Today's Top Supply Chain and Logistics News From WSJ

January 10 2018 - 7:21AM

Dow Jones News

By Paul Page

Sign up: With one click, get this newsletter delivered to your

inbox.

The new U.S. tax law may sow big changes in the country's

agriculture supply chains. A provision inserted into the tax code

just before the final measure passed in December gives a critical

boost to farm cooperatives over independent dealers, the WSJ's

Jacob Bunge and Richard Rubin report, an action that may reshape

parts of the agriculture economy while sharply reducing taxes for

many farmers. The new provision allows farmers to deduct up to 20%

of their total sales to cooperatives, letting some farmers reduce

their taxable income to zero and effectively handing them a bigger

tax bill if they sell to separate companies and distributors. Tax

experts say that will give cooperatives a significant edge,

benefiting co-op giants including American Crystal Sugar Co., Land

O'Lakes Inc. and CHS Inc., while stinging agribusinesses like

Cargill Inc. and Archer Daniels Midland Co., and smaller private

operations. It could alter the grain business, pushing processors

and exporters to buy more directly from co-ops, raising their

costs.

Managing brick-and-mortar stores may not be a drag on sales

after all. Target Corp. demonstrated the advantage of having both

physical stores and online sales during the holiday period, using

its retail space to fulfill 70% of its digital orders, the WSJ's

Khadeeja Safdar and Imani Moise report, either through in-store

pickup or by shipping from the stores to customers. The results

came as Target boosted same-store sales 3.4% during November and

December, a turnaround from last year when the retailer was hurt by

mismatches in its supply chain and online competition. The results

add new wrinkles to questions in the retail world over online

fulfillment strategies. Target's idea is to have its network of

1,800 stores do double-duty as fulfillment centers while scaling up

its use of the Shipt same-day delivery service it acquired. The

company is getting a boost from the economy, with consumers buying

goods as fast as the stores can stock them, or have them

delivered.

Boeing Co. is speeding up its supply chain to keep up with rapid

growth in aircraft orders. The plane maker delivered a record 763

jetliners in 2017 and secured net orders for 912 planes, the latest

sign of a years-long demand surge that is fueling the airline and

aerospace industries. The WSJ's Doug Cameron reports the results

highlight Boeing's ability to boost production while introducing

new aircraft models and redrawing parts of its supply chain to

boost cash flow and profits. Boeing and rival Airbus SE have hefty

backlogs, but investors increasingly are focused on deliveries and

cash flow rather than new plane deals. Boeing has pressed suppliers

for better terms, moved some production in house and boosted

automation to cut costs. Production is up by about a third since

2010 while the commercial aircraft workforce has been reduced by

around a third -- the kind of result manufacturers strive for but

rarely reach.

SUPPLY CHAIN STRATEGIES

The temperature-controlled logistics business is heating

up.Americold Realty Trust is heading to the public equity markets

with an initial public offering that the warehouse manager expects

to raise $330.8 million. The WSJ's Allison Prang reports the

Atlanta-based company, owned by billionaire investor Ron Burkle's

Yucaipa Cos., plans to sell 24 million shares for between $14 and

$16. Americold has 160 temperature-controlled warehouses, most of

them in the U.S., but several in Asian markets including China that

are putting a bigger premium on the so-called cold chain -- the

management of perishable goods including food and pharmaceuticals.

The trade grew at a healthy rate even as broader transport and

logistics sectors lagged in recent years, and shipping companies

have been building up perishables services. Seaborne shipments of

vegetables into the U.S. rose 8.4% in the fourth quarter last year

from the year before, according to trade data analysts Panjiva, and

have grown by nearly a third since 2013.

QUOTABLE

IN OTHER NEWS

Chinese rescue crews expanded their search area around a

stricken Iranian oil tanker and are trying to prevent a sinking

that would pose a bigger environmental disaster. (WSJ)

U.S. consumer credit rose in November at the fastest pace in 16

years. (WSJ)

Mexico's inflation accelerated in 2017 to its fastest rate in 17

years. (WSJ)

A measure of U.S. small-business confidence fell in December but

had its "strongest year" so far in 2017. (WSJ)

Samsung Electronics Co. expects its fourth-quarter operating

profit to reach a company record $14.1 billion. (WSJ)

Action-camera company GoPro Inc. is cutting more than one-fifth

of its workforce and exiting the drone market. (WSJ)

A North Dakota lawmaker says President Donald Trump told her he

supports a federal online sales tax mandate. (Rapid City

Journal)

Jim Johnston, the tough-talking former trucker who had led the

Owner-Operator Independent Drivers Association since 1974, died at

78. (Land Line)

Ford Motor Co. is working with food-delivery specialist

Postmates to develop services with autonomous vehicles. (CNBC)

U.S. apparel imports expanded 6.1% in November and Vietnam's

share of the market expanded to 14.4%. (Sourcing Journal)

More apparel companies are breaking away from the traditional

fashion calendar to speed up their supply chains. (Digiday)

Lululemon Athletica Inc. sharply raised its profit and revenue

outlook on strong holiday sales. (Business of Fashion)

Canadian regulators are considering a rule similar to a U.S.

mandate requiring that truckers use electronic logging devices.

(Journal of Commerce)

J.B. Hunt Transport Services Inc. is expanding its dedicated

last-mile delivery service across the entire U.S. (DC Velocity)

Shipping group BIMCO expects strong growth in container ship

deliveries this year to hold down price increases. (Lloyd's

List)

CMA CGM SA named Ludovic Renou president of its U.S. operation.

(MarineLink)

Container throughput at South Korea's Incheon Port rose 13.8%

last year. (Port Technology)

The regional Phoenix-Mesa Gateway Airport is adding cargo and

customs facilities to draw U.S.-Mexico e-commerce traffic. (Air

Cargo News)

ABOUT US

Paul Page is deputy editor of WSJ Logistics Report. Follow him

at @PaulPage, and follow the entire WSJ Logistics Report team:

@brianjbaskin , @jensmithWSJ and @EEPhillips_WSJ. Follow the WSJ

Logistics Report on Twitter at @WSJLogistics.

Write to Paul Page at paul.page@wsj.com

(END) Dow Jones Newswires

January 10, 2018 07:06 ET (12:06 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

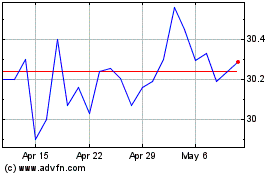

CHS (NASDAQ:CHSCP)

Historical Stock Chart

From Mar 2024 to Apr 2024

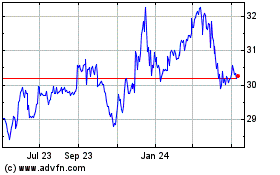

CHS (NASDAQ:CHSCP)

Historical Stock Chart

From Apr 2023 to Apr 2024