Trinity Biotech plc (Nasdaq:TRIB), a leading developer and

manufacturer of diagnostic products for the point-of-care and

clinical laboratory markets, today announced results for the

quarter ended September 30, 2011.

Quarter 3 Results

Total revenues for Q3, 2011 were $19.8m which compares to $18.7m

in Q3, 2010, representing an increase of 6%.

Point-of-care revenues for Q3, 2011 decreased by 6% when

compared to Q3, 2010. This was attributable to lower HIV sales in

Africa, mainly due to timing factors. Consequently, it is expected

that this will be offset by correspondingly increased revenues in

Q4, 2011.

Clinical Laboratory revenues increased from $14.5m to $15.9m,

which represents an increase of 9% compared to Q3, 2010. However,

excluding Fitzgerald revenues, which fell by 6% in the quarter, the

increase in our core diabetes/infectious diseases revenues was

13%.

Revenues for Q3, 2011 by key product area were as follows:

| |

|

|

|

| |

2010 Quarter

3 |

2011 Quarter

3 |

Increase/

Decrease |

| |

US$'000 |

US$'000 |

% |

| Point-of-Care |

4,202 |

3,941 |

-6% |

| |

|

|

|

| Clinical Laboratory |

14,547 |

15,885 |

9% |

| |

|

|

|

| Total |

18,749 |

19,826 |

6% |

Gross profit for Q3, 2011 amounted to $10.3m, representing

a gross margin of 51.7% which compares favourably to the gross

margin of 50.6% for the same period in 2010. This continues the

trend of improving gross margins since the divestiture of the

coagulation product line in Q2, 2010.

Research and Development expenses increased from $0.8m to $0.9m,

an increase of 13.1%. Meanwhile, Selling, General and

Administrative (SG&A) expenses have decreased by 8.5% to $5.2m

compared to Q3, 2010. This is due to the elimination of costs

which were initially retained during the transition period

following the divestiture of the coagulation product line.

Operating profit for Q3, 2011 was $4.1m, and represents an

increase of over 25% when compared with Q3, 2010. Operating

margin at 20.7% remains above our target of 20% and represents a

significant improvement compared to the 17.4% reported in Q3,

2010.

Net financial income for Q3, 2011 was $0.5m which compares to

net financial income of $0.4m in Q3, 2010. This improvement is

attributable to a lower interest expense due to the repayment of

some minor elements of lease and other financing, in addition to

higher interest income being earned on increased cash balances.

The tax charge for Q3, 2011 was $0.7m which represents an

effective tax rate of 15.3%. This compares with an effective rate

of 6.6% in Q3, 2010, which was lower due to the utilisation of tax

losses forward.

Profit After Tax was $3.9m which is an increase of 12.2% over

Q3, 2010. Similarly, EPS for Q3, 2011 increased by 12.1% from 16.5

cents to 18.5 cents.

Free Cash Flows generated during the quarter were slightly over

$3m. This in turn was offset by $3m spent on share repurchases

and the payment of a scheduled deferred consideration payment of

$0.3m in relation to the acquisition of Phoenix Biotech. The

net result is that our cash position has remained broadly static at

$71.1m.

Share buyback

During the quarter, we repurchased 291,223 ADRs at an average

price of $10.28 as part of our share buyback program. The

total amount spent on repurchases during the quarter was just over

$3m.

Comments

Commenting on the results, Kevin Tansley, Chief Financial

Officer, said "We are very pleased with our results this quarter as

we are showing improvements in all of our key indicators. Revenues

have grown by 6% and profits and EPS are each up by over 12%.

This increase in profitability was achieved notwithstanding

the increase of over $500,000 in the tax charge this quarter when

compared to the particularly low effective tax rate in quarter 3,

2010. Meanwhile, our gross margin has increased to 51.7% and

our operating margin has continued to improve, reaching a new high

of 20.7%. We continue to generate strong cash flows, which in

this quarter were used to fund our on-going share buyback

program."

Ronan O'Caoimh, CEO, stated "We continue to deliver on our key

objectives of simultaneously growing revenues and profitability. We

are particularly pleased with the 13% organic revenue growth in our

key infectious diseases and diabetes business. This was

achieved before the impact of our new A1c instrument, Premier,

which has just been launched. Meanwhile, we are making

excellent progress on the development of our new point-of-care

products, the first of which will be submitted to the FDA for

approval later this year."

Forward-looking statements in this release are made pursuant to

the "safe harbor" provision of the Private Securities Litigation

Reform Act of 1995. Investors are cautioned that such

forward-looking statements involve risks and uncertainties

including, but not limited to, the results of research and

development efforts, the effect of regulation by the United States

Food and Drug Administration and other agencies, the impact of

competitive products, product development commercialisation and

technological difficulties, and other risks detailed in the

Company's periodic reports filed with the Securities and Exchange

Commission.

