Trinity Biotech - Momentum

August 02 2012 - 8:00PM

Zacks

Trinity Biotech plc (TRIB), which has delivered eight

positive earnings surprises in the last ten quarters, is currently

hovering around its 52-week high of $12.76 hit on July 16. ADRs of

this Ireland-based diagnostic test kits and instrument company have

been moving mostly upward since mid-June based on second-quarter

results, a growth-oriented guidance and a 50% dividend.

With a year-to-date return of more than 26% and an attractive

valuation, this Zacks #1 Rank (Strong Buy) stock looks like a solid

momentum pick.

Second-Quarter Earnings

On July 12, Trinity Biotech reported second-quarter earnings of

19 cents per ADR, which were in line with the Zacks Consensus

Estimate and up 11% from last year. Total revenues climbed 7% to

$20.8 million, driven by impressive sales in both the clinical

laboratory and point-of-care divisions. The Zacks Consensus

Estimate, however, was $21.0 million.

Clinical laboratory revenues climbed 7.2% to $16.4 million,

while revenues from the point-of-care unit climbed 6.1% to $4.4

million.

Trinity Biotech repurchased more than 175,000 ADRs during the

second quarter of 2012 at an average cost of $11.49 per ADR. The

company’s most recent dividend of 15 cents per ADR jumped 50% from

that paid in 2011.

Guidance Reflects Growth

The company expects to generate earnings of at least 80 cents

per ADR in 2012 on revenues of $86.0 million. This marks gains of

10.1% in earnings and 10.4% in revenues from 2011.

Earnings Momentum on the Upswing

The Zacks Consensus Estimate for 2012 rose 3.9% to 79 cents per

ADR over the last 60 days. For 2013, the Zacks Consensus Estimate

is pegged at 91 cents per ADR, up 8.3% over the same time

frame.

The Zacks Consensus Estimate for 2012 reflects a year-over-year

improvement of about 13.3%, while 2013 indicates a year-over-year

jump of 15.1%.

Valuation Looks Attractive Trinity Biotech’s valuation looks

attractive. The company currently trades at a forward P/E of 15.9x,

reflecting a huge discount of 60.5% to the peer group average of

40.2x. Also, on a price-to-book basis, ADRs currently trade at

1.7x, a 52.8% discount to its peer group average of 3.6x.

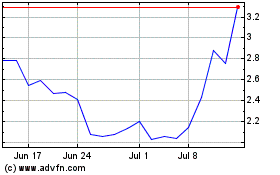

Strong Chart

ADRs of Trinity Biotech have displayed an upward trend since

mid-June, barring minor hiccups. The chart reveals that the stock

has been consistently trading above its 200-day and 50-day moving

average since early March.

Volume is fairly strong, averaging roughly 66K daily. Trinity

Biotech has constantly outperformed the S&P 500 since the

latter half of April 2012. The year-to-date return for the stock is

approximately 26.2%, compared with the S&P 500’s return of

7.7%.

Headquartered in Bray, Ireland and founded in 1992, Trinity

Biotech focuses on developing, acquiring, manufacturing and

marketing medical diagnostic products. The company, which has a

market cap of $268.21 million, serves the clinical laboratory and

point-of-care divisions of the diagnostic market. The products are

used for the detection of infectious, autoimmune and sexually

transmitted diseases apart from diabetes and deficiencies related

to the liver and intestine. Furthermore, Trinity Biotech provides

raw materials to the life sciences industry. The company, which

operates in more than 75 countries across the globe, sells its

products through its own sales force in the US, UK, Germany and

France. Moreover, it operates through a network of international

distributors and strategic partners.

TRINITY BIOTECH (TRIB): Free Stock Analysis Report

To read this article on Zacks.com click here.

Trinity Biotech (NASDAQ:TRIB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Trinity Biotech (NASDAQ:TRIB)

Historical Stock Chart

From Apr 2023 to Apr 2024