U.S. Dollar Advances Ahead Of Powell's Testimony

March 01 2018 - 4:51AM

RTTF2

The U.S. dollar firmed against its major counterparts in the

European session on Thursday, as investors await second

Congressional testimony from Federal Reserve Chair Powell amid

speculation that the central bank may quicken the pace of monetary

tightening this year.

Powell will testify before the Senate Banking Committee at 10:00

am ET.

His appearance comes after the House testimony on Tuesday, when

he spurred hopes for a faster pace of rate hikes in the wake of

strong economic outlook.

Data from the Labor Department showed that first-time claims for

U.S. unemployment benefits unexpectedly fell last week.

The report said initial jobless claims fell to 210,000 in the

week ended February 24th.

Economists had expected jobless claims to inch up to

226,000.

Data from the Commerce Department showed that U.S. personal

income increased slightly more than expected in January, while

personal spending rose in line with estimates.

The report said that personal income climbed by 0.4 percent in

January, while personal spending edged up by 0.2 percent.

The currency held steady against its major rivals in the Asian

session, with the exception of the yen.

The greenback rose to 1.2163 against the euro, its strongest

since January 18. The greenback is likely to find resistance around

the 1.91 level.

Final data from IHS Markit showed that the Eurozone

manufacturing sector continued to expand at a robust pace in

February but the pace of growth slowed from January.

The factory Purchasing Managers' Index fell to a 4-month low of

58.6 from 59.6 in January.

The greenback reversed from an early 3-day low of 106.55 against

the yen, rising to 107.00. The greenback is seen finding resistance

around the 110.00 mark.

Survey data from the Cabinet Office showed that Japan's consumer

confidence weakened unexpectedly in February, though slightly.

The seasonally adjusted consumer confidence index dropped to

44.3 in February from 44.7 in January.

The greenback firmed to 0.9483 against the Swiss franc, its

highest since January 24. On the upside, 0.96 is seen as the next

resistance level for the greenback.

The greenback strengthened to a 2-1/2-month high of 1.2865

against the loonie, after having fallen to 1.2827 at 2:45 am ET.

The greenback is poised to challenge resistance around the 1.30

level.

On the flip side, the greenback surrendered some of its gains

against the pound with the pair trading at 1.3776. This may be

compared to a 1-1/2-month peak of 1.3727 hit at 5:00 am ET. The

next possible support for the greenback is seen around the 1.43

mark.

Survey data from IHS Markit and the Chartered Institute of

Procurement & Supply showed that the British manufacturing

sector expanded at the weakest pace in eight months in

February.

The Purchasing Managers' Index, or PMI, dropped slightly to 55.2

in February from 55.3 in January.

The greenback eased to 0.7231 against the kiwi and 0.7766

against the aussie, from its early 3-week high 0.7186 and more than

2-month high of 0.7713, respectively. If the greenback falls

further, 0.74 and 0.79 are likely seen as its next support levels

against the kiwi and the aussie, respectively.

The U.S. ISM manufacturing index for February and construction

spending for January are set for release shortly.

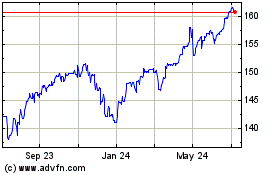

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Mar 2024 to Apr 2024

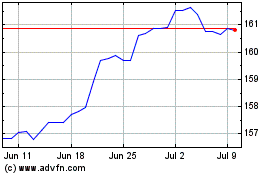

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Apr 2023 to Apr 2024