Viacom's TV Business Continues to Suffer From Cord Cutting

February 08 2018 - 9:02AM

Dow Jones News

By Austen Hufford

Viacom Inc. reported a deeper-than-expected revenue decline in

its latest quarter as its television networks in the U.S. saw less

advertising and subscription revenue.

The decline comes as investors have also been watching a

potential merger between Viacom and CBS Corp. Last week the

companies disclosed that their boards had formed a special

committee to evaluate a potential merger, a deal that would reunite

two big pieces of the Redstone family's media empire.

Shares in Viacom, which owns networks including MTV, Comedy

Central and Nickelodeon, fell 3.3% in premarket trading

Thursday.

Viacom, like other linear-television channel providers, is hurt

when viewers cut their cable subscriptions from both lower

advertising payments and a decline in affiliate revenue generated

through subscription fees paid to cable companies.

In its first quarter, Viacom said U.S. advertising revenue

decreased 5% to $937 million, due to lower linear impressions.

Higher rates and growth in digital advertising revenue didn't

offset the declines. Domestic affiliate revenue decreased 8% to

$907 million due to subscriber declines and lower subscription

video-on-demand revenue, which was partially offset by rate

increases.

Revenue in its movie division decreased 28% to $544 million in

the quarter, as U.S. revenue fell 42% to $270 million and

international revenue declined 6% to $274 million. The unit saw

declines in theatrical, licensing and home entertainment

revenue.

The company also said it had made progress on cost cuts and was

on-track to achieve $100 million in new cost savings this year and

"hundreds of millions more" in 2019.

The company said profit was boosted by the enactment of the new

tax law.

For its first quarter, Viacom reported a profit of $537 million,

or $1.33 a share, up from $396 million, or $1 a share, a year

earlier. Excluding the tax benefit and other charges, Viacom posted

an adjusted profit of $1.03 a share, down a penny from the prior

year. Analysts polled by Thomson Reuters expected Viacom to earn a

profit of 94 cents a share.

Revenue fell 7.6% to $3.07 billion, below analysts' estimates of

$3.14 billion.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

February 08, 2018 08:47 ET (13:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

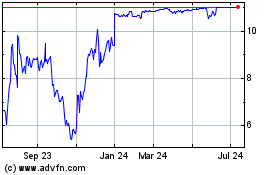

Via Renewables (NASDAQ:VIA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Via Renewables (NASDAQ:VIA)

Historical Stock Chart

From Apr 2023 to Apr 2024