Trinity Biotech develops, acquires, manufactures and markets

diagnostic systems, including both reagents and instrumentation,

for the point-of-care and clinical laboratory segments of the

diagnostic market. The products are used to detect infectious

diseases and to quantify the level of Haemoglobin A1c and other

chemistry parameters in serum, plasma and whole blood. Trinity

Biotech sells direct in the United States, Germany, France and the

U.K. and through a network of international distributors and

strategic partners in over 75 countries worldwide. For further

information, please see the Company's website:

www.trinitybiotech.com.

The Trinity Biotech PLC logo is available at

http://www.globenewswire.com/newsroom/prs/?pkgid=10602

| Trinity Biotech

plc |

| Consolidated Income

Statements |

| |

|

|

|

|

| (US$000's except share data) |

Three Months Ended Sept 30,

2011 |

Three Months Ended Sept 30,

2010 |

Nine Months Ended Sept 30,

2011 |

Nine Months Ended Sept 30,

2010 |

| |

(unaudited) |

(unaudited) |

(unaudited) |

(unaudited) |

| |

|

|

|

|

| Revenues |

19,826 |

18,749 |

57,935 |

70,388 |

| |

|

|

|

|

| Cost of sales |

(9,571) |

(9,262) |

(28,119) |

(36,215) |

| |

|

|

|

|

| Gross profit |

10,255 |

9,487 |

29,816 |

34,173 |

| Gross profit % |

51.7% |

50.6% |

51.5% |

48.5% |

| |

|

|

|

|

| Other operating income |

191 |

651 |

721 |

1,234 |

| |

|

|

|

|

| Research & development expenses |

(857) |

(758) |

(2,344) |

(3,750) |

| Selling, general and administrative

expenses |

(5,237) |

(5,721) |

(15,500) |

(20,426) |

| Indirect share based payments |

(252) |

(392) |

(1,006) |

(779) |

| |

|

|

|

|

| Operating profit |

4,100 |

3,267 |

11,687 |

10,452 |

| |

|

|

|

|

| Non-recurring items |

-- |

(587) |

-- |

46,474 |

| |

|

|

|

|

| Financial income |

549 |

514 |

1,822 |

792 |

| Financial expenses |

(3) |

(69) |

(10) |

(426) |

| Net financial income |

546 |

445 |

1,812 |

366 |

| |

|

|

|

|

| Profit before tax |

4,646 |

3,125 |

13,499 |

57,292 |

| |

|

|

|

|

| Income tax expense on operating

activities |

(711) |

(206) |

(1,950) |

(888) |

| Income tax credit on non-recurring items |

-- |

-- |

-- |

354 |

| Profit for the

period |

3,935 |

2,919 |

11,549 |

56,758 |

| Profit for the period (excluding

non-recurring items) |

3,935 |

3,506 |

11,549 |

9,930 |

| |

|

|

|

|

| Earnings per ADR (US cents) |

18.5 |

13.8 |

54.1 |

268.6 |

| Earnings per ADR (US cents) – excluding

non-recurring items |

18.5 |

16.5 |

54.1 |

47.0 |

| |

|

|

|

|

| Diluted earnings per ADR (US cents) |

17.7 |

13.5 |

51.8 |

263.9 |

| Diluted earnings per ADR (US cents) –

excluding non-recurring items |

17.7 |

16.2 |

51.8 |

46.2 |

| |

|

|

|

|

| Weighted average no. of ADRs used in

computing basic earnings per ADR |

21,297,539 |

21,183,785 |

21,345,527 |

21,127,858 |

| |

|

|

|

|

| The above financial statements

have been prepared in accordance with the principles of

International Financial Reporting Standards and the Company's

accounting policies but do not constitute an interim financial

report as defined in IAS 34 (Interim Financial

Reporting). |

| Trinity

Biotech plc Consolidated Balance Sheets |

|

| |

|

| |

Sept 30,

2011 US$ '000

(unaudited) |

June 30,

2011 US$ '000

(unaudited) |

March 31,

2011 US$ '000

(unaudited) |

Dec 31,

2010 US$ '000

(audited) |

| ASSETS |

|

|

|

|

| Non-current assets |

|

|

|

|

| Property, plant and equipment |

7,603 |

7,260 |

6,630 |

5,999 |

| Goodwill and intangible assets |

43,515 |

41,799 |

40,267 |

37,248 |

| Deferred tax assets |

3,950 |

4,158 |

4,385 |

4,680 |

| Other assets |

509 |

534 |

11,729 |

11,623 |

| Total non-current

assets |

55,577 |

53,751 |

63,011 |

59,550 |

| |

|

|

|

|

| Current assets |

|

|

|

|

| Inventories |

19,478 |

18,971 |

18,636 |

17,576 |

| Trade and other receivables |

23,172 |

23,686 |

24,078 |

