U.S. Spending on Luxury Goods Slows as Global Financial Concerns Grow

May 28 2012 - 8:20AM

Marketwired

Growing fears of an economic crisis in Europe has had a significant

impact on the sales of luxury goods. "The environment is getting

more difficult," SpendingPulse vice president Michael McNamara said

in a recent telephone interview. "It doesn't seem that the wealth

effect is enough to hold the sector up against economic headwinds."

The Paragon Report examines investing opportunities in Retail

Industry and provides equity research on Fossil, Inc. (NASDAQ:

FOSL) and Coach, Inc. (NYSE: COH).

Access to the full company reports can be found at:

www.ParagonReport.com/FOSL

www.ParagonReport.com/COH

MasterCard Advisors SpendingPulse has said that in the U.S.

spending on luxury goods have decreased. Jewelry sales had the

worst performance falling 3.7 percent in April. All other luxury

sales climbed just 1.8 percent in April from a year earlier. Luxury

sales in the first quarter had previously gained 6.7 percent, and

13 percent in the fourth quarter of 2011. Growth has been slowed as

tourists have restrained from spending as a result of the stronger

dollar and growing concerns of Europe's economic troubles, McNamara

said.

Paragon Report releases regular market updates on the Retail

Industry so investors can stay ahead of the crowd and make the best

investment decisions to maximize their returns. Take a few minutes

to register with us free at www.ParagonReport.com and get exclusive

access to our numerous stock reports and industry newsletters.

"In Europe, a softening macro environment toward the end of the

first quarter and changes in our merchandising and assortment

strategies across certain categories negatively impacted both our

wholesale and retail sales in that region," Fossil's CFO Mike Kovar

said in the company's earnings release. The company's 2012

earnings-per-share of $5.30-$5.40 fell short of analysts'

expectations of $5.56.

Coach, a leading marketer of modern classic American

accessories, last month announced sales of $1.11 billion for its

third fiscal quarter ended March 31, 2012, compared with $951

million reported in the same period of the prior year, an increase

of 17 percent. The company also announced that its Board of

Directors has voted to increase its cash dividend by 33%, raising

it to an annual rate of $1.20 per share starting with the dividend

to be paid to stockholders in July 2012.

Paragon Report provides Market Research focused on equities that

offer growth opportunities, value, and strong potential return. We

strive to provide the most up-to-date market activities. We

constantly create research reports and newsletters for our members.

The Paragon Report has not been compensated by any of the

above-mentioned companies. We act as independent research portal

and are aware that all investment entails inherent risks. Please

view the full disclaimer at:

www.ParagonReport.com/disclaimer

Add to Digg Bookmark with del.icio.us Add to Newsvine

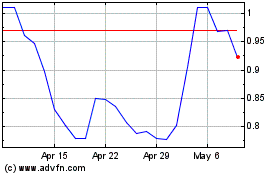

Fossil (NASDAQ:FOSL)

Historical Stock Chart

From Mar 2024 to Apr 2024

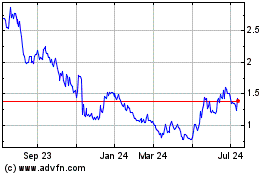

Fossil (NASDAQ:FOSL)

Historical Stock Chart

From Apr 2023 to Apr 2024