United Community Banks, Inc. Reports Special Loan Loss Provision

October 12 2011 - 5:30AM

Marketwired

United Community Banks, Inc. (NASDAQ: UCBI) announced today that it

will record a special loan loss provision of $25.0 million during

the third quarter of 2011 related to its largest single loan

relationship. The borrower continues to be current with principal

and interest payments as well as related expenses for the

underlying collateral, including the requirement to maintain

adequate carrying costs in a collateral account at United. However,

after further reassessing this $76.6 million commercial loan

relationship, it was determined that the ultimate repayment of

these loans through the sale of the underlying collateral is

unlikely at this time, primarily the result of disposition activity

below originally expected levels.

"Even though the collateral accounts would be sufficient to

cover debt service requirements and related costs for another five

to six quarters, we believe it is prudent to classify these loans

as nonperforming at quarter-end due to the uncertainties about

sources of repayment in the future," stated Jimmy Tallent,

president and chief executive officer. "We plan to obtain updated

appraisals in the fourth quarter and believe that the $25.0 million

specific reserve will be sufficient to cover any charge-offs to

fair market values."

"On the positive side," Tallent continued, "excluding this

addition to nonperforming loans and the special loan loss provision

of $25.0 million, or 26 cents per diluted share, we expect to

report earnings of 10 cents per diluted share which is equal to

consensus and slightly above the second quarter of 2011. We will

comment further on credit quality and earnings for the third

quarter during our scheduled conference call on October 27th."

About United Community Banks, Inc.

Headquartered in Blairsville, United Community Banks is the

third-largest bank holding company in Georgia. United Community

Banks has assets of $7.4 billion and operates 27 community banks

with 106 banking offices located throughout north Georgia, the

Atlanta region, coastal Georgia, western North Carolina and east

Tennessee. The Company specializes in providing personalized

community banking services to individuals and small to mid-size

businesses. United Community Banks also offers the convenience of

24-hour access through a network of ATMs, telephone and on-line

banking. United Community Banks common stock is listed on the

Nasdaq Global Select Market under the symbol UCBI. Additional

information may be found at the Company's web site at

www.ucbi.com.

Safe Harbor

This news release contains forward-looking statements, as

defined by federal securities laws, including statements about

financial United's outlook and business environment. These

statements are provided to assist in the understanding of future

financial performance and such performance involves risks and

uncertainties that may cause actual results to differ materially

from those anticipated in such statements. Any such statements are

based on current expectations and involve a number of risks and

uncertainties. For a discussion of some factors that may cause such

forward-looking statements to differ materially from actual

results, please refer to the sections entitled "Risk Factors" of

United Community Banks, Inc.'s 2010 annual report filed on Form

10-K and first and second quarter 2011 quarterly reports filed on

Form 10-Q with the Securities and Exchange Commission.

Forward-looking statements speak only as of the date they are made,

and we undertake no obligation to update or revise forward-looking

statements.

For more information: Rex S. Schuette Chief Financial Officer

706-781-2265 Email Contact

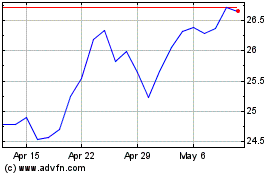

United Communty Banks (NASDAQ:UCBI)

Historical Stock Chart

From Mar 2024 to Apr 2024

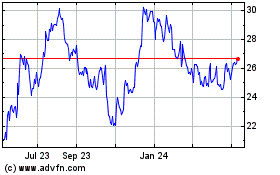

United Communty Banks (NASDAQ:UCBI)

Historical Stock Chart

From Apr 2023 to Apr 2024