25,529 |

| Income tax receivable |

156 |

199 |

91 |

217 |

| Cash and cash equivalents |

71,128 |

71,422 |

59,818 |

58,002 |

| Total current assets |

113,934 |

114,278 |

102,623 |

101,324 |

| |

|

|

|

|

| TOTAL ASSETS |

169,511 |

168,029 |

165,634 |

160,874 |

| |

|

|

|

|

| EQUITY AND LIABILITIES |

|

|

|

|

| Equity attributable to the equity

holders of the parent |

|

|

|

|

| Share capital |

1,103 |

1,097 |

1,094 |

1,092 |

| Share premium |

2,683 |

2,055 |

1,743 |

161,599 |

| Accumulated surplus/(deficit) |

141,177 |

139,928 |

137,705 |

(25,412) |

| Other reserves |

4,008 |

4,008 |

4,008 |

4,008 |

| Total equity |

148,971 |

147,088 |

144,550 |

141,287 |

| |

|

|

|

|

| Current liabilities |

|

|

|

|

| Interest-bearing loans and borrowings |

152 |

176 |

174 |

162 |

| Income tax payable |

812 |

770 |

890 |

597 |

| Trade and other payables |

11,411 |

12,153 |

12,680 |

11,447 |

| Provisions |

50 |

50 |

50 |

50 |

| Total current

liabilities |

12,425 |

13,149 |

13,794 |

12,256 |

| |

|

|

|

|

| Non-current liabilities |

|

|

|

|

| Interest-bearing loans and borrowings |

-- |

34 |

74 |

111 |

| Other payables |

16 |

62 |

52 |

30 |

| Deferred tax liabilities |

8,099 |

7,696 |

7,164 |

7,190 |

| Total non-current

liabilities |

8,115 |

7,792 |

7,290 |

7,331 |

| |

|

|

|

|

| TOTAL LIABILITIES |

20,540 |

20,941 |

21,084 |

19,587 |

| |

|

|

|

|

| TOTAL EQUITY AND

LIABILITIES |

169,511 |

168,029 |

165,634 |

160,874 |

| |

| The above financial

statements have been prepared in accordance with the principles of

International Financial Reporting Standards and the Company's

accounting policies but do not constitute an interim financial

report as defined in IAS 34 (Interim Financial Reporting). |

| Trinity Biotech

plc |

| Consolidated Statement

of Cash Flows |

| |

|

|

|

|

| (US$000's) |

Three Months Ended Sept 30,

2011 |

Three Months Ended Sept 30,

2010 |

Nine Months Ended Sept 30,

2011 |

Nine Months Ended Sept 30,

2010 |

| |

(unaudited) |

(unaudited) |

(unaudited) |

(unaudited) |

| |

|

|

|

|

| |

|

|

|

|

| Cash and cash equivalents at

beginning of period |

71,422 |

50,042 |

58,002 |

6,078 |

| |

|

|

|

|

| Operating cash flows before changes in

working capital |

5,029 |

5,260 |

14,967 |

14,586 |

| Changes in working capital |

(335) |

(332) |

(231) |

1,357 |

| Cash generated from operations |

4,694 |

4,928 |

14,736 |

15,943 |

| |

|

|

|

|

| Net Interest and Income taxes

received/(paid) |

417 |

347 |

1,463 |

(230) |

| |

|

|

|

|

| Capital Expenditure & Financing

(net) |

(2,069) |

(1,515) |

(6,268) |

(4,950) |

| |

|

|

|

|

| Free cash flow |

3,042 |

3,760 |

9,931 |

10,763 |

| |

|

|

|

|

| Proceeds from sale of Coagulation product

line |

-- |

-- |

11,250 |

66,517 |

| |

|

|

|

|

| Cash paid to acquire Phoenix Bio-tech |

(333) |

-- |

(1,833) |

-- |

| |

|

|

|

|

| Repurchase of own company shares |

(3,003) |

-- |

(4,073) |

-- |

| |

|

|

|

|

| Dividend Payment |

-- |

-- |

(2,149) |

-- |

| |

|

|

|

|

| Repayment of bank debt |

-- |

-- |

-- |

(29,556) |

| |

|

|

|

|

| Cash and cash equivalents at end of

period |

71,128 |

53,802 |

71,128 |

53,802 |

| |

|

|

|

|

| |

|

|

|

|

| The above financial statements

have been prepared in accordance with the principles of

International Financial Reporting Standards and the Company's

accounting policies but do not constitute an interim financial

report as defined in IAS 34 (Interim Financial Reporting). |

CONTACT: Trinity Biotech plc

Kevin Tansley

(353)-1-2769800

E-mail: kevin.tansley@trinitybiotech.com

Lytham Partners LLC

Joe Diaz, Joe Dorame & Robert Blum

602-889-9700

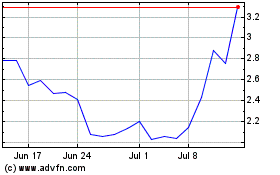

Trinity Biotech (NASDAQ:TRIB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Trinity Biotech (NASDAQ:TRIB)

Historical Stock Chart

From Apr 2023 to Apr 2024