroscience, genomics,

discovery pharmacology and for supporting clinical studies. In

addition, Eurofins is one of the key emerging players in specialty

clinical diagnostic testing in Europe and the USA. With over 30,000

staff in 400 laboratories across 41 countries, Eurofins offers a

portfolio of over 150,000 analytical methods for evaluating the

safety, identity, composition, authenticity, origin and purity of

biological substances and products, as well as for innovative

clinical diagnostic. The Group objective is to provide its

customers with high-quality services, accurate results on time and

expert advice by its highly qualified staff.

Eurofins is committed to pursuing its dynamic growth strategy by

expanding both its technology portfolio and its geographic reach.

Through R&D and acquisitions, the Group draws on the latest

developments in the field of biotechnology and analytical chemistry

to offer its clients unique analytical solutions and the most

comprehensive range of testing methods.

As one of the most innovative and quality oriented international

players in its industry, Eurofins is ideally positioned to support

its clients’ increasingly stringent quality and safety standards

and the expanding demands of regulatory authorities around the

world.

The shares of Eurofins Scientific are listed on the Euronext

Paris Stock Exchange (ISIN FR0000038259, Reuters EUFI.PA, Bloomberg

ERF FP).

Important disclaimer:

This press release contains forward-looking statements and

estimates that involve risks and uncertainties. The forward-looking

statements and estimates contained herein represent the judgment of

Eurofins Scientific’s management as of the date of this release.

These forward-looking statements are not guarantees for future

performance, and the forward-looking events discussed in this

release may not occur. Eurofins Scientific disclaims any intent or

obligation to update any of these forward-looking statements and

estimates. All statements and estimates are made based on the

information available to the Company’s management as of the date of

publication, but no guarantee can be made as to their validity.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171023006262/en/

For more information, please visit

www.eurofins.com or contact:Investor

RelationsEurofins Scientific+32 2 766 1620ir@eurofins.com

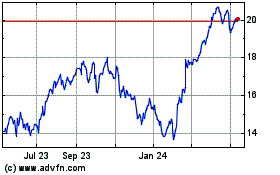

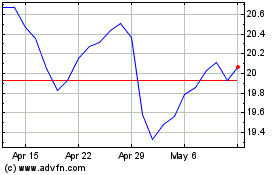

Enerplus (NYSE:ERF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Enerplus (NYSE:ERF)

Historical Stock Chart

From Apr 2023 to Apr 2024