Western Digital Corporation (NASDAQ: WDC) (“Western Digital” or

the “company”) today announced that it is commencing a cash tender

offer (the “Tender Offer”) with respect to any and all of its

outstanding 10.500% senior unsecured notes due 2024 (the

“Notes”).

The price offered in the Tender Offer for the Notes and other

information relating to the Tender Offer and the Consent

Solicitation (as defined below) are set forth in the table

below.

CUSIP Nos.

OutstandingPrincipalAmount

Title ofSecurity

Per $1,000 Principal Amount

Tender

OfferConsideration(1)

Early

TenderPremium(2)

TotalConsideration(1)(2)

958102 AK1 andU9547K

AB9(unregistered) &958102 AL9(registered)

$3,350,000,000

10.500%SeniorUnsecuredNotes due2024

$ 1,137.25 $30 $1,167.25

(1) Excludes accrued and unpaid interest, which will be paid in

addition to the Tender Offer Consideration or the Total

Consideration, as applicable.

(2) No separate consent payment or fee is being paid to holders

in the Consent Solicitation.

In conjunction with the Tender Offer, Western Digital is

soliciting consents (“Consents”) from holders of the Notes to

certain proposed amendments (the “Proposed Amendments”) to the

indenture (the “Indenture”) governing the Notes (the “Consent

Solicitation”). The Proposed Amendments would amend the Indenture

to eliminate most of the covenants and certain default provisions

applicable to the Notes. In addition, Western Digital intends to

issue a conditional notice of redemption with respect to the Notes

and prior to the redemption date, Western Digital may elect to

satisfy and discharge its obligations under the Notes and the

Indenture in accordance with the satisfaction and discharge

provisions of the Indenture.

Delivery of Consents to the Proposed Amendments by holders of at

least a majority of the aggregate principal amount of the

outstanding Notes (excluding Notes owned by Western Digital or any

of its affiliates) is required for the adoption of the Proposed

Amendments.

Each holder who validly tenders and does not withdraw its Notes

and validly delivers and does not revoke its corresponding Consents

prior to 5:00 p.m., New York City time, on Feb. 9, 2018 (as may be

extended or earlier terminated, the “Early Tender Time”) will

receive, if such Notes are accepted for purchase pursuant to the

Tender Offer and the Consent Solicitation, the total consideration

of $1,167.25 per $1,000 principal amount of Notes tendered, which

includes the tender offer consideration of $1,137.25 and an early

tender premium of $30. Holders who validly tender and do not

withdraw their Notes and validly deliver and do not revoke their

corresponding Consents after the Early Tender Time but prior to the

Expiration Time will receive only the tender offer consideration of

$1,137.25 per $1,000 principal amount of Notes tendered and will

not be entitled to receive an early tender premium if such Notes

are accepted for purchase pursuant to the Tender Offer and the

Consent Solicitation. In addition, accrued and unpaid interest up

to, but not including, the applicable settlement date of the Notes

will be paid in cash on all validly tendered and accepted

Notes.

The company expects that it will accept for purchase and pay for

Notes validly tendered and not validly withdrawn at or prior to the

Early Tender Time on Feb. 13, 2018, and that it will accept for

purchase and pay for Notes validly tendered (and not validly

withdrawn) subsequent to the Early Tender Time but prior to the

Expiration Time on Feb. 27, 2018.

The Tender Offer and the Consent Solicitation are scheduled to

expire at 11:59 p.m., New York City time, on Feb. 26, 2018, (as the

same may be extended, the “Expiration Time”). Tendered Notes may be

withdrawn at any time prior to 5:00 p.m. New York City time, on

Feb. 9, 2018 (unless such deadline is extended) but not thereafter,

except to the extent that the company is required by law to provide

additional withdrawal rights.

Subject to the terms and conditions described below, payment of

the tender offer consideration and an early tender premium to

holders who tendered Notes prior to the Early Tender Time may occur

after the Early Tender Time and prior to the Expiration Time (the

“Initial Settlement Date”). Payment of the tender offer

consideration to holders who tendered notes prior to the Expiration

Time but after the Early Tender Time will occur promptly after the

Expiration Time (the “Final Settlement Date”).

