TIDMTSTL

RNS Number : 3166F

Tristel PLC

20 February 2018

TRISTEL plc

("Tristel", the "Company" or the "Group")

Half-year Report

Unaudited Interim Results for the six months ended 31 December

2017

Tristel plc (AIM: TSTL), the manufacturer of infection

prevention and contamination control products, announces its

interim results for the six months ended 31 December 2017, ahead of

guidance at the AGM.

Tristel's lead technology is a proprietary chlorine dioxide

formulation and the Company addresses three distinct markets:

-- The Human Healthcare market - via the Tristel brand

-- The Contamination Control market - via the Crystel brand

-- The Animal Healthcare market - via the Anistel brand

Financial highlights

-- Revenue up 10% to GBP10.7m (2016: GBP9.7m)

-- Overseas sales up 28% to GBP5.4m (2016: GBP4.2m),

representing 50% of total sales (2016: 43%)

-- EBITDA before share-based payments up 18% to GBP2.7m (2016: GBP2.3m).

-- Pre-tax profit before share-based payments up 18% to GBP2m (2016: GBP1.7m).

-- EPS before share-based payments up 21% to 4.0p (2016: 3.3p).

-- Interim dividend of 1.6p per share (2016: 1.4p), up 14%

-- Cash of GBP4.9m (2016: GBP3.9m)

Operational highlights

-- Established direct representation in Hong Kong

-- Developing the collaboration with MobileODT, which includes

the development of a software APP for training and disinfection

compliance

-- Additional data requirements of Environmental Protection

Agency (EPA) provided. Approval awaited

Commenting on current trading, Paul Swinney, Chief Executive of

Tristel, said: "We are very satisfied with overseas sales growth of

28% and with overseas revenues now accounting for one-half of all

revenues. We have increased our pre-tax profit margin, before

share-based payments, to 19% from 18% last year, even after costs

of GBP0.5m incurred in the USA regulatory programme. Pre-tax profit

before share-based payments has risen by 18% to GBP2m.

"We are progressing steadily with our planned entry into the

North American hospital market having satisfied the additional data

requirements of the EPA. A decision is expected from the EPA during

the second half of this financial year. Our expectation continues

to be that sales in North America will start next financial

year.

"For many years we have been represented in Hong Kong by

distributors and have now decided to employ our own team in this

market. We expect the increased margin from selling directly to

hospitals to exceed operational costs in next financial year. In

the second half of this financial year, there will be an

exceptional early termination payment to the distributor of

approximately GBP0.2m."

Tristel plc www.tristel.com

Paul Swinney, Chief Executive Tel: 01638 721 500

Liz Dixon, Finance Director

finnCap

Geoff Nash / Giles Rolls, Corporate Tel: 020 7220 0500

Finance

Alice Lane, Corporate Broking

Walbrook PR Ltd Tel: 020 7933 8780 or tristel@walbrookpr.com

Paul McManus Mob: 07980 541 893

Lianne Cawthorne Mob: 07584 391 303

Chairman's statement

Results

The Company made steady progress during the first half, with

sales increasing to GBP10.7m, up 10% on the comparable period last

year. Overseas sales grew very strongly by GBP1.2m, or 28%, whereas

UK sales registered a decline of GBP0.2m (although sales in the

first half last year had benefitted from a bulk purchase of GBP0.2m

by our largest customer, NHS Supply Chain). These interim results

did not enjoy the benefits of a weakening pound to the extent they

did last year.

We are particularly pleased with the continued strong

performance of our direct operations in Central Europe (managed by

our office in Berlin), Australasia (managed by offices in Melbourne

and Tauranga), and those of our international distributors (managed

by Tristel UK). We operate in China through a small team that

manages a network of distributors. In Hong Kong we have a

subsidiary but had no direct presence during the first half of the

financial year, although this has changed in the second half.

In Hong Kong we have sold through various distributors over the

years. The Hong Kong business has declined recently and to

counteract this we have recruited a sales force, negotiated the

termination of the distributorship and secured a cooperative hand

over of the business, including two government supply contracts.

The cost of securing an orderly transfer of contracts and

customers, together with set-up costs, will be expensed in the

current financial year and will result in an exceptional cost in

the second half of approximately GBP0.2m. We expect this cost to be

quickly recouped given we will achieve a much greater gross margin

though our direct sales channel.

