U.S. Dollar Climbs Ahead Of Fed Decision

November 08 2018 - 4:35AM

RTTF2

The U.S. dollar strengthened against its major counterparts in

the European session on Thursday, as investors await the Federal

Reserve's interest rate decision for more clues about its rate hike

plans for this year and next.

The decision is due at 2:00 pm ET.

Economists forecast the interest rate to remain unchanged in the

range of 2 percent to 2.25 percent at the meeting in

Washington.

All eyes are on the accompanying statement to get more

indications about an expected rate hike next month.

The U.S. midterm election results came largely in line with

expectations, with Democrats regaining control of the House of

Representatives and Republicans holding power in the Senate.

China's exports and imports exceeded forecasts in October

despite U.S. tariffs on Chinese goods, official data showed.

Exports grew 15.6 percent annually, beating forecasts for an

increase of 11.7 percent.

Data from the Labor Department showed that first-time claims for

U.S. unemployment benefits decreased slightly in the week ended

November 3.

The report said initial jobless claims edged down to 214,000, a

decrease of 1,000 from the previous week's revised level of

215,000.

The currency has been trading higher against its key

counterparts in the Asian session.

The greenback rose to 113.75 against the yen, from a low of

113.47 hit at 5:15 pm ET. If the greenback rises further, it may

challenge resistance around the 115.00 level.

Data from the Bank of Japan showed that Japan overall bank

lending rose 2.2 percent on year in October, coming in at 529.471

trillion yen.

That follows the 2.3 percent increase in September.

The greenback appreciated to 1.0036 against the Swiss franc from

Wednesday's closing value of 1.0021. On the upside, 1.02 is

possibly seen as the next resistance level for the greenback.

Data from the State Secretariat for Economic Affairs showed that

Switzerland's unemployment rate remained stable in October.

The jobless rate came in at seasonally adjusted 2.5 percent in

October, the same rate as seen in September and in line with

expectations.

After falling to 1.1445 against the euro at 3:30 am ET, the

greenback reversed direction and edged up to 1.1404. The greenback

is seen finding resistance around the 1.13 level.

Data from Destatis showed that Germany's exports and imports

declined unexpectedly in September.

Exports dropped 0.8 percent month-on-month, reversing a 0.1

percent rise in August. At the same time, imports slid 0.4 percent

following August's 2.4 percent decrease.

The greenback reached as high as 1.3087 against the pound, up

from a low of 1.3150 touched at 3:50 am ET. Next key resistance for

the greenback is seen around the 1.28 level.

On the flip side, the greenback held steady against the kiwi,

after having advanced to 0.6770 at 6:30 am ET. At Wednesday's

close, the pair was worth 0.6784.

The greenback dropped to 0.7299 against the aussie and 1.3088

against the loonie, from its early highs of 0.7265 and

1.3126,respectively. The greenback is likely to find support around

0.74 against the aussie and 1.28 against the loonie.

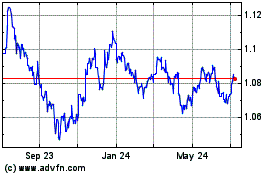

Euro vs US Dollar (FX:EURUSD)

Forex Chart

From Mar 2024 to Apr 2024

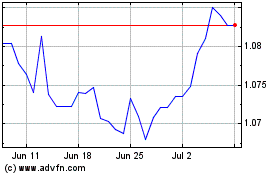

Euro vs US Dollar (FX:EURUSD)

Forex Chart

From Apr 2023 to Apr 2024