These Stocks Have Left Amazon Behind This Year -- Update

June 20 2018 - 4:59PM

Dow Jones News

By Akane Otani

Everyone knows that Amazon.com has left retailers for dead. Just

don't tell investors in some stocks of big store chains.

Shares of retailers are enjoying their biggest rally in years,

an unexpected turnaround fueled by strong earnings, buoyant

consumer confidence and a nationwide shopping spree.

The SPDR S&P Retail ETF is up 11% this year, more than

tripling the S&P 500's 3.5% gain. During Tuesday's market rout,

the retail ETF fell less than the broader market. Share prices of

department stores like Macy's Inc. and Dillard's Inc. have risen

more than 55% this year, even edging out Amazon.com's 50%

advance.

The sector's big gains represent an abrupt reversal from

previous years, when competition from e-commerce giants like Amazon

pounded many traditional retailers, everything from teen apparel to

companies making auto accessories. The S&P Retail Index had

underperformed the S&P 500 in four of the last five years.

Retail's sudden resurgence is sparking a debate over whether

flush-feeling consumers can keep the rally going, or if a series of

temporary factors boosted the stocks in a way that is likely to

fade in the second half of the year.

Some investors have found reasons to be optimistic. For one,

many retailers have posted better-than-expected earnings reports:

Macy's, Home Depot Inc. and Walmart Inc. all reporting same-store

sales rising in the latest quarter. That has lifted share prices

for some stocks whose valuations had fallen to single digits last

year.

Retail sales -- a measure of what Americans spend on everything

from cars to clothing to sporting goods -- also rose 0.8% last

month from a year earlier, according to the Commerce Department.

Analysts attributed the gains, which marked the biggest one-month

jump since November, to a combination of rising wages, low

unemployment and tax cuts that have left many Americans with more

money to spend -- all things that retailers hope will keep business

at their stores humming.

"It is nice to see that consumer confidence is improving...and

that [consumers are] voting on apparel certainly is a help in the

industry," said Fran Horowitz-Bonadies, chief executive officer of

Abercrombie & Fitch Co., on the firm's earnings call at the

start of the month.

Still, some analysts caution that retail's recent rebound could

be temporary, driven heavily by factors like one-time gains from

the U.S. tax overhaul rather than fundamental changes in the

industry.

"Retail has received a second wind from the tax cuts which we

think will ultimately fade," said Morgan Stanley analysts in a

recent report.

Some analysts are forecasting a steep deceleration in earnings

growth for the sector in the coming months. "If so, look for the

stocks to roll over as well," Morgan Stanley analysts wrote.

Other analysts point to the dollar as a reason why the rally may

not last. While many retailers cited dollar weakness as boosting

spending by foreign customers during the last quarter, the currency

has since rebounded. Further dollar gains would make retailers'

goods more expensive to customers abroad, potentially slowing sales

at companies with large multinational presences.

"People are saying, okay, these guys aren't going away now, so

after the tremendous pressure we saw in 2016 and 2017, a number of

those names are doing better," said Jim Tierney, chief investment

officer of concentrated U.S. growth at AllianceBernstein.

He remains cautious on retail in the longer term, despite this

year's comeback, likening its recent performance to a "dead cat

bounce": a short rebound following a sharp and prolonged

selloff.

Macy's, which fell 30% in 2017 even as the broader S&P 500

jumped 19%, has climbed 57% after closing dozens of stores while

sales at its remaining stores have rebounded. In May, the company

posted same-store sales that surpassed analysts' estimates, thanks

to a pickup in spending by international tourists, revamped shoe

and fine jewelry departments and increased spending on full-priced

goods by customers.

Specialty retailers have also fared well. Dick's Sporting Goods

Inc. is up 28% after losing 46% in 2017, buoyed by reports showing

its profits growing even as its hunting business suffered following

a decision to tighten gun policies. Teen retailers Abercrombie

& Fitch and American Eagle Outfitters Inc., which both posted

better-than-expected same-store sales for the latest quarter, have

risen more than 30% apiece.

Write to Akane Otani at akane.otani@wsj.com

(END) Dow Jones Newswires

June 20, 2018 16:44 ET (20:44 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

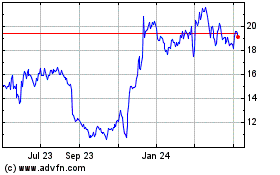

Macys (NYSE:M)

Historical Stock Chart

From Mar 2024 to Apr 2024

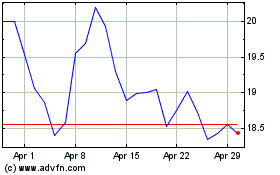

Macys (NYSE:M)

Historical Stock Chart

From Apr 2023 to Apr 2024