The consummation of the Tender Offer and the Consent

Solicitation is conditioned upon, among other things, (i) our

receipt of aggregate proceeds (before underwriting discounts and

other offering expenses) from concurrent notes offerings, on or

prior to the Initial Settlement Date or the Final Settlement Date,

as the case may be on terms satisfactory to us, of at least $2.3

billion, and (ii) with respect to the Consent Solicitation, the

execution, delivery and effectiveness of the supplement to the

Indenture, which will implement the Proposed Amendments. If any of

the conditions is not satisfied, Western Digital may terminate the

Tender Offer and the Consent Solicitation and return tendered

Notes. Western Digital has the right to waive any of the foregoing

conditions with respect to the Notes in whole or in part. In

addition, Western Digital has the right, in its sole discretion, to

terminate the Tender Offer and the Consent Solicitation at any

time, subject to applicable law.

This announcement shall not constitute an offer to purchase or a

solicitation of an offer to sell any securities. The complete terms

and conditions of the Tender Offer and the Consent Solicitation are

set forth in an Offer to Purchase and Consent Solicitation

Statement, dated Jan. 29, 2018, and the related Letter of

Transmittal (the “Tender Offer Documents”) that are being sent to

holders of the Notes. The Tender Offer and the Consent Solicitation

are being made only through, and subject to the terms and

conditions set forth in, the Tender Offer Documents and related

materials.

Merrill Lynch, Pierce, Fenner & Smith Incorporated will act

as Dealer Manager for the Tender Offer and as Solicitation Agent

for the Consent Solicitation. Questions regarding the Tender Offer

and the Consent Solicitation may be directed to Merrill Lynch,

Pierce, Fenner & Smith Incorporated at (888) 292-0070

(toll-free) or at (980) 388-3636 (collect).

Global Bondholder Services Corporation will act as Depositary

and Information Agent for the Tender Offer and Consent

Solicitation. Requests for the Tender Offer Documents may be

directed to Global Bondholder Services Corporation at (212)

430-3774 (for brokers and banks) or (866) 470-3700 (for all

others).

None of Western Digital, its board of directors, the trustee for

the Notes, the Information Agent, the Dealer Manager and the

Solicitation Agent or any of their respective affiliates makes any

recommendation as to whether holders should tender, or refrain from

tendering, all or any portion of the principal amount of their

Notes pursuant to the Tender Offer or deliver, or refrain from

delivering, any consent to the Proposed Amendments pursuant to the

Consent Solicitation.

About Western Digital

Western Digital creates environments for data to thrive. The

company is driving the innovation needed to help customers capture,

preserve, access and transform an ever-increasing diversity of

data. Everywhere data lives, from advanced data centers to mobile

sensors to personal devices, our industry-leading solutions deliver

the possibilities of data. Western Digital data-centric solutions

are marketed under the G-Technology™, HGST, SanDisk®, Tegile™,

Upthere™ and WD® brands.

Forward-Looking Statements

This press release contains forward-looking statements,

including statements concerning a proposed tender off for the

notes. These forward-looking statements are based on management’s

current expectations and are subject to risks and uncertainties

that could cause actual results to differ materially from those

expressed or implied in the forward-looking statements, including:

volatility in global economic conditions; uncertainties with

respect to the company’s business ventures with Toshiba; business

conditions and growth in the storage ecosystem; impact of

competitive products and pricing; market acceptance and cost of

commodity materials and specialized product components; actions by

competitors; unexpected advances in competing technologies; the

development and introduction of products based on new technologies

and expansion into new data storage markets; risks associated with

acquisitions, mergers and joint ventures; difficulties or delays in

manufacturing; impacts of new tax legislation; and other risks and

uncertainties listed in the company's filings with the SEC,

including the company’s Form 10-Q filed with the SEC on Nov. 7,

2017, to which your attention is directed. You should not place

undue reliance on these forward-looking statements, which speak

only as of the date hereof, and the company undertakes no

obligation to update these forward-looking statements to reflect

new events or events.

###

Western Digital, the Western Digital logo, G-Technology, HGST,

SanDisk, Tegile, Upthere and WD are registered trademarks or

trademarks of Western Digital Corporation or its affiliates in the

U.S. and/or other countries.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180129006208/en/

Western Digital CorporationInvestor Contact:Bob

Blair949.672.7834robert.blair@wdc.comorMedia Contact:Jim

Pascoe408.717.6999jim.pascoe@wdc.com

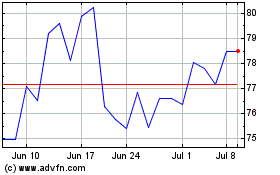

Western Digital (NASDAQ:WDC)

Historical Stock Chart

From Mar 2024 to Apr 2024

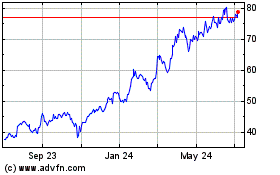

Western Digital (NASDAQ:WDC)

Historical Stock Chart

From Apr 2023 to Apr 2024