Overseas sales First half First half Period-on-period Period-on-period Period-on-period

2017-18 2016-17 growth GBP growth % growth % at a

GBP GBP constant currency

----------------------- ------------ ------------ -------------------- --------------------- --------------------

Australia

(subsidiary) 1,155,000 776,000 379,000 49% 48%

----------------------- ------------ ------------ -------------------- --------------------- --------------------

China (subsidiary) 297,000 295,000 2,000 0% 2%

----------------------- ------------ ------------ -------------------- --------------------- --------------------

Hong Kong (subsidiary

managing a

distributor) 222,000 354,000 (132,000) (37%) (35%)

----------------------- ------------ ------------ -------------------- --------------------- --------------------

Germany & Central

Europe (subsidiary) 1,953,000 1,526,000 427,000 28% 23%

----------------------- ------------ ------------ -------------------- --------------------- --------------------

New Zealand

(subsidiary) 374,000 299,000 75,000 25% 28%

----------------------- ------------ ------------ -------------------- --------------------- --------------------

Overseas distributors

(managed by UK) 1,372,000 943,000 429,000 45% 45%

----------------------- ------------ ------------ -------------------- --------------------- --------------------

Total overseas sales 5,373,000 4,193,000 1,180,000 28% 27%

----------------------- ------------ ------------ -------------------- --------------------- --------------------

Total UK sales 5,354,000 5,555,000 (201,000) (4%) (4%)

----------------------- ------------ ------------ -------------------- --------------------- --------------------

Worldwide sales 10,727,000 9,748,000 979,000 10% 10%

----------------------- ------------ ------------ -------------------- --------------------- --------------------

Whilst we are very pleased with our progress overseas we are

working to reinvigorate sales growth in our domestic market. In

several of the key clinical departments in which we enjoy very high

penetration in the UK, for example Ear, Nose and Throat and

Cardiology, further growth opportunities are limited. In response,

we have developed new products for rinse water management in

endoscope washing machines, and for surface disinfection in

hospitals, and have high hopes for their success. Rinse water

management involves both a capital and consumable sales. Whilst

first half revenues were modest we are pleased that we are already

achieving sales from sixteen installations in the UK and Australia.

The new range of surface disinfectants will come to market in the

second half of the year and we continue to secure new patents for

these surface product innovations.

We succeeded in raising the gross profit margin to 75% from 74%

last first half, and our pre-tax profit margin, before share-based

payments, of 19% improved upon last year (2016: 18%).

Investment to secure future growth

During the half we raised the pace of our investment in staff,

manufacturing plant, product development and intellectual property

to accelerate our future rate of revenue and profits growth.

Matching the increase in sales of 10%, headcount increased by

twelve, a 11% increase. We invested GBP0.2m in specialised

manufacturing equipment; GBP0.2m in product development for the new

surfaces range, and GBP0.1m in the creation and maintenance of our

intellectual property. We will continue to invest in future

growth.

We plan to continue with a significant capital investment

programme throughout calendar 2018 as we complete tooling and

manufacturing set-up for the new surface product innovations.

We are also investing heavily to enter new geographical markets

including North America. During the period we spent GBP0.5m on our

North American market entry plan compared to GBP0.2m in the

corresponding period last year. We are pursuing both FDA and EPA

approvals for various products. We have incorporated a Delaware

subsidiary but have not yet recruited a business development team.

We would expect to do this during the second half. I am satisfied

that we are progressing well towards our strategic objective of

generating first revenues in North America in financial year

2018-19.

Dividend

During the first half a final dividend of 2.63 pence per share

was paid, totalling GBP1.1m. At the period end cash was GBP4.9m

compared to GBP3.9m on 31 December 2016. We will pay an interim

dividend of 1.6 pence per share on 12 April 2018 to shareholders on

the register on 23 March 2018, with an ex-dividend date of 22 March

2018. Our policy is to cover the dividend with earnings by at least

two times and pay 40% as an interim and 60% as a final.

Outlook

In October 2016 we outlined our strategic financial targets to

take us to the year ending June 2019. We are half way through this

current plan and on track to meet its objectives which were:

-- to grow sales by 10-15% on average over the three years;

-- to attain a pre-tax profit before share-based payments margin

of at least 17.5%, whilst investing in future growth.

