UPDATE: GE Says Operating Margin To Grow 30 To 50 Basis Points In 2012

May 23 2012 - 1:44PM

Dow Jones News

General Electric Co. (GE) Chief Executive Jeff Immelt said

Wednesday that the conglomerate's industrial profit margin may not

grow as much as expected this year, although he vowed that the

difference will be made up in 2013.

He blamed the issue solely on anticipated higher shipments this

year of low-margin wind turbines, which have suffered from pricing

pressure.

"The split between '12 and '13 [on improvement in profit margin]

is going to be specifically a function of wind turbines," said

Immelt, speaking during an Electrical Products Group conference in

Florida.

GE has repeatedly forecast a 50-basis-point improvement in

full-year profit margin this year, to 15.4%. Immelt backed off the

goal during his presentation Wednesday, saying he now thinks the

figure could grow only 30 basis points.

But he forecast 2013 margin improvement of 50 to 70 basis

points, noting that the result still could be two-year margin

improvement of 100 basis points, to 15.9%.

"On balance, the [combined] 100 basis points we feel good

about," Immelt said. "I actually feel pretty good about our ability

to execute on margins going forward [and] we look forward to

proving that to you."

GE shares were off 1.8%, at $18.83 in recent trading.

The Fairfield, Conn., conglomerate's industrial profit margin is

a closely watched barometer for investors and analysts, because the

company has been counting on its industrial businesses to drive

results as it shrinks its GE Capital finance arm.

GE's industrial margin slipped to 13.8% in the first quarter,

from 14.3% in the year-ago period, although GE executives

previously have said they expected the bulk of this year's margin

growth to come in the second half.

Immelt was upbeat overall during Wednesday's presentation,

saying the economy in Europe "continues to be slow" but calling

business in the U.S. slightly better than expected and emerging

markets solid.

He also said GE will have $100 billion in cash to allocate from

2012 through 2016, buoyed by the company's announcement last week

that GE Capital will restart a dividend to its parent for the first

time since the payments were suspended during the financial

crisis.

Under the plan, GE Capital will pay a quarterly dividend of $475

million to GE, as well as a $4.5 billion special dividend this

year.

Immelt reiterated Wednesday the company's plan to use the cash

from the finance unit to buy back shares. He also said GE will use

a portion of its cash trove for dividends to common shareholders,

and he reiterated that the conglomerate's acquisition strategy for

the time being will focus on "bolt-on" deals ranging from $1

billion to $3 billion.

Meanwhile, Immelt said GE has a plan to cut about $2 billion in

costs over the next two years. He said it plans to achieve the goal

through its restructuring in Europe, as well as other efforts to

consolidate and share certain back-office business functions.

-By Bob Sechler, Dow Jones Newswires; 512-258-1690;

bob.sechler@dowjones.com

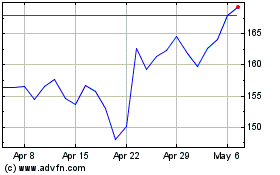

GE Aerospace (NYSE:GE)

Historical Stock Chart

From Mar 2024 to Apr 2024

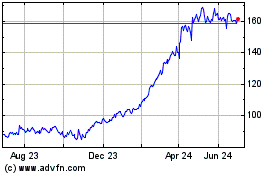

GE Aerospace (NYSE:GE)

Historical Stock Chart

From Apr 2023 to Apr 2024