Unilever Picks Rotterdam Over London for Headquarters -- 2nd Update

March 15 2018 - 6:34AM

Dow Jones News

By Saabira Chaudhuri and Costas Paris

LONDON -- Unilever PLC has decided to consolidate its dual

headquarters in Rotterdam over London, a politically charged move

that came despite last-minute lobbying from the British

government.

In a Wednesday board meeting, directors decided on the Dutch

city but Unilever executives were still receiving calls from the

U.K. government into the night, according to a person familiar with

the matter.

The company's announcement early Thursday came alongside details

of a broader restructuring of its operations into three divisions

with separate headquarters. Beauty and personal care, as well as a

home care unit, will be based in London, while its foods and

refreshment division will continue to be based in Rotterdam.

Unilever had for months wrangled with the question of where to

situate the combined company. The maker of consumer products such

as Magnum ice cream and Hellmann's mayonnaise currently splits its

headquarters between London and Rotterdam. That is a legacy of its

dual structure, which essentially consists of two separate British

and Dutch operating companies, each with its own shares.

The decision has taken on great significance in the U.K., which

is in the process of negotiating its exit from the European Union.

Critics of that move -- triggered by a 2016 referendum -- have

warned the split from the EU could force some big companies to move

to mainland Europe.

Unilever's finance chief, Graeme Pitkethly, said Thursday that

Brexit wasn't a factor in the decision to choose the Netherlands.

Unilever's decision reflected that shares in the Netherlands entity

made up about 55% of the combined ordinary shares for the group and

that these trade with greater liquidity than shares in the U.K.

entity, he added.

The company plans to continue to spend nearly GBP1 billion

annually in the U.K. including on research and development. The

7,300 people it employs in the U.K. and the 3,100 people in the

Netherlands won't be affected by the changes.

A U.K. government spokesman said the company had shown its

long-term commitment to the country by locating what the government

called its two fastest-growing divisions in the U.K., safeguarding

jobs and investment.

However, Rajesh Agrawal, London's deputy mayor for business,

described the move as "clearly disappointing news for the

capital."

Unilever shares fell about 1% in London and 0.7% in the

Netherlands in early trading, with analysts saying the move

shouldn't have a major impact for investors.

Following an unsolicited takeover approach by Kraft Heinz Co.

early last year, Unilever launched its review of that structure and

determined that unification was in the best interests of the

company and shareholders.

The company said the simplified structure will give it more

flexibility to make portfolio changes and help long-term

performance. It expects to make the change by the end of the

year.

The news on its legal base confirms a Wall Street Journal

article Wednesday that said the company's board had decided on the

Dutch city.

Critics of Unilever's current structure have complained it is

unwieldy and can interfere with deal making -- including by

hindering the company's ability to use stock to make big

acquisitions. The shares of the two operating companies, Unilever

PLC and Unilever NV, aren't convertible and the value of a single

share in each company must remain equal. That makes it tough to

issue new stock to fund a deal.

Unilever Chief Financial Officer Graeme Pitkethly in an

interview said Unilever's approach to acquisitions won't change

following its move to simplify its structure. The company has in

recent years favored small to midsize deals. But the new structure

gives Unilever the "strategic flexibility to act should the

opportunity arise," he added.

However, some analysts have questioned whether the company would

ultimately use equity to fund a deal.

The move to three divisions each with its own separate

headquarters will reduce centralization because each one will get

its own specific, tailored resources rather than sharing central

ones, said Mr. Pitkethly. It is part of a broader effort by

Unilever to push more resources to local markets and resembles

changes made by its sprawling rivals also seeking focus as fast

changing shopper behavior, the advent of e-commerce and

increasingly sophisticated local competition cap growth. Reckitt

Benckiser Group PLC, the owner of Durex condoms and Finish

dishwasher tablets, last year said it was splitting into two

divisions. Nestlé SA recently said its baby-foods business would be

regionally rather than globally managed.

Unilever plans to maintain listings in the Netherlands, the U.K.

and the U.S. and will remain subject to British and Dutch corporate

governance codes. Whether it will remain a component of the FTSE

100 depends on the exchange but Mr. Pitkethly noted that current

practice wouldn't allow Unilever to keep its place. The London

Stock Exchange didn't immediately respond to a request for

comment.

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com and

Costas Paris at costas.paris@wsj.com

(END) Dow Jones Newswires

March 15, 2018 06:19 ET (10:19 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

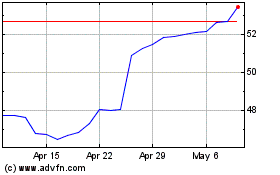

Unilever (NYSE:UL)

Historical Stock Chart

From Mar 2024 to Apr 2024

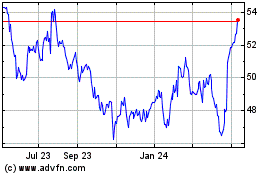

Unilever (NYSE:UL)

Historical Stock Chart

From Apr 2023 to Apr 2024