From revenues of GBP17.1m in the year to 30 June 2016, we set

out our ambitions to grow this business significantly. We are

making good progress in this regard and I believe that these growth

and profitability targets remain very achievable. We look forward

to the Group's continued progress in the years ahead.

Francisco Soler

Chairman

20 February 2018

CONDENSED CONSOLIDATED INCOME STATEMENT

RESULTS FOR THE SIX MONTHSED 31 DECEMBER 2017

6 months 6 months

ended ended Year ended

31-Dec-17 31-Dec-16 30-Jun-17

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Note

Revenue 3 10,727 9,748 20,273

Cost of sales (2,643) (2,496) (4,598)

Gross profit 8,084 7,252 12,675

Administrative expenses

- share based payments (164) (5) (121)

Administrative expenses

- depreciation & amortisation (713) (595) (1,310)

Administrative expenses

- other (5,367) (4,959) (10,342)

------------- ------------- ------------

Total administrative expenses (6,244) (5,559) (11,773)

Operating profit 1,840 1,693 3,902

Finance income 1 2 4

Other income - - 41

Results from equity accounted

associate 8 6 19

Profit before taxation 1,849 1,701 3,966

Taxation (296) (312) (549)

Profit for the period 1,553 1,389 3,417

============= ============= ============

Attributable to:

Equity holders of the parent 1,553 1,389 3,417

1,553 1,389 3,417

============= ============= ============

Earnings per share from

continuing operations

attributable to equity holders Note

of the parent 4

Basic (pence) 3.62 3.30 8.06

============= ============= ============

Diluted (pence) 3.46 3.14 7.80

============= ============= ============

All amounts relate to continuing operations.

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX MONTHSED 31 DECEMBER 2017

6 months 6 months

ended ended Year ended

31-Dec-17 31-Dec-16 30-Jun-17

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Profit for the period 1,553 1,389 3,417

Items that will be reclassified

subsequently to Profit and loss

Exchange differences on translation

of foreign operations 6 81 47

------------- ------------- ------------

Other comprehensive income for

the period 6 81 47

-

Total comprehensive income for

the period 1,559 1,470 3,464

============= ============= ============

Attributable to:

Equity holders of the parent 1,559 1,470 3,464

1,559 1,470 3,464

============= ============= ============

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTHSED 31 DECEMBER 2017

Share Share Merger Foreign Retained Total Non- Total

earnings attributable controlling equity

to owners of interests

the parent

capital premium reserve exchange

account reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

30 June 2016 421 10,411 478 (1) 3,648 14,957 7 14,964

Transactions with owners

Dividends paid - - - - (2,193) (2,193) - (2,193)

Shares issued 3 32 - - - 35 - 35

Share-based

payments - - - - 5 5 - 5

--------- --------- --------- ---------- ----------- -------------- ------------- -----------

Total

transactions

with owners 3 32 - - (2,188) (2,153) - (2,153)

--------- --------- --------- ---------- ----------- -------------- ------------- -----------

Profit for the

period ended

31 Dec 2016 - - - - 1,389 1,389 (2) 1,387

Other

comprehensive

income:-

Exchange

differences

on

translation

of foreign

operations - - - 81 - 81 - 81

--------- --------- --------- ---------- ----------- -------------- ------------- -----------

Total

comprehensive

income - - - 81 1,389 1,470 (2) 1,468

--------- --------- --------- ---------- ----------- -------------- ------------- -----------

31 Dec 2016 424 10,443 478 80 2,849 14,274 5 14,279

========= ========= ========= ========== =========== ============== ============= ===========

Transactions with owners

Dividends paid - - - - (594) (594) - (594)

Shares issued 3 262 - - - 265 - 265

Share-based

payments - - - - 116 116 - 116

--------- --------- --------- ---------- ----------- -------------- ------------- -----------

Total

transactions

with owners 3 262 - - (478) (213) - (213)

--------- --------- --------- ---------- ----------- -------------- ------------- -----------

Profit for the

period ended

30 Jun 2017 - - - - 2,028 2,028 2 2,030

Other

comprehensive

income:-

Exchange

differences

on

translation

of foreign

operations - - - (34) - (34) - (34)

