UK Competition Authority to Probe Effect of Sainsbury-Asda Merger on Suppliers

October 16 2018 - 7:43AM

Dow Jones News

By Maryam Cockar

The U.K. competition watchdog is to examine the potential effect

on suppliers of the proposed merger of J Sainsbury PLC (SBRY.LN)

and Asda Group Ltd., as well as consider the affect of growing

competition from discount grocers.

The Competition and Markets Authority said Tuesday that it will

look at whether the enlarged group could use its increased buying

power to squeeze suppliers and if this could have a possible

knockon effect for consumers.

It said suppliers might not be able to innovate as much or could

have to charge higher prices to rivals that would compete with the

merged company.

The CMA said it will assess competition from discount retailers

such as Aldi and Lidl, which have expanded significantly in the

U.K. in recent years, and examine whether the merger would reduce

competition.

The CMA will also consider competition from B&M European

Value Retail SA (BME.LN) and online-only retailers such as Ocado

Group PLC (OCDO.LN) and Amazon (AMZN).

In April, U.S. retail giant Walmart (WMT) said it would sell its

U.K. arm, Asda, to Sainsbury in a deal that valued the grocer at

about 7.3 billion pounds ($9.59 billion). If the tie-up is approved

it would create the largest supermarket in U.K.

In September, the CMA referred the merger for an in-depth

investigation and recently said that it has identified 463 areas in

the U.K. where the two grocery chains overlap.

The CMA said it expects to issue its provisional findings early

next year, ahead of the deadline for its final decision on the

proposed merger on March 5.

Write to Maryam Cockar at maryam.cockar@dowjones.com

(END) Dow Jones Newswires

October 16, 2018 07:28 ET (11:28 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

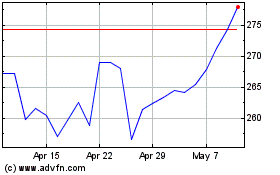

Sainsbury (j) (LSE:SBRY)

Historical Stock Chart

From Mar 2024 to Apr 2024

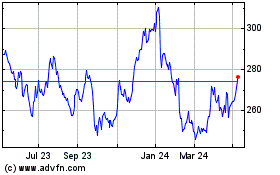

Sainsbury (j) (LSE:SBRY)

Historical Stock Chart

From Apr 2023 to Apr 2024