UPDATE: British Land Posts Increase In Profit, Net Asset Value

May 23 2011 - 5:06AM

Dow Jones News

The U.K.'s second largest real-estate investment trust British

Land Co PLC (BLND.LN) Monday posted a 3% rise in underlying pretax

profit and said its net asset value had increased by 13%, adding

that the company expected strong demand for prime office and retail

property to result in improved rents.

The FTSE 100-listed commercial property landlord said its net

asset value per share rose to 567 pence for the 12 months to March

31, from 504 pence a year earlier. The figure was ahead of the 554

pence consensus analyst estimate.

British Land said its full-year underlying pretax profit was

GBP256 million, compared to GBP249 million a year earlier. It

posted underlying earnings per share in line with analyst

expectations at 28.5 pence, compared to 28.4 pence a year

earlier.

"British Land has had a very active year, we have again

outperformed the market and there is real momentum in the

business," said chief executive Chris Grigg.

"Our strong letting performance across our portfolio shows

clearly that there is still demand from occupiers for the

well-located prime retail and London office assets we provide and

we expect this to continue," he added.

"British Land continued to benefit from a high quality

portfolio, focused on central London offices, retail parks,

shopping centers and foodstores," analysts at Oriel Securities

said.

"The length and strength of income continues to be attractive

with an average lease term to the first break of 11.5 years and an

occupancy rate of 98%," they added.

British Land said its portfolio valuation rose 6.9% to GBP9.6

billion, driven by strong lettings performance and developments.

This included a 2% rise in the fourth quarter.

The REIT said it was committed to a GBP1.6 billion London

development program with its partners, which would deliver 2.2

million square feet of space by 2014.

The company's pipeline includes its GBP340 million Leadenhall

Building development in the City of London financial district,

which has been dubbed the 'Cheesegrater.' The 47-story skyscraper

will provide 610,000 square feet of space when it is completed in

2014.

At 0825 GMT, British Land shares traded down 3% at 575 pence,

giving the company a market capitalization of just under GBP5.1

billion and underperforming the benchmark FTSE 100 index, which

traded down 1.7%.

"Ordinarily these would be regarded as good results, but

following the blockbuster results posted by Land Securities PLC

(LAND.LN) last week, British Land's results look pedestrian," said

Arbuthnot Research analyst Graham Jones.

Shares in U.K. property companies soared last week after the

U.K.'s largest real-estate investment trust Land Securities posted

a 15% increase in full-year pretax profit and a double-digit rise

in its net asset value.

"Given last week's share price jump, we believe the results will

have a neutral impact on its share price today and prefer peer Land

Securities," analysts at J.P. Morgan Cazenove said. However, they

added there is strong momentum in the business and the statement is

upbeat so they consider any weakness as a buying opportunity.

The company proposed a fourth quarter dividend of 6.5 pence per

share, keeping the total dividend at 26 pence. It intends to

maintain the quarterly dividend of 6.5 pence per share in the

upcoming financial year.

-By Michael Haddon, Dow Jones Newswires; 4420-7842-9289;

michael.haddon@dowjones.com

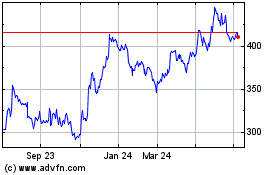

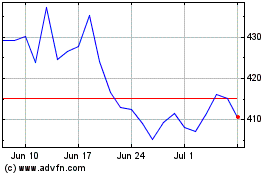

British Land (LSE:BLND)

Historical Stock Chart

From Mar 2024 to Apr 2024

British Land (LSE:BLND)

Historical Stock Chart

From Apr 2023 to Apr 2024