--------- --------- --------- ---------- ----------- -------------- ------------- -----------

Total

comprehensive

income - - - (34) 2,028 1,994 - 1,996

--------- --------- --------- ---------- ----------- -------------- ------------- -----------

30 Jun 2017 427 10,705 478 46 4,399 16,055 7 16,062

--------- --------- --------- ---------- ----------- -------------- ------------- -----------

Transactions with owners

Dividends paid - - - - (1,130) (1,130) - (1,130)

Shares issued 2 187 - - - 189 - 189

Share-based

payments - - - - 164 164 - 164

--------- --------- --------- ---------- ----------- -------------- ------------- -----------

Total

transactions

with owners 2 187 - - (966) (777) - (777)

--------- --------- --------- ---------- ----------- -------------- ------------- -----------

Profit for the

period ended

31 Dec 2017 - - - - 1,553 1,553 - 1,553

Other

comprehensive

income:-

Exchange

differences

on

translation

of foreign

operations - - - 6 - 6 - 6

--------- --------- --------- ---------- ----------- -------------- ------------- -----------

Total

comprehensive

income - - - 6 1,553 1,559 - 1,559

--------- --------- --------- ---------- ----------- -------------- ------------- -----------

31 Dec 2017 429 10,892 478 52 4,986 16,837 7 16,844

========= ========= ========= ========== =========== ============== ============= ===========

CONDENSED CONSOLIDATED BALANCE SHEET

AS AT 31 DECEMBER 2017

31-Dec-17 31-Dec-16 30-Jun-17

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Non-current assets

Investment 589 - 589

Goodwill & other Intangible assets 6,815 6,882 6,989

Property, plant and equipment 1,518 1,381 1,409

8,922 8,263 8,987

------------- ------------- -----------

Current assets

Inventories 2,226 1,753 2,292

Trade and other receivables 3,871 3,776 3,745

Cash and cash equivalents 4,945 3,854 5,088

11,042 9,383 11,125

Total assets 19,964 17,646 20,112

============= ============= ===========

Capital and reserves attributable to the

Company's equity holders

Called up share capital 429 424 427

Share premium account 10,892 10,443 10,705

Merger reserve 478 478 478

Foreign exchange reserves 52 80 46

Retained earnings 4,986 2,849 4,399

Equity attributable to equity

holders of parent 16,837 14,274 16,055

------------- ------------- -----------

Non-controlling interest 7 5 7

Total Equity 16,844 14,279 16,062

------------- ------------- -----------

Current liabilities

Trade and other payables 2,296 2,583 3,147

Current tax liabilities 639 649 728

Total current liabilities 2,935 3,232 3,875

------------- ------------- -----------

Non-current liabilities

Deferred tax 185 135 175

------------- ------------- -----------

Total liabilities 3,120 3,367 4,050

Total equity and liabilities 19,964 17,646 20,112

============= ============= ===========

CONDENSED CONSOLIDATED CASH FLOW STATEMENT

FOR THE SIX MONTHSED 31 DECEMBER 2017

6 months 6 months

ended ended Year ended

31-Dec-17 31-Dec-16 30-Jun-17

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Cash flows generated from

operating activities

Cash generated from operating Note

activities 6 1,814 1,701 4,806

Corporation tax (375) (94) (454)

1,439 1,607 4,352

------------- ------------- ------------

Cash flows used in investing

activities

Interest received 1 2 4

Purchase of intangible assets (263) (204) (419)

Consideration for acquisition - (959) (994)

Purchase of investments - - (589)

Purchase of property, plant

and equipment (402) (244) (585)

Proceeds on sale of property,

plant and equipment 17 14 45

(647) (1,391) (2,538)

------------- ------------- ------------

Cash flows used in financing

activities

Share issues 189 35 300

Equity dividends paid (1,130) (2,193) (2,787)

(941) (2,158) (2,487)

------------- ------------- ------------

(Decrease) in cash and cash

equivalents (149) (1,942) (673)

Cash and cash equivalents

at the beginning of the

period 5,088 5,715 5,715

Exchange difference on cash

and cash equivalents 6 81 46

Cash and cash equivalents

at the end of the period 4,945 3,854 5,088

============= ============= ============

NOTES TO THE ACCOUNTS

FOR THE SIX MONTHSED 31 DECEMBER 2017

1 PRINCIPal ACCOUNTING POLICIES

Basis of Preparation

For the year ended 30 June 2017, the Group prepared consolidated

financial statements under International Financial Reporting

Standards ('IFRS') as adopted by the European Commission. These

condensed consolidated interim financial statements (the interim

financial statements) have been prepared under the historical cost

convention. They are based on the recognition and measurement

principles of IFRS in issue as adopted by the European Union (EU)

which are effective from 1 July 2017.

