The Zacks Analyst Blog Highlights: D.R. Horton, Berkshire Hathaway, Masco, USG and PPG Industries - Press Releases

December 27 2011 - 3:30AM

Zacks

For Immediate Release

Chicago, IL – December 27, 2011 – Zacks.com announces the list

of stocks featured in the Analyst Blog. Every day the Zacks Equity

Research analysts discuss the latest news and events impacting

stocks and the financial markets. Stocks recently featured in the

blog include D.R. Horton (DHI),

Berkshire Hathaway (BRK.B),

Masco (MAS), USG (USG) and

PPG Industries (PPG).

Get the most recent insight from Zacks Equity Research with the

free Profit from the Pros newsletter:

http://at.zacks.com/?id=5513

Here are highlights from Friday’s Analyst

Blog:

New Home Sales Up Slightly

New Home Sales rose by 1.6% in November from October, to a rate

of 315,000. Relative to a year ago, sales are up 9.8%. While the

monthly increase is more than welcome, it is still a very dismal

rate of new home sales.

There was a upward revision to the October numbers of 3,000 from

310,000. The November level was also somewhat better than the

expected rate of 315,000. Regardless of the changes at the edges,

this is still a very bad level. The 19 lowest months on record

(back to 1963) for new home sales have all been in the last 19

months.

New home sales have only exceeded the 400,000 level three times

since September 2008 when the financial markets collapsed. The most

recent time was in April 2010, as sales were inflated by the rush

to get in under the wire and collect the homebuyer tax credit.

Sales collapsed after that.

Relative to the peak of the housing bubble (7/05, 1.389 million),

new home sales are down 77.3%. Prior to September 2008, there had

only been 20 months in which new home sales were below the 400,000

level, with the most recent being in 1982 (which was a time of a

very nasty recession brought on by sky-high interest rates

inflicted by the Fed to break the back of inflation).

New home sales fall sharply before all recessions (with the

exception of the dot.com bust, which caused recession of

2001) and then start to increase sharply in the middle of, or

towards the end of, the recession. That clearly is not happening

this time around. New home sales are vital to the overall

economy. If new homes are not selling, then home builders have no

reason to build more of them. After all, that is very expensive

inventory to sit on.

Unlike used home sales, each new home built creates a huge amount

of economic activity. Not only are low new home sales bad for the

big homebuilders like D.R. Horton (DHI),

but also for all the companies that make the products and supplies

that go into making a new house. They range

from Berkshire Hathaway (BRK.B) for

bricks, roofing materials and insulation

to Masco (MAS) for plumbing fixtures and

cabinets to USG (USG) for wallboard

to PPG Industries (PPG) for glass and

paint.

In terms of employment, it is not just all the roofers and framers

that lose jobs due to weak new home sales, but employees at all the

firms that make the stuff that goes into making a new home. Of

course, if those employees are out of work, they are not spending

on other goods and services, dragging down a host of seemingly

unrelated businesses.

Not that the direct impact of construction jobs should be

underestimated. Since the recession started, 34% jobs lost have

come from the construction industry.

Want more from Zacks Equity Research? Subscribe to the free

Profit from the Pros newsletter: http://at.zacks.com/?id=5515.

About Zacks Equity Research

Zacks Equity Research provides the best of quantitative and

qualitative analysis to help investors know what stocks to buy and

which to sell for the long-term.

Continuous coverage is provided for a universe of 1,150 publicly

traded stocks. Our analysts are organized by industry which gives

them keen insights to developments that affect company profits and

stock performance. Recommendations and target prices are six-month

time horizons.

Zacks "Profit from the Pros" e-mail newsletter provides

highlights of the latest analysis from Zacks Equity Research.

Subscribe to this free newsletter today:

http://at.zacks.com/?id=5517

About Zacks

Zacks.com is a property of Zacks Investment Research, Inc.,

which was formed in 1978 by Leon Zacks. As a PhD from MIT Len knew

he could find patterns in stock market data that would lead to

superior investment results. Amongst his many accomplishments was

the formation of his proprietary stock picking system; the Zacks

Rank, which continues to outperform the market by nearly a 3 to 1

margin. The best way to unlock the profitable stock recommendations

and market insights of Zacks Investment Research is through our

free daily email newsletter; Profit from the Pros. In short, it's

your steady flow of Profitable ideas GUARANTEED to be worth your

time! Register for your free subscription to Profit from the Pros

at http://at.zacks.com/?id=5518.

Visit http://www.zacks.com/performance for information about the

performance numbers displayed in this press release.

Follow us on Twitter: http://twitter.com/zacksresearch

Join us on Facebook:

http://www.facebook.com/home.php#/pages/Zacks-Investment-Research/57553657748?ref=ts

Disclaimer: Past performance does not guarantee future results.

Investors should always research companies and securities before

making any investments. Nothing herein should be construed as an

offer or solicitation to buy or sell any security.

Media Contact

Zacks Investment Research

800-767-3771 ext. 9339

support@zacks.com

http://www.zacks.com

BERKSHIRE HTH-B (BRK.B): Free Stock Analysis Report

D R HORTON INC (DHI): Free Stock Analysis Report

MASCO (MAS): Free Stock Analysis Report

PPG INDS INC (PPG): Free Stock Analysis Report

USG CORP (USG): Free Stock Analysis Report

To read this article on Zacks.com click here.

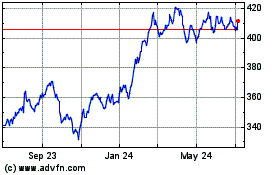

Berkshire Hathaway (NYSE:BRK.B)

Historical Stock Chart

From Mar 2024 to Apr 2024

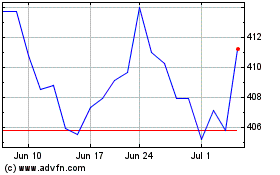

Berkshire Hathaway (NYSE:BRK.B)

Historical Stock Chart

From Apr 2023 to Apr 2024