Why the Pentagon Got Just One Bid to Build Next-Generation GPS Satellites

April 26 2018 - 12:43PM

Dow Jones News

By Andy Pasztor

Lockheed Martin Corp. will remain the sole producer of Global

Positioning System satellites after two main rivals decided against

bidding, reflecting new Air Force acquisition strategies that favor

incumbent contractors on some big-ticket space programs.

The decisions by Boeing Co. and Northrop Grumman Corp. this week

to forgo competing for the multibillion-dollar business reflect

efforts by Air Force brass to reduce long-term costs and accelerate

production of GPS satellites. The outcome underscores the

Pentagon's broader drive to transform acquisition of space

technology -- satellites, rockets, missile warning systems -- into

a less expensive and more nimble process.

The U.S. military, which already has committed to buy up to 10

GPS III satellites from Lockheed Martin, has been advised by

procurement experts inside and outside the Air Force that the best

way to streamline the program is to stick with the existing

supplier, say people familiar with the details.

The GPS supports a range of widely used devices from navigation

aids to signals that keep cash-dispensing machines used by bank

customers operating. The Air Force has run the GPS program for

decades, providing services to both government and commercial

users.

The changes are being implemented against a backdrop of

heightened threats to U.S. space technology from Russia and China.

Military and intelligence experts warn that U.S. national-security

satellites, for example, could be blinded or damaged by hostile

forces using lasers, antisatellite weapons and other types of

weapons.

Air Force leaders also are under congressional pressure to show

progress in overhauling the acquisition of space hardware. Some

House GOP leaders advocate a separate branch of the armed services

dubbed a space corps.

With development steps largely paid for and 22 additional

next-generation GPS III satellites slated for procurement, the goal

is to shift toward faster, more commodity-style assembly, according

to one person involved in discussions. "The Air Force realizes it

needs to dramatically squeeze costs while ratcheting up the pace of

production," this person said.

There are currently 31 GPS satellites in orbit, including

spares. The latest models feature greater power, accuracy and

jam-resistant capabilities. The first Lockheed Martin-built GPS III

satellite, with a longer lifespan than its predecessors, is

scheduled to launch this fall at the earliest.

In the past, the Air Force's sprawling acquisition bureaucracy

balked at favoring speed over competitive bidding to get the best

price. But now, the focus is on moving quickly and in other

programs, building prototypes to swiftly demonstrate cutting-edge

technologies before committing to long-term production.

The restructuring aims "to put large amounts of hardware on

orbit now, at the lowest possible cost," according to industry

consultant Jim McAleese. Such moves "are critical for the Air Force

at all levels," he said in an interview Wednesday.

Boeing, which built a previous version of GPS satellites,

declined to comment, except to point to a statement earlier this

month explaining it didn't bid because the Air Force's request, in

part, emphasized the importance of uninterrupted production over

creating new GPS features and capabilities.

Northrop spokesmen couldn't be reached for comment, but the

company has indicated it didn't submit a bid because it didn't make

financial sense. Last year, Northrop surprised aerospace industry

analysts by not bidding on some larger Pentagon contracts,

including an unmanned tanker aircraft program for the Navy and an

Air Force training aircraft.

A Lockheed Martin spokesman also declined to comment. When it

submitted its bid, the company said modular design envisioned

"insertion of modern technologies and new Air Force requirements in

a low-risk manner."

For Lockheed, which faces the end of production on its premier

Pentagon communications and missile-warning satellite

constellations, retaining GPS business is particularly important.

The company also has invested heavily in recent years to shake up

its commercial satellite-making operations, and industry officials

said some of those efficiencies could give it a distinct price

advantage over Boeing and Northrop Grumman.

Lockheed went over budget on its initial GPS production, but

company officials have said the program is back on track. The

Pentagon now says the unit costs for each satellite will be less

than 6% higher than initially projected, though cost overruns for

development were significantly larger.

At a space conference in Colorado last week, Air Force officials

declined to discuss specifics of GPS bidding procedures, but said

rigorous cost estimating would be used if the service ended up

receiving only one bid. They also spelled out the scope and

reasoning behind the new direction in space contracting.

Future satellite fleets will have to be "more defensible and

resilient systems," said Lt. Gen John Thompson, head of the Air

Force's Space and Missile Systems Center in suburban Los Angeles.

He said future requests for bids would "take advantage of

similarities between programs," noting that "we have so much

redesign work to do" regarding SMC's structure and acquisition

policies.

Write to Andy Pasztor at andy.pasztor@wsj.com

(END) Dow Jones Newswires

April 26, 2018 12:28 ET (16:28 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

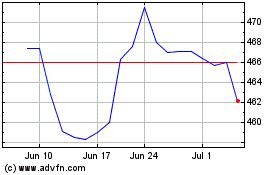

Lockheed Martin (NYSE:LMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

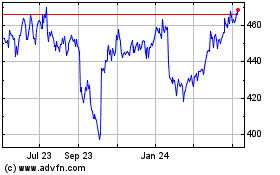

Lockheed Martin (NYSE:LMT)

Historical Stock Chart

From Apr 2023 to Apr 2024