Accounting Policies

The interim report is unaudited and has been prepared on the

basis of IFRS accounting policies.

The accounting policies adopted in the preparation of this

unaudited interim financial report are consistent with the most

recent annual financial statements being those for the year ended

30 June 2017.

2 Publication of non-statutory accounts

The financial information for the six months ended 31 December

2017 and 31 December 2016 have not been audited and does not

constitute full financial statements within the meaning of Section

434 of the Companies Act 2006.

The financial information relating to the year ended 30 June

2017 does not constitute full financial statements within the

meaning of Section 434 of the Companies Act 2006. This information

is based on the Group's statutory accounts for that period. The

statutory accounts were prepared in accordance with International

Financial Reporting Standards ("IFRS") and received an unqualified

audit report and did not contain statements under Section 498(2) or

(3) of the Companies Act 2006. These financial statements have been

filed with the Registrar of Companies.

3 SEGMENTAL ANALYSIS

The Board considers the Group's revenue lines to be split into

three operating segments, which span the different Group entities.

The operating segments consider the nature of the product sold, the

nature of production, the class of customer and the method of

distribution. The Group's operating segments are identified from

the information which is reported to the chief operating decision

maker.

The first segment concerns the manufacture, development and sale

of infection control and hygiene products which incorporate the

Company's chlorine dioxide chemistry, and are used primarily for

infection control in hospitals ("Human Health"). This segment

generates approximately 89% of Group revenues.

The second segment, which constitutes 5% of the business

activity, relates to manufacture and sale of disinfection and

cleaning products, principally into veterinary and animal welfare

sectors ("Animal Health").

The third segment addresses the pharmaceutical and personal care

manufacturing industries ("Contamination Control"). This activity

has generated 6% of the Group's revenue for the period.

The operation is monitored and measured on the basis of the key

performance indicators of each segment, these being revenue and

gross profit; strategic decisions are made on the basis of revenue

and gross profit generating from each segment.

The Group's centrally incurred administrative expenses and

operating income are not attributable to individual segments.

6 months ended 6 months ended Year ended

31 December 2017 31 December 2016 30 June 2017

(unaudited) (unaudited) (audited)

Human Animal Cont'n Total Human Animal Cont'n Total Human Animal Cont'n Total

Health Health Control Health Health Control Health Health Control

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue 9,535 488 704 10,727 8,730 440 578 9,748 18,107 878 1,288 20,273

Cost

of

material (2,213) (179) (251) (2,643) (2,170) (106) (220) (2,496) (3,881) (223) (494) (4,598)

------------ ------------ --------- --------- ------------ ------------ ---------- --------- ------------ ------------ --------- ----------

Gross

profit 7,322 309 453 8,084 6,562 332 358 7,252 14,226 655 794 15,675

============ ============ ========= ============ ============ ========== ============ ============ =========

Centrally incurred income

and expenditure not attributable

to individual segments:

-

Dep'n & amort'n of

non- financial assets (713) (595) (1,310)

Other administrative

expenses (5,367) (4,959) (10,342)

Share based payments (164) (5) (121)

--------- --------- ----------

Segment operating profit 1,840 1,693 3,902

--------- --------- ----------

Segment operating profit

can be reconciled to Group

profit before tax as follows:

-

Segment operating profit 1,840 1,693 3,902

Results from equity

accounted associate 8 6 19

Finance income 1 2 4

Other income - - 41

Group profit 1,849 1,701 3,966

========= ========= ==========

The Group's revenues from external customers are divided into the following

geographical areas:

6 months ended 6 months ended Year ended

31 December 2017 31 December 2016 30 June 2017

(unaudited) (unaudited) (audited)

Human Animal Cont'n Total Human Animal Cont'n Total Human Animal Cont'n Total

healthcare healthcare control healthcare healthcare control healthcare healthcare Control

