Texas Regulators Approve Sempra's $9.45 Billion Oncor Buyout

March 08 2018 - 1:14PM

Dow Jones News

By Peg Brickley

Texas regulators that killed two earlier deals for a major piece

of the state's power infrastructure, Oncor, Thursday gave the nod

to Sempra Energy's $9.45 billion deal for a majority stake.

Sempra, of California, was the winner of a competition that

lasted years, a contest for the thriving transmissions business

that dominated the bankruptcy of Energy Future Holdings Corp., the

former TXU Corp.

The Public Utility Commission of Texas voted to approve Sempra's

buyout of Energy Future's 80% stake in the business, which carries

power to millions of people.

Earlier contenders included Hunt Consolidated Inc., which

attempted a feat of financial engineering that worried regulators,

and NextEra Energy Inc., a Florida power company that balked at

safeguards regulators insisted on for Oncor.

Last summer, Sempra topped an offer from Warren Buffett's

Berkshire Hathaway Energy Co., then sat down with Texas groups that

had opposed the Hunt and NextEra deals. Sempra agreed to

protections to keep Oncor under local management, and protected its

balance sheet, winning support for its deal from cities and major

industrial power customers, among others.

Cash from the Sempra deal will be divided among creditors of

Energy Future, which filed for chapter 11 bankruptcy protection in

April 2014, burdened with $42 billion in leveraged buyout debt.

Most of the former TXU Corp., businesses that generate and sell

power, exited bankruptcy in 2016, to become Vistra Energy. The

chapter 11 plan for the so-called T-side of Energy Future's

business resolved the bulk of the LBO debt.

Energy Future, the holding company, was left in chapter 11, with

its Oncor stake to sell and billions of dollars in debt to pay

off.

The regulated power-carrying business was a little-noticed

element of the 2007 LBO by Kohlberg Kravis Roberts, TPG and a

Goldman Sachs affiliate. As energy prices dove, plunging Energy

Future into a contentious bankruptcy, creditors began referring to

Oncor as a crown jewel, worth enough to make good some of their

losses.

Write to Peg Brickley at peg.brickley@wsj.com

(END) Dow Jones Newswires

March 08, 2018 12:59 ET (17:59 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

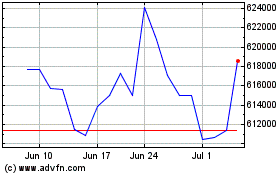

Berkshire Hathaway (NYSE:BRK.A)

Historical Stock Chart

From Mar 2024 to Apr 2024

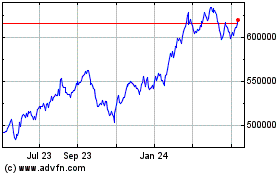

Berkshire Hathaway (NYSE:BRK.A)

Historical Stock Chart

From Apr 2023 to Apr 2024