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

United

Kingdom 4,397 337 620 5,354 4,739 314 502 5,555 8,910 636 1,129 10,675

Germany 1,881 - 27 1,908 1,523 3 - 1,526 3,048 62 150 3,260

Rest

of the

World 3,257 151 57 3,465 2,468 123 76 2,667 6,149 180 9 6,338

------------ ------------ --------- --------- ------------ ------------ ---------- --------- ------------ ------------ --------- ----------

Group

Revenues 9,535 488 704 10,727 8,730 440 578 9,748 18,107 878 1,288 20,273

============ ============ ========= ========= ============ ============ ========== ========= ============ ============ ========= ==========

4 EARNINGS PER SHARE

The calculations of earnings per share are based on the

following profits and number of shares:

6 months ended 6 months Year ended

31 December ended 30 June 2017

2017 31 December

2016

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Retained profit for the

period attributable to equity

holders of the parent 1,553 1,389 3,417

================ ============== ===============

Retained profit for the

period attributable to equity

holders of the parent adjusted

for share based payments 1,717 1,394 3,538

================ ============== ===============

Shares '000 Shares '000 Shares '000

Number Number Number

Weighted average number

of ordinary shares for the

purpose of basic earnings

per share 42,884 42,056 42,418

Share options 1,942 2,198 1,399

Weighted average number

of ordinary shares for the

purpose of diluted earnings

per share 44,826 44,254 43,817

================ ============== ===============

Earnings per ordinary share

Basic (pence) 3.62 3.30 8.06

Diluted (pence) 3.46 3.14 7.80

Before share based payments

(pence) 4.00 3.30 8.34

================ ============== ===============

5 Dividends

6 months ended 6 months ended Year ended

31 December 31 December 30 June 2017

2017 2016

(unaudited) (unaudited) (audited)

Amounts recognised as distributions GBP'000 GBP'000 GBP'000

to equity holders in the

period:

Ordinary shares of 1p each

Special dividend for the

year ended 30 June 2016 of

3.00p per share (2015: 3.00p) - 1,265 1,265

Final dividend for the year

ended 30 June 2017 of 2.63p

(2016: 2.19p) per share 1,130 928 928

Interim dividend for the

year ended 30 June 2017 of

1.40p (2016: 1.14p) per share - - 594

1,130 2,193 2,787

================ ================ ===============

Proposed interim dividend

for the year ending 30 June

2018 of 1.60p (2017: 1.40p)

per share 688 594 -

================ ================ ===============

The proposed interim dividend has not been included as a

liability in the financial statements.

6 RECONCILIATION OF PROFIT BEFORE TAX to cash GENERATED from operations

6 months 6 months

ended ended Year ended

31-Dec-17 31-Dec-16 30-Jun-17

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Profit before taxation 1,849 1,701 3,966

Adjustments for:

Depreciation 276 270 564

Amortisation of intangibles 437 325 679

Impairment - - 67

Gain on settlement of pre-existing

agreement - - (41)

Share based payments expense

(IFRS2) 164 5 121

(Profit)/Loss on disposal

of property plant and equipment - (6) (16)

Loss on disposal of intangible

asset - - -

Finance costs - - -

Finance income (1) (2) (4)

Operating cash flows before

movement in working capital 2,725 2,293 5,336

Decrease/(increase) in inventories 66 122 (294)

Increase in trade and other

receivables (126) (41) (1)

(Decrease) in trade and

other payables (851) (673) (235)

Cash generated from operating

activities 1,814 1,701 4,806

============= ============= ============

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR KMGMZVLKGRZM

(END) Dow Jones Newswires

February 20, 2018 02:00 ET (07:00 GMT)

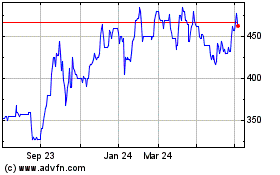

Tristel (LSE:TSTL)

Historical Stock Chart

From Mar 2024 to Apr 2024

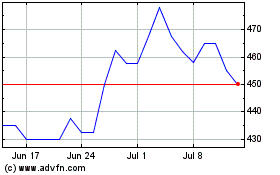

Tristel (LSE:TSTL)

Historical Stock Chart

From Apr 2023